Allspring Global Investments Holdings LLC grew its holdings in DXP Enterprises, Inc. (NASDAQ:DXPE - Free Report) by 54.0% in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 10,406 shares of the industrial products company's stock after acquiring an additional 3,649 shares during the period. Allspring Global Investments Holdings LLC owned about 0.07% of DXP Enterprises worth $856,000 as of its most recent filing with the Securities & Exchange Commission.

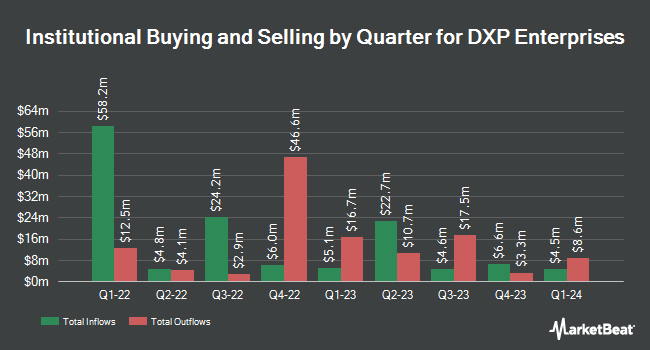

Several other institutional investors have also modified their holdings of the business. Wellington Management Group LLP acquired a new position in shares of DXP Enterprises during the fourth quarter worth $67,901,000. Arrowstreet Capital Limited Partnership grew its stake in shares of DXP Enterprises by 2,589.0% during the fourth quarter. Arrowstreet Capital Limited Partnership now owns 149,349 shares of the industrial products company's stock worth $12,339,000 after purchasing an additional 143,795 shares in the last quarter. GAMMA Investing LLC grew its stake in shares of DXP Enterprises by 9,327.6% during the first quarter. GAMMA Investing LLC now owns 41,953 shares of the industrial products company's stock worth $3,451,000 after purchasing an additional 41,508 shares in the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. grew its stake in shares of DXP Enterprises by 5.7% during the fourth quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 720,320 shares of the industrial products company's stock worth $59,513,000 after purchasing an additional 38,900 shares in the last quarter. Finally, JPMorgan Chase & Co. grew its stake in shares of DXP Enterprises by 26.5% during the fourth quarter. JPMorgan Chase & Co. now owns 123,986 shares of the industrial products company's stock worth $10,244,000 after purchasing an additional 25,942 shares in the last quarter. Institutional investors and hedge funds own 74.82% of the company's stock.

DXP Enterprises Stock Down 2.4%

Shares of DXPE stock traded down $2.27 on Friday, reaching $91.46. 97,595 shares of the stock were exchanged, compared to its average volume of 156,337. The company has a current ratio of 2.70, a quick ratio of 2.25 and a debt-to-equity ratio of 1.40. The business's 50 day moving average price is $85.47 and its 200 day moving average price is $87.65. The company has a market capitalization of $1.44 billion, a price-to-earnings ratio of 19.01 and a beta of 1.16. DXP Enterprises, Inc. has a twelve month low of $45.00 and a twelve month high of $107.06.

DXP Enterprises (NASDAQ:DXPE - Get Free Report) last released its quarterly earnings data on Wednesday, May 7th. The industrial products company reported $1.26 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.20 by $0.06. DXP Enterprises had a net margin of 4.27% and a return on equity of 20.41%. The company had revenue of $476.57 million during the quarter, compared to the consensus estimate of $477.00 million. As a group, sell-side analysts expect that DXP Enterprises, Inc. will post 4.07 earnings per share for the current fiscal year.

Insider Buying and Selling at DXP Enterprises

In other DXP Enterprises news, CMO Paz Maestas sold 3,000 shares of the company's stock in a transaction on Wednesday, June 18th. The shares were sold at an average price of $79.09, for a total value of $237,270.00. Following the completion of the transaction, the chief marketing officer owned 607,737 shares in the company, valued at $48,065,919.33. This represents a 0.49% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. Also, COO Nicholas Little sold 45,938 shares of the company's stock in a transaction on Monday, June 30th. The shares were sold at an average price of $87.73, for a total transaction of $4,030,140.74. Following the completion of the transaction, the chief operating officer owned 812,328 shares of the company's stock, valued at $71,265,535.44. This represents a 5.35% decrease in their position. The disclosure for this sale can be found here. Insiders sold 53,938 shares of company stock valued at $4,690,731 in the last 90 days. 22.70% of the stock is currently owned by insiders.

Wall Street Analyst Weigh In

Separately, Wall Street Zen downgraded shares of DXP Enterprises from a "buy" rating to a "hold" rating in a research note on Friday, May 16th.

Check Out Our Latest Report on DXPE

DXP Enterprises Company Profile

(

Free Report)

DXP Enterprises, Inc, together with its subsidiaries, engages in distributing maintenance, repair, and operating (MRO) products, equipment, and services in the United States and Canada. It operates through three segments: Service Centers (SC), Supply Chain Services (SCS), and Innovative Pumping Solutions (IPS).

Read More

Before you consider DXP Enterprises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DXP Enterprises wasn't on the list.

While DXP Enterprises currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.