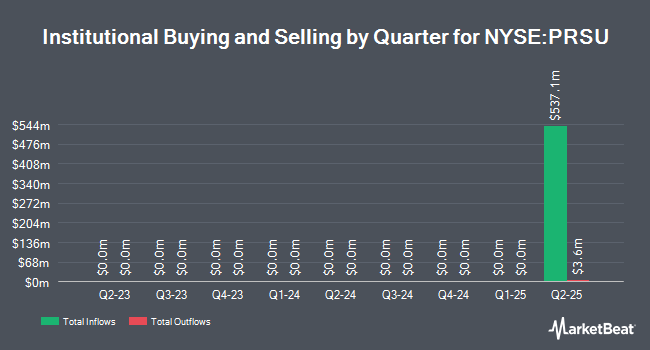

Allspring Global Investments Holdings LLC purchased a new stake in shares of Pursuit Attractions and Hospitality, Inc. (NYSE:PRSU - Free Report) in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 1,492,806 shares of the company's stock, valued at approximately $43,665,000. Allspring Global Investments Holdings LLC owned approximately 5.28% of Pursuit Attractions and Hospitality as of its most recent SEC filing.

Several other institutional investors and hedge funds also recently made changes to their positions in PRSU. KLP Kapitalforvaltning AS purchased a new stake in Pursuit Attractions and Hospitality in the second quarter worth approximately $112,000. State of Alaska Department of Revenue purchased a new stake in Pursuit Attractions and Hospitality in the second quarter worth approximately $367,000. Finally, Veracity Capital LLC purchased a new stake in Pursuit Attractions and Hospitality in the second quarter worth approximately $3,497,000. Institutional investors own 89.91% of the company's stock.

Pursuit Attractions and Hospitality Trading Up 1.9%

Shares of Pursuit Attractions and Hospitality stock opened at $36.76 on Wednesday. The company's fifty day simple moving average is $35.98 and its 200-day simple moving average is $31.96. The stock has a market capitalization of $1.04 billion, a PE ratio of 3.18, a P/E/G ratio of 2.19 and a beta of 1.76. Pursuit Attractions and Hospitality, Inc. has a 1-year low of $26.66 and a 1-year high of $47.49. The company has a debt-to-equity ratio of 0.13, a current ratio of 1.04 and a quick ratio of 0.89.

Pursuit Attractions and Hospitality (NYSE:PRSU - Get Free Report) last issued its quarterly earnings results on Thursday, February 10th. The company reported ($2.20) earnings per share for the quarter. The business had revenue of $25.57 million for the quarter. Pursuit Attractions and Hospitality had a return on equity of 21.30% and a net margin of 51.67%. As a group, equities analysts anticipate that Pursuit Attractions and Hospitality, Inc. will post 1.25 earnings per share for the current year.

Insider Buying and Selling at Pursuit Attractions and Hospitality

In other Pursuit Attractions and Hospitality news, Director Jill Bright purchased 1,000 shares of the company's stock in a transaction dated Tuesday, August 26th. The shares were acquired at an average price of $36.77 per share, for a total transaction of $36,770.00. Following the purchase, the director directly owned 6,311 shares of the company's stock, valued at $232,055.47. The trade was a 18.83% increase in their position. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. 4.10% of the stock is owned by corporate insiders.

Wall Street Analyst Weigh In

Several equities research analysts recently issued reports on PRSU shares. Oppenheimer restated an "outperform" rating on shares of Pursuit Attractions and Hospitality in a report on Friday, August 8th. Weiss Ratings restated a "hold (c)" rating on shares of Pursuit Attractions and Hospitality in a report on Wednesday, October 8th. Three research analysts have rated the stock with a Buy rating and one has assigned a Hold rating to the company's stock. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $29.67.

Get Our Latest Report on PRSU

Pursuit Attractions and Hospitality Profile

(

Free Report)

Pursuit Attractions & Hospitality, Inc engages in the provision of hospitality and leisure activities, experiential marketing, and live events. It operates through the following segments: Pursuit, Spiro, and GES Exhibitions. The Pursuit segment provides travel experiences that include recreational attractions, unique hotels and lodges, food and beverage, retail, sightseeing, and ground transportation services.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Pursuit Attractions and Hospitality, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pursuit Attractions and Hospitality wasn't on the list.

While Pursuit Attractions and Hospitality currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.