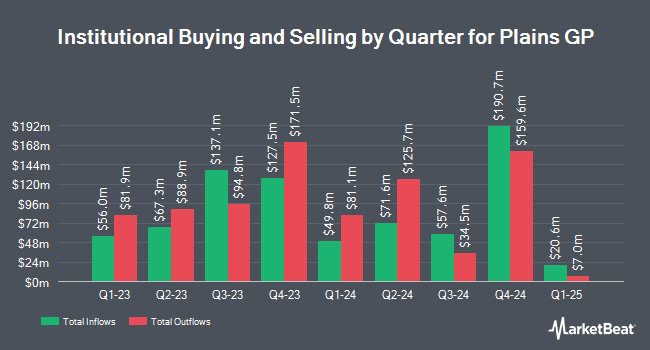

Advisors Capital Management LLC lifted its holdings in shares of Plains GP Holdings, L.P. (NYSE:PAGP - Free Report) by 1.3% in the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 2,435,140 shares of the pipeline company's stock after acquiring an additional 31,730 shares during the quarter. Advisors Capital Management LLC owned approximately 1.23% of Plains GP worth $52,015,000 as of its most recent filing with the Securities & Exchange Commission.

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Invesco Ltd. raised its holdings in Plains GP by 42.9% in the first quarter. Invesco Ltd. now owns 4,190,610 shares of the pipeline company's stock worth $89,511,000 after purchasing an additional 1,258,315 shares in the last quarter. Hsbc Holdings PLC grew its stake in shares of Plains GP by 25.8% in the first quarter. Hsbc Holdings PLC now owns 2,563,031 shares of the pipeline company's stock worth $54,746,000 after acquiring an additional 526,215 shares during the last quarter. Turtle Creek Wealth Advisors LLC purchased a new stake in shares of Plains GP in the first quarter worth $10,322,000. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. grew its stake in shares of Plains GP by 17.9% in the first quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 2,559,937 shares of the pipeline company's stock worth $54,680,000 after acquiring an additional 389,096 shares during the last quarter. Finally, Gilman Hill Asset Management LLC bought a new position in Plains GP during the 1st quarter valued at about $6,044,000. Institutional investors own 88.30% of the company's stock.

Analysts Set New Price Targets

Several brokerages have issued reports on PAGP. Morgan Stanley dropped their target price on Plains GP from $22.00 to $20.00 and set an "equal weight" rating on the stock in a research report on Tuesday, August 26th. JPMorgan Chase & Co. lifted their target price on Plains GP from $19.00 to $20.00 and gave the company a "neutral" rating in a research note on Wednesday, June 18th. Wolfe Research reissued a "peer perform" rating on shares of Plains GP in a research note on Friday, July 25th. Finally, Mizuho upped their price objective on Plains GP from $20.00 to $22.00 and gave the stock an "outperform" rating in a report on Wednesday, June 18th. One investment analyst has rated the stock with a Strong Buy rating, one has given a Buy rating, five have issued a Hold rating and one has assigned a Sell rating to the company's stock. According to MarketBeat.com, the company currently has an average rating of "Hold" and an average price target of $20.50.

Check Out Our Latest Stock Analysis on Plains GP

Plains GP Trading Down 0.1%

Plains GP stock traded down $0.02 during mid-day trading on Tuesday, hitting $18.59. The company's stock had a trading volume of 243,372 shares, compared to its average volume of 1,643,142. The company has a 50 day moving average of $19.21 and a 200-day moving average of $19.21. The stock has a market cap of $3.68 billion, a PE ratio of 35.04 and a beta of 0.76. The company has a debt-to-equity ratio of 0.49, a quick ratio of 0.92 and a current ratio of 1.01. Plains GP Holdings, L.P. has a one year low of $16.60 and a one year high of $22.31.

Plains GP Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, August 14th. Shareholders of record on Thursday, July 31st were given a $0.38 dividend. This represents a $1.52 annualized dividend and a yield of 8.2%. The ex-dividend date of this dividend was Thursday, July 31st. Plains GP's dividend payout ratio is 220.29%.

Plains GP Company Profile

(

Free Report)

Plains GP Holdings, L.P., through its subsidiary, Plains All American Pipeline, L.P., owns and operates midstream infrastructure systems in the United States and Canada. It operates in two segments, Crude Oil and Natural Gas Liquids (NGLs). The company engages in the gathering and transporting crude oil and NGLs using pipelines, gathering systems, and trucks.

Further Reading

Before you consider Plains GP, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Plains GP wasn't on the list.

While Plains GP currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.