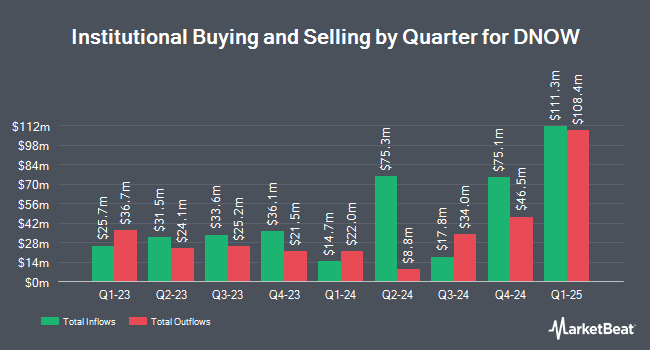

Allianz Asset Management GmbH lifted its stake in shares of DNOW Inc. (NYSE:DNOW - Free Report) by 72.2% during the 1st quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 1,158,105 shares of the oil and gas company's stock after purchasing an additional 485,650 shares during the quarter. Allianz Asset Management GmbH owned 1.10% of DNOW worth $19,780,000 as of its most recent SEC filing.

Several other large investors also recently modified their holdings of the stock. Raymond James Financial Inc. bought a new stake in shares of DNOW during the 4th quarter worth $3,903,000. Teacher Retirement System of Texas increased its holdings in DNOW by 0.8% in the fourth quarter. Teacher Retirement System of Texas now owns 100,117 shares of the oil and gas company's stock worth $1,303,000 after purchasing an additional 792 shares in the last quarter. KLP Kapitalforvaltning AS bought a new position in shares of DNOW during the 4th quarter worth about $807,000. Prudential Financial Inc. increased its holdings in shares of DNOW by 4.7% during the fourth quarter. Prudential Financial Inc. now owns 218,267 shares of the oil and gas company's stock valued at $3,136,000 after acquiring an additional 9,737 shares in the last quarter. Finally, WINTON GROUP Ltd bought a new position in shares of DNOW in the 4th quarter worth $221,000. 97.63% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

A number of research firms recently commented on DNOW. Susquehanna lowered their price target on DNOW from $19.00 to $18.00 and set a "neutral" rating for the company in a research report on Monday, April 14th. Wall Street Zen upgraded DNOW from a "hold" rating to a "buy" rating in a research note on Saturday, April 26th. Finally, Stifel Nicolaus cut their target price on DNOW from $19.00 to $18.00 and set a "buy" rating for the company in a research note on Monday, July 21st.

Get Our Latest Analysis on DNOW

DNOW Stock Performance

NYSE DNOW traded up $0.35 during trading hours on Monday, hitting $15.48. The company had a trading volume of 228,484 shares, compared to its average volume of 1,126,847. DNOW Inc. has a 52 week low of $11.42 and a 52 week high of $18.45. The firm has a 50 day simple moving average of $14.72 and a 200 day simple moving average of $15.18. The firm has a market capitalization of $1.63 billion, a price-to-earnings ratio of 20.97 and a beta of 1.08.

DNOW (NYSE:DNOW - Get Free Report) last issued its quarterly earnings results on Wednesday, May 7th. The oil and gas company reported $0.22 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.19 by $0.03. The firm had revenue of $599.00 million during the quarter, compared to the consensus estimate of $587.17 million. DNOW had a return on equity of 9.00% and a net margin of 3.40%. The company's revenue for the quarter was up 6.4% on a year-over-year basis. During the same quarter last year, the company posted $0.21 EPS. On average, research analysts forecast that DNOW Inc. will post 0.86 earnings per share for the current year.

DNOW Company Profile

(

Free Report)

DNOW Inc distributes downstream energy and industrial products for petroleum refining, chemical processing, LNG terminals, power generation utilities, and customer on-site locations in the United States, Canada, and internationally. The company provides consumable maintenance, repair, and operating supplies; pipes, manual and automated valves, fittings, flanges, gaskets, fasteners, electrical instrumentations, artificial lift, pumping solutions, valve actuation and modular process, and measurement and control equipment; and mill supplies, tools, safety supplies, and personal protective equipment, as well as artificial lift systems, coatings, and miscellaneous expendable items.

Read More

Before you consider DNOW, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DNOW wasn't on the list.

While DNOW currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.