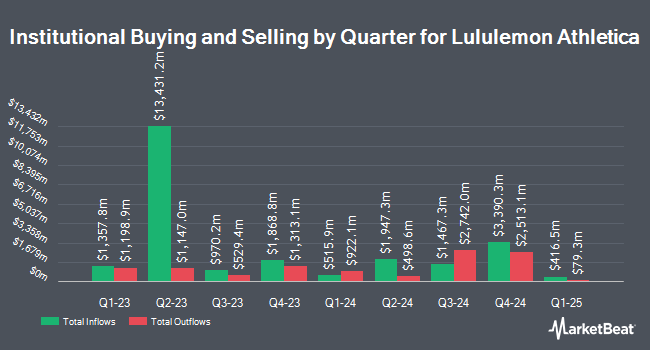

Allianz Asset Management GmbH decreased its holdings in shares of lululemon athletica inc. (NASDAQ:LULU - Free Report) by 88.8% in the first quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 10,637 shares of the apparel retailer's stock after selling 84,372 shares during the period. Allianz Asset Management GmbH's holdings in lululemon athletica were worth $3,011,000 as of its most recent SEC filing.

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in the business. Cornerstone Planning Group LLC increased its holdings in shares of lululemon athletica by 506.3% during the first quarter. Cornerstone Planning Group LLC now owns 97 shares of the apparel retailer's stock worth $26,000 after buying an additional 81 shares in the last quarter. Anderson Financial Strategies LLC acquired a new stake in shares of lululemon athletica during the fourth quarter worth approximately $30,000. Garde Capital Inc. acquired a new stake in shares of lululemon athletica during the first quarter worth approximately $35,000. CENTRAL TRUST Co increased its holdings in shares of lululemon athletica by 154.9% during the first quarter. CENTRAL TRUST Co now owns 130 shares of the apparel retailer's stock worth $37,000 after buying an additional 79 shares in the last quarter. Finally, Dunhill Financial LLC increased its holdings in shares of lululemon athletica by 650.0% during the first quarter. Dunhill Financial LLC now owns 135 shares of the apparel retailer's stock worth $38,000 after buying an additional 117 shares in the last quarter. Institutional investors own 85.20% of the company's stock.

Wall Street Analyst Weigh In

LULU has been the subject of several recent analyst reports. Truist Financial dropped their price objective on shares of lululemon athletica from $297.00 to $290.00 and set a "buy" rating for the company in a report on Friday, June 6th. TD Securities raised their price target on shares of lululemon athletica from $370.00 to $373.00 and gave the company a "buy" rating in a report on Tuesday, June 3rd. Barclays lowered their price target on shares of lululemon athletica from $276.00 to $270.00 and set an "equal weight" rating for the company in a report on Monday, June 9th. Bank of America lowered their price target on shares of lululemon athletica from $400.00 to $370.00 and set a "buy" rating for the company in a report on Friday, June 6th. Finally, Citigroup lowered their price target on shares of lululemon athletica from $325.00 to $270.00 and set a "neutral" rating for the company in a report on Friday, June 6th. One equities research analyst has rated the stock with a sell rating, thirteen have issued a hold rating, sixteen have given a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat, lululemon athletica presently has an average rating of "Moderate Buy" and an average target price of $333.57.

Check Out Our Latest Report on LULU

Insider Buying and Selling

In related news, CEO Calvin Mcdonald sold 27,049 shares of the business's stock in a transaction on Friday, June 27th. The shares were sold at an average price of $235.69, for a total value of $6,375,178.81. Following the sale, the chief executive officer directly owned 110,564 shares of the company's stock, valued at approximately $26,058,829.16. The trade was a 19.66% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Corporate insiders own 0.54% of the company's stock.

lululemon athletica Trading Down 3.6%

Shares of LULU stock traded down $7.20 on Friday, hitting $193.33. The stock had a trading volume of 4,678,061 shares, compared to its average volume of 3,116,957. lululemon athletica inc. has a twelve month low of $191.44 and a twelve month high of $423.32. The firm has a market cap of $23.17 billion, a P/E ratio of 13.10, a PEG ratio of 1.65 and a beta of 1.16. The company has a fifty day moving average price of $248.66 and a two-hundred day moving average price of $298.81.

lululemon athletica (NASDAQ:LULU - Get Free Report) last posted its quarterly earnings data on Thursday, June 5th. The apparel retailer reported $2.60 EPS for the quarter, meeting the consensus estimate of $2.60. The business had revenue of $2.37 billion for the quarter, compared to analysts' expectations of $2.36 billion. lululemon athletica had a net margin of 16.82% and a return on equity of 43.48%. The firm's revenue was up 7.3% compared to the same quarter last year. During the same period in the previous year, the firm posted $2.54 EPS. On average, analysts expect that lululemon athletica inc. will post 14.36 earnings per share for the current year.

lululemon athletica Company Profile

(

Free Report)

Lululemon Athletica Inc, together with its subsidiaries, designs, distributes, and retails athletic apparel, footwear, and accessories under the lululemon brand for women and men. It offers pants, shorts, tops, and jackets for healthy lifestyle, such as yoga, running, training, and other activities. It also provides fitness-inspired accessories.

Read More

Before you consider lululemon athletica, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and lululemon athletica wasn't on the list.

While lululemon athletica currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.