Allianz Asset Management GmbH grew its position in shares of Stag Industrial, Inc. (NYSE:STAG - Free Report) by 122.0% in the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 404,435 shares of the real estate investment trust's stock after acquiring an additional 222,289 shares during the quarter. Allianz Asset Management GmbH owned about 0.22% of Stag Industrial worth $14,608,000 at the end of the most recent quarter.

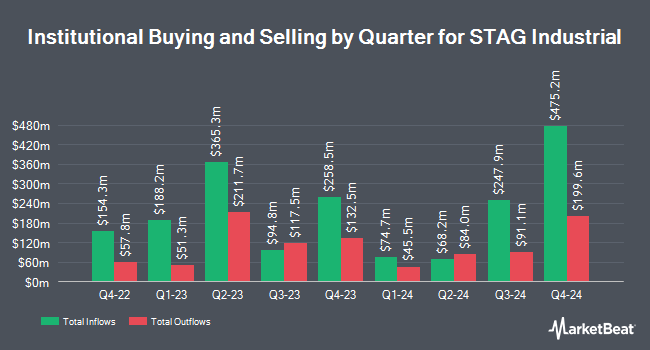

Other hedge funds have also made changes to their positions in the company. FMR LLC grew its position in Stag Industrial by 30.1% in the fourth quarter. FMR LLC now owns 9,024,946 shares of the real estate investment trust's stock valued at $305,224,000 after acquiring an additional 2,088,839 shares in the last quarter. Earnest Partners LLC boosted its holdings in Stag Industrial by 6.6% in the fourth quarter. Earnest Partners LLC now owns 3,795,425 shares of the real estate investment trust's stock valued at $128,361,000 after purchasing an additional 235,622 shares during the last quarter. Nuveen Asset Management LLC boosted its holdings in Stag Industrial by 5.9% in the fourth quarter. Nuveen Asset Management LLC now owns 3,679,641 shares of the real estate investment trust's stock valued at $124,445,000 after purchasing an additional 204,948 shares during the last quarter. Geode Capital Management LLC boosted its holdings in Stag Industrial by 0.5% in the fourth quarter. Geode Capital Management LLC now owns 3,421,549 shares of the real estate investment trust's stock valued at $115,748,000 after purchasing an additional 18,009 shares during the last quarter. Finally, Boston Trust Walden Corp boosted its holdings in Stag Industrial by 17.5% in the first quarter. Boston Trust Walden Corp now owns 2,942,495 shares of the real estate investment trust's stock valued at $106,283,000 after purchasing an additional 437,527 shares during the last quarter. Hedge funds and other institutional investors own 88.67% of the company's stock.

Insider Buying and Selling

In other news, Director Benjamin S. Butcher sold 28,843 shares of Stag Industrial stock in a transaction that occurred on Friday, June 6th. The stock was sold at an average price of $36.90, for a total transaction of $1,064,306.70. Following the sale, the director owned 7,115 shares of the company's stock, valued at approximately $262,543.50. The trade was a 80.21% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Company insiders own 1.10% of the company's stock.

Stag Industrial Stock Performance

NYSE:STAG traded up $0.04 during trading hours on Friday, reaching $35.60. 1,363,012 shares of the stock were exchanged, compared to its average volume of 1,367,492. The company has a quick ratio of 1.25, a current ratio of 1.25 and a debt-to-equity ratio of 0.86. The firm has a 50 day simple moving average of $35.99 and a 200-day simple moving average of $34.90. Stag Industrial, Inc. has a 52 week low of $28.61 and a 52 week high of $41.63. The stock has a market capitalization of $6.64 billion, a P/E ratio of 26.77 and a beta of 0.93.

Stag Industrial (NYSE:STAG - Get Free Report) last announced its quarterly earnings results on Tuesday, April 29th. The real estate investment trust reported $0.61 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.60 by $0.01. The business had revenue of $205.57 million for the quarter, compared to the consensus estimate of $202.04 million. Stag Industrial had a return on equity of 7.04% and a net margin of 31.05%. The business's revenue was up 9.7% on a year-over-year basis. During the same quarter last year, the business posted $0.59 EPS. As a group, sell-side analysts forecast that Stag Industrial, Inc. will post 2.47 earnings per share for the current fiscal year.

Stag Industrial Dividend Announcement

The company also recently announced a dividend, which will be paid on Friday, August 15th. Shareholders of record on Friday, August 1st will be paid a dividend of $0.1242 per share. This represents a yield of 4.22%. The ex-dividend date of this dividend is Thursday, July 31st. Stag Industrial's payout ratio is 112.03%.

Wall Street Analyst Weigh In

A number of brokerages recently commented on STAG. Royal Bank Of Canada reissued a "sector perform" rating and issued a $38.00 price target on shares of Stag Industrial in a report on Monday, May 19th. Robert W. Baird reduced their price target on Stag Industrial from $39.00 to $38.00 and set a "neutral" rating for the company in a report on Wednesday, May 7th. Finally, Raymond James Financial increased their price target on Stag Industrial from $36.00 to $38.00 and gave the company an "outperform" rating in a report on Wednesday, May 7th. Four research analysts have rated the stock with a hold rating and three have given a buy rating to the company's stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus target price of $39.71.

Get Our Latest Analysis on Stag Industrial

Stag Industrial Company Profile

(

Free Report)

STAG Industrial, Inc is a real estate investment company, which engages in acquiring, owning, and managing single-tenant, industrial real estate assets. It offers industrial real estate operating platform to real estate ownership. The company was founded by Benjamin S. Butcher on July 21, 2010 and is headquartered in Boston, MA.

Further Reading

Before you consider Stag Industrial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stag Industrial wasn't on the list.

While Stag Industrial currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.