Alight Capital Management LP acquired a new position in Take-Two Interactive Software, Inc. (NASDAQ:TTWO - Free Report) during the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund acquired 60,000 shares of the company's stock, valued at approximately $12,435,000. Take-Two Interactive Software comprises approximately 5.8% of Alight Capital Management LP's portfolio, making the stock its 4th biggest holding.

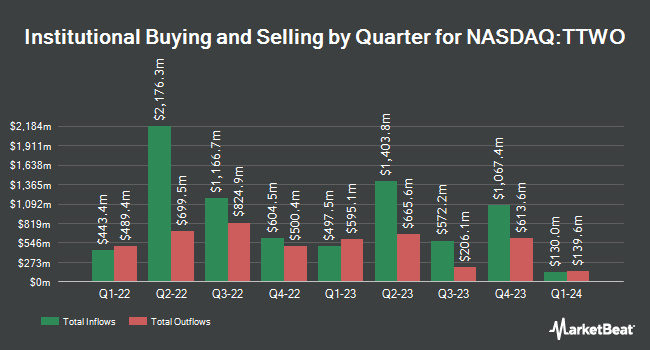

A number of other large investors have also added to or reduced their stakes in TTWO. Clarius Group LLC bought a new position in shares of Take-Two Interactive Software during the 1st quarter valued at approximately $404,000. Mackenzie Financial Corp increased its position in shares of Take-Two Interactive Software by 13.2% during the 4th quarter. Mackenzie Financial Corp now owns 15,698 shares of the company's stock valued at $2,890,000 after purchasing an additional 1,833 shares during the last quarter. Cornerstone Investment Partners LLC increased its position in shares of Take-Two Interactive Software by 14.1% during the 1st quarter. Cornerstone Investment Partners LLC now owns 292,616 shares of the company's stock valued at $60,645,000 after purchasing an additional 36,112 shares during the last quarter. Stonebridge Financial Group LLC increased its position in shares of Take-Two Interactive Software by 3,986.2% during the 1st quarter. Stonebridge Financial Group LLC now owns 1,185 shares of the company's stock valued at $246,000 after purchasing an additional 1,156 shares during the last quarter. Finally, Wealth Enhancement Advisory Services LLC boosted its holdings in Take-Two Interactive Software by 8.4% during the 4th quarter. Wealth Enhancement Advisory Services LLC now owns 15,810 shares of the company's stock valued at $2,910,000 after acquiring an additional 1,231 shares during the period. Institutional investors own 95.46% of the company's stock.

Insider Transactions at Take-Two Interactive Software

In related news, Director Jon J. Moses sold 1,000 shares of the company's stock in a transaction that occurred on Thursday, September 4th. The stock was sold at an average price of $239.57, for a total value of $239,570.00. Following the sale, the director owned 21,901 shares of the company's stock, valued at approximately $5,246,822.57. This represents a 4.37% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CEO Strauss Zelnick sold 20,000 shares of the company's stock in a transaction on Wednesday, August 27th. The stock was sold at an average price of $230.69, for a total value of $4,613,800.00. The disclosure for this sale can be found here. Insiders have sold 141,411 shares of company stock worth $32,430,724 in the last quarter. Insiders own 1.34% of the company's stock.

Analyst Ratings Changes

A number of equities analysts recently issued reports on TTWO shares. Bank of America boosted their price objective on Take-Two Interactive Software from $260.00 to $285.00 and gave the company a "buy" rating in a report on Friday, August 8th. Robert W. Baird boosted their price objective on Take-Two Interactive Software from $210.00 to $230.00 and gave the company an "outperform" rating in a report on Friday, May 16th. UBS Group upped their target price on Take-Two Interactive Software from $275.00 to $285.00 and gave the stock a "buy" rating in a report on Friday, August 8th. Wall Street Zen cut Take-Two Interactive Software from a "hold" rating to a "sell" rating in a report on Wednesday, May 21st. Finally, Wedbush upped their target price on Take-Two Interactive Software from $269.00 to $275.00 and gave the stock an "outperform" rating in a report on Friday, August 8th. Eighteen investment analysts have rated the stock with a Buy rating and two have given a Hold rating to the company. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $248.32.

View Our Latest Research Report on Take-Two Interactive Software

Take-Two Interactive Software Trading Up 3.6%

TTWO stock traded up $8.57 during midday trading on Monday, hitting $248.25. 811,101 shares of the company's stock were exchanged, compared to its average volume of 1,973,480. The stock has a market capitalization of $45.79 billion, a PE ratio of -10.37, a P/E/G ratio of 6.03 and a beta of 1.00. The business has a 50-day simple moving average of $232.40 and a two-hundred day simple moving average of $224.28. Take-Two Interactive Software, Inc. has a 1-year low of $146.76 and a 1-year high of $248.70. The company has a current ratio of 1.16, a quick ratio of 1.16 and a debt-to-equity ratio of 0.72.

Take-Two Interactive Software (NASDAQ:TTWO - Get Free Report) last announced its quarterly earnings results on Thursday, August 7th. The company reported $0.61 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.28 by $0.33. The company had revenue of $1.50 billion during the quarter, compared to the consensus estimate of $1.31 billion. Take-Two Interactive Software had a positive return on equity of 7.33% and a negative net margin of 72.92%.Take-Two Interactive Software's revenue for the quarter was up 16.4% on a year-over-year basis. During the same period in the previous year, the business earned ($1.52) EPS. Take-Two Interactive Software has set its Q2 2026 guidance at 0.850-0.950 EPS. FY 2026 guidance at 2.600-2.850 EPS. On average, sell-side analysts predict that Take-Two Interactive Software, Inc. will post 0.97 EPS for the current fiscal year.

Take-Two Interactive Software Profile

(

Free Report)

Take-Two Interactive Software, Inc develops, publishes, and markets interactive entertainment solutions for consumers worldwide. It develops and publishes action/adventure products under the Grand Theft Auto, LA Noire, Max Payne, Midnight Club, and Red Dead Redemption names, as well as other franchises.

Featured Articles

Before you consider Take-Two Interactive Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Take-Two Interactive Software wasn't on the list.

While Take-Two Interactive Software currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.