Aigen Investment Management LP grew its position in shares of The Mosaic Company (NYSE:MOS - Free Report) by 271.1% in the first quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 116,278 shares of the basic materials company's stock after buying an additional 84,944 shares during the quarter. Aigen Investment Management LP's holdings in Mosaic were worth $3,141,000 as of its most recent filing with the SEC.

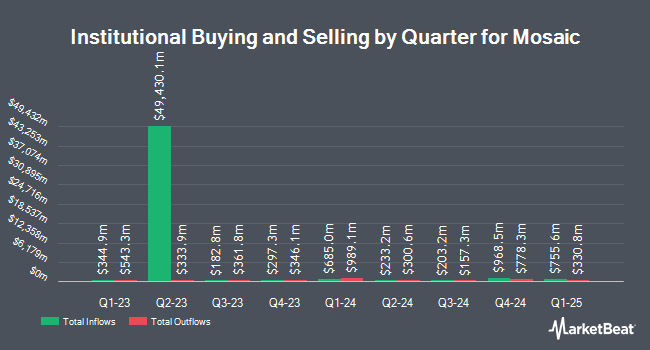

Other large investors also recently bought and sold shares of the company. Dimensional Fund Advisors LP grew its stake in shares of Mosaic by 24.2% during the 4th quarter. Dimensional Fund Advisors LP now owns 11,041,218 shares of the basic materials company's stock worth $271,382,000 after purchasing an additional 2,151,426 shares during the period. Criteria Caixa S.A.U. acquired a new position in shares of Mosaic during the 4th quarter worth $36,231,000. Victory Capital Management Inc. grew its stake in shares of Mosaic by 606.2% during the 1st quarter. Victory Capital Management Inc. now owns 1,389,335 shares of the basic materials company's stock worth $37,526,000 after purchasing an additional 1,192,602 shares during the period. Covalis Capital LLP acquired a new position in shares of Mosaic during the 4th quarter worth $27,031,000. Finally, Deutsche Bank AG grew its stake in shares of Mosaic by 33.5% during the 4th quarter. Deutsche Bank AG now owns 3,672,283 shares of the basic materials company's stock worth $90,265,000 after purchasing an additional 921,924 shares during the period. Hedge funds and other institutional investors own 77.54% of the company's stock.

Insider Activity

In other Mosaic news, SVP Walter F. Precourt III sold 18,000 shares of the firm's stock in a transaction dated Thursday, May 29th. The shares were sold at an average price of $35.73, for a total transaction of $643,140.00. Following the sale, the senior vice president directly owned 128,546 shares of the company's stock, valued at $4,592,948.58. This trade represents a 12.28% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. 0.50% of the stock is owned by corporate insiders.

Wall Street Analyst Weigh In

A number of research firms have recently weighed in on MOS. Wall Street Zen raised shares of Mosaic from a "hold" rating to a "buy" rating in a research note on Saturday, July 5th. UBS Group upped their price target on shares of Mosaic from $45.00 to $46.00 and gave the stock a "buy" rating in a research note on Wednesday. Scotiabank reaffirmed an "outperform" rating on shares of Mosaic in a research note on Wednesday, May 14th. Oppenheimer reissued an "outperform" rating and issued a $43.00 price objective (up from $39.00) on shares of Mosaic in a research note on Tuesday, July 15th. Finally, Royal Bank Of Canada reissued an "outperform" rating on shares of Mosaic in a research note on Monday, July 14th. Five research analysts have rated the stock with a hold rating, eight have given a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat.com, Mosaic has an average rating of "Moderate Buy" and a consensus target price of $36.50.

Check Out Our Latest Stock Report on MOS

Mosaic Stock Performance

NYSE MOS opened at $31.98 on Friday. The Mosaic Company has a fifty-two week low of $22.36 and a fifty-two week high of $38.23. The stock has a market cap of $10.15 billion, a price-to-earnings ratio of 10.84, a price-to-earnings-growth ratio of 1.44 and a beta of 1.12. The business has a fifty day moving average of $35.86 and a 200-day moving average of $30.89. The company has a quick ratio of 0.44, a current ratio of 1.14 and a debt-to-equity ratio of 0.26.

Mosaic (NYSE:MOS - Get Free Report) last released its quarterly earnings results on Tuesday, August 5th. The basic materials company reported $0.51 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.71 by ($0.20). Mosaic had a return on equity of 4.74% and a net margin of 8.35%. The firm had revenue of $3.01 billion for the quarter, compared to analyst estimates of $3.11 billion. During the same period in the prior year, the business earned $0.54 earnings per share. Mosaic's revenue for the quarter was up 6.7% on a year-over-year basis. As a group, analysts predict that The Mosaic Company will post 2.04 earnings per share for the current fiscal year.

About Mosaic

(

Free Report)

The Mosaic Company, through its subsidiaries, produces and markets concentrated phosphate and potash crop nutrients in North America and internationally. The company operates through three segments: Phosphates, Potash, and Mosaic Fertilizantes. It owns and operates mines, which produce concentrated phosphate crop nutrients, such as diammonium phosphate, monoammonium phosphate, and ammoniated phosphate products; and phosphate-based animal feed ingredients primarily under the Biofos and Nexfos brand names, as well as produces a double sulfate of potash magnesia product under K-Mag brand name.

Featured Stories

Want to see what other hedge funds are holding MOS? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for The Mosaic Company (NYSE:MOS - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Mosaic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mosaic wasn't on the list.

While Mosaic currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.