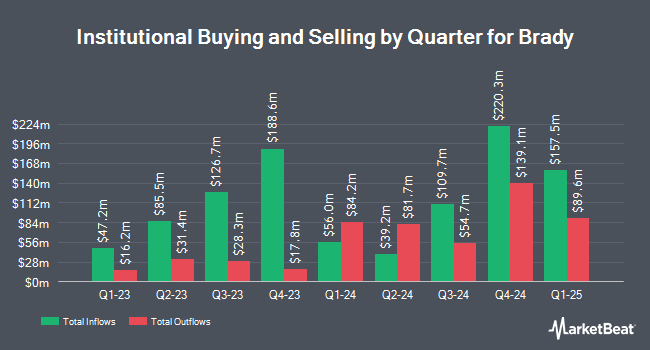

Algert Global LLC cut its stake in Brady Corporation (NYSE:BRC - Free Report) by 51.8% during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 83,284 shares of the industrial products company's stock after selling 89,406 shares during the quarter. Algert Global LLC owned approximately 0.17% of Brady worth $5,883,000 at the end of the most recent reporting period.

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. Caitong International Asset Management Co. Ltd purchased a new position in Brady in the 1st quarter valued at about $74,000. Pacer Advisors Inc. purchased a new position in Brady in the 1st quarter worth approximately $159,000. KBC Group NV lifted its stake in Brady by 33.7% in the 1st quarter. KBC Group NV now owns 2,391 shares of the industrial products company's stock worth $169,000 after purchasing an additional 602 shares in the last quarter. Hancock Whitney Corp purchased a new position in Brady in the 4th quarter worth approximately $219,000. Finally, NBC Securities Inc. lifted its stake in Brady by 99,900.0% in the 1st quarter. NBC Securities Inc. now owns 3,000 shares of the industrial products company's stock worth $211,000 after purchasing an additional 2,997 shares in the last quarter. 76.28% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

A number of research analysts have weighed in on the stock. Sidoti raised shares of Brady to a "strong-buy" rating in a research note on Monday, May 19th. Wall Street Zen raised shares of Brady from a "hold" rating to a "buy" rating in a research note on Friday. One investment analyst has rated the stock with a Strong Buy rating, According to data from MarketBeat, the company presently has an average rating of "Strong Buy".

Read Our Latest Stock Report on BRC

Brady Trading Up 3.5%

Shares of BRC stock traded up $2.5530 during trading on Friday, hitting $76.5530. 228,479 shares of the stock traded hands, compared to its average volume of 130,076. The firm has a market capitalization of $3.62 billion, a P/E ratio of 18.95 and a beta of 0.81. The company has a debt-to-equity ratio of 0.09, a current ratio of 1.87 and a quick ratio of 1.26. The firm's fifty day moving average price is $69.91 and its 200-day moving average price is $70.41. Brady Corporation has a 52-week low of $62.70 and a 52-week high of $77.68.

Brady Profile

(

Free Report)

Brady Corporation manufactures and supplies identification solutions (IDS) and workplace safety (WPS) products to identify and protect premises, products, and people in the United States and internationally. The company offers materials, printing systems, RFID, and bar code scanners for product identification, brand protection labeling, work in process labeling, finished product identification, and industrial track and trace applications; safety signs, floor-marking tapes, pipe markers, labeling systems, spill control products, lockout/tagout device, and software and services for safety compliance auditing, procedure writing, and training; and hand-held printers, wire markers, sleeves, and tags for wire identification.

Read More

Before you consider Brady, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brady wasn't on the list.

While Brady currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.