Advyzon Investment Management LLC purchased a new position in shares of Boston Scientific Corporation (NYSE:BSX - Free Report) during the first quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor purchased 2,853 shares of the medical equipment provider's stock, valued at approximately $288,000.

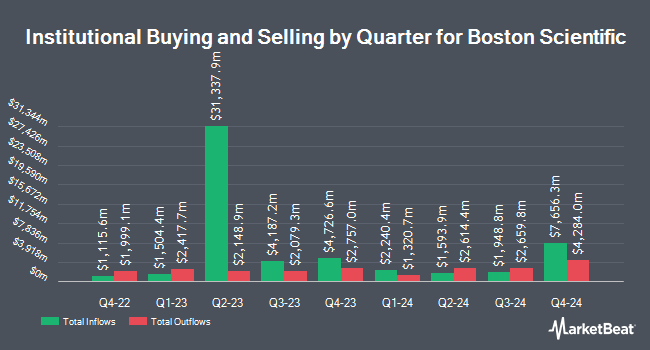

Several other hedge funds have also made changes to their positions in the stock. Bank Pictet & Cie Europe AG raised its position in shares of Boston Scientific by 40.8% during the 4th quarter. Bank Pictet & Cie Europe AG now owns 73,096 shares of the medical equipment provider's stock worth $6,529,000 after buying an additional 21,173 shares in the last quarter. Oppenheimer & Co. Inc. lifted its holdings in shares of Boston Scientific by 18.8% in the first quarter. Oppenheimer & Co. Inc. now owns 39,523 shares of the medical equipment provider's stock valued at $3,987,000 after buying an additional 6,264 shares during the period. Segall Bryant & Hamill LLC bought a new position in Boston Scientific during the first quarter valued at about $8,234,000. Blue Trust Inc. raised its position in Boston Scientific by 13.0% in the first quarter. Blue Trust Inc. now owns 5,000 shares of the medical equipment provider's stock worth $504,000 after acquiring an additional 575 shares in the last quarter. Finally, BI Asset Management Fondsmaeglerselskab A S lifted its holdings in Boston Scientific by 109.9% in the 4th quarter. BI Asset Management Fondsmaeglerselskab A S now owns 270,107 shares of the medical equipment provider's stock valued at $24,126,000 after acquiring an additional 141,398 shares during the last quarter. Institutional investors own 89.07% of the company's stock.

Insider Transactions at Boston Scientific

In related news, Director Yoshiaki Fujimori sold 2,901 shares of the company's stock in a transaction on Tuesday, July 29th. The shares were sold at an average price of $106.99, for a total transaction of $310,377.99. Following the completion of the transaction, the director directly owned 2,081 shares in the company, valued at $222,646.19. This represents a 58.23% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, Director Edward J. Ludwig sold 4,000 shares of the firm's stock in a transaction on Friday, July 25th. The stock was sold at an average price of $106.03, for a total transaction of $424,120.00. Following the completion of the sale, the director owned 18,479 shares in the company, valued at $1,959,328.37. This represents a 17.79% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 345,029 shares of company stock worth $35,976,603. Insiders own 0.50% of the company's stock.

Analysts Set New Price Targets

A number of brokerages recently weighed in on BSX. Truist Financial raised their target price on shares of Boston Scientific from $120.00 to $125.00 and gave the stock a "buy" rating in a report on Thursday, July 24th. Raymond James Financial raised their price objective on Boston Scientific from $121.00 to $124.00 and gave the stock a "strong-buy" rating in a research note on Thursday, July 24th. Wall Street Zen raised Boston Scientific from a "hold" rating to a "buy" rating in a research report on Tuesday, April 29th. Leerink Partners assumed coverage on Boston Scientific in a research report on Monday, June 16th. They issued an "outperform" rating and a $118.00 price target for the company. Finally, Robert W. Baird lifted their price target on Boston Scientific from $117.00 to $123.00 and gave the stock an "outperform" rating in a research note on Thursday, July 24th. Two research analysts have rated the stock with a hold rating, twenty-two have issued a buy rating and three have assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Buy" and an average target price of $117.50.

Read Our Latest Analysis on BSX

Boston Scientific Stock Performance

Shares of NYSE BSX traded down $0.06 during trading hours on Thursday, hitting $102.89. 5,405,736 shares of the stock were exchanged, compared to its average volume of 7,704,204. Boston Scientific Corporation has a one year low of $74.01 and a one year high of $108.94. The company's 50 day moving average is $103.58 and its 200 day moving average is $102.04. The company has a debt-to-equity ratio of 0.49, a current ratio of 1.37 and a quick ratio of 0.88. The firm has a market capitalization of $152.46 billion, a P/E ratio of 61.25, a P/E/G ratio of 2.48 and a beta of 0.66.

Boston Scientific (NYSE:BSX - Get Free Report) last released its quarterly earnings results on Wednesday, July 23rd. The medical equipment provider reported $0.75 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.72 by $0.03. The company had revenue of $5.06 billion during the quarter, compared to analysts' expectations of $4.89 billion. Boston Scientific had a net margin of 13.55% and a return on equity of 19.21%. The business's quarterly revenue was up 22.8% compared to the same quarter last year. During the same period in the prior year, the company earned $0.62 earnings per share. On average, research analysts expect that Boston Scientific Corporation will post 2.85 EPS for the current year.

Boston Scientific Profile

(

Free Report)

Boston Scientific Corporation develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide. It operates through two segments, MedSurg and Cardiovascular. The company offers devices to diagnose and treat gastrointestinal and pulmonary conditions, such as resolution clips, biliary stent systems, stents and electrocautery enhanced delivery systems, direct visualization systems, digital catheters, and single-use duodenoscopes; devices to treat urological conditions, including ureteral stents, catheters, baskets, guidewires, sheaths, balloons, single-use digital flexible ureteroscopes, holmium laser systems, artificial urinary sphincter, laser system, fiber, and hydrogel systems; and devices to treat neurological movement disorders and manage chronic pain, such as spinal cord stimulator system, proprietary programming software, radiofrequency generator, indirect decompression systems, practice optimization tools, and deep brain stimulation system.

Further Reading

Before you consider Boston Scientific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boston Scientific wasn't on the list.

While Boston Scientific currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report