Allspring Global Investments Holdings LLC lifted its stake in Village Super Market, Inc. (NASDAQ:VLGEA - Free Report) by 114.7% during the second quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 106,601 shares of the company's stock after buying an additional 56,959 shares during the quarter. Allspring Global Investments Holdings LLC owned approximately 0.72% of Village Super Market worth $4,104,000 as of its most recent SEC filing.

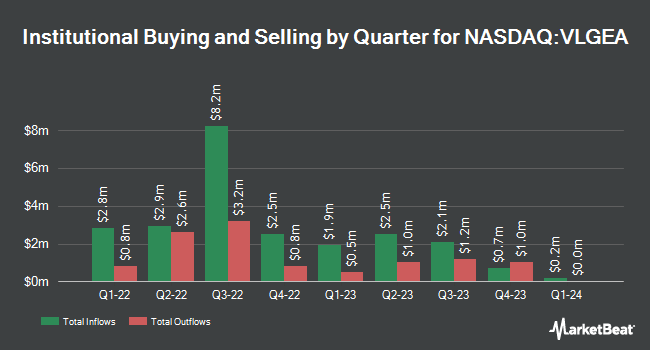

A number of other hedge funds have also recently modified their holdings of VLGEA. Charles Schwab Investment Management Inc. boosted its stake in shares of Village Super Market by 169.7% in the first quarter. Charles Schwab Investment Management Inc. now owns 64,540 shares of the company's stock worth $2,453,000 after buying an additional 40,609 shares during the last quarter. American Century Companies Inc. boosted its position in Village Super Market by 13.1% during the first quarter. American Century Companies Inc. now owns 298,665 shares of the company's stock worth $11,352,000 after purchasing an additional 34,578 shares in the last quarter. Universal Beteiligungs und Servicegesellschaft mbH purchased a new position in Village Super Market during the first quarter worth approximately $1,056,000. Informed Momentum Co LLC purchased a new position in Village Super Market during the first quarter worth approximately $929,000. Finally, Nuveen LLC purchased a new position in Village Super Market during the first quarter worth approximately $814,000. Hedge funds and other institutional investors own 39.02% of the company's stock.

Village Super Market Price Performance

Shares of Village Super Market stock opened at $33.11 on Tuesday. The business has a 50 day simple moving average of $36.16 and a two-hundred day simple moving average of $36.49. Village Super Market, Inc. has a 12 month low of $28.33 and a 12 month high of $40.15. The stock has a market capitalization of $488.37 million, a P/E ratio of 8.71 and a beta of 0.53. The company has a debt-to-equity ratio of 0.14, a current ratio of 1.13 and a quick ratio of 0.85.

Village Super Market (NASDAQ:VLGEA - Get Free Report) last announced its earnings results on Tuesday, October 7th. The company reported $1.05 EPS for the quarter. Village Super Market had a return on equity of 11.97% and a net margin of 2.43%.The business had revenue of $599.67 million during the quarter.

Village Super Market Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Thursday, October 23rd. Investors of record on Thursday, October 2nd will be issued a $0.25 dividend. This represents a $1.00 annualized dividend and a dividend yield of 3.0%. The ex-dividend date of this dividend is Thursday, October 2nd. Village Super Market's dividend payout ratio (DPR) is currently 26.32%.

Analysts Set New Price Targets

A number of equities analysts have issued reports on the company. Weiss Ratings downgraded Village Super Market from a "buy (a-)" rating to a "buy (b+)" rating in a research report on Wednesday, October 8th. Wall Street Zen downgraded Village Super Market from a "strong-buy" rating to a "buy" rating in a research report on Saturday, August 9th. One investment analyst has rated the stock with a Buy rating, According to data from MarketBeat, the company presently has an average rating of "Buy".

Check Out Our Latest Stock Analysis on VLGEA

Village Super Market Profile

(

Free Report)

Village Super Market, Inc operates a chain of supermarkets in the United States. The company offers grocery, meat, produce, dairy, deli, seafood, prepared foods, and bakery and frozen foods. It also provides non-food products, including health and beauty care, general merchandise, liquor, and pharmacy products through retail and online stores.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Village Super Market, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Village Super Market wasn't on the list.

While Village Super Market currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.