Magellan Asset Management Ltd cut its holdings in shares of Alphabet Inc. (NASDAQ:GOOG - Free Report) by 0.2% in the first quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 958,373 shares of the information services provider's stock after selling 1,886 shares during the quarter. Alphabet accounts for about 1.8% of Magellan Asset Management Ltd's investment portfolio, making the stock its 26th largest holding. Magellan Asset Management Ltd's holdings in Alphabet were worth $149,727,000 as of its most recent SEC filing.

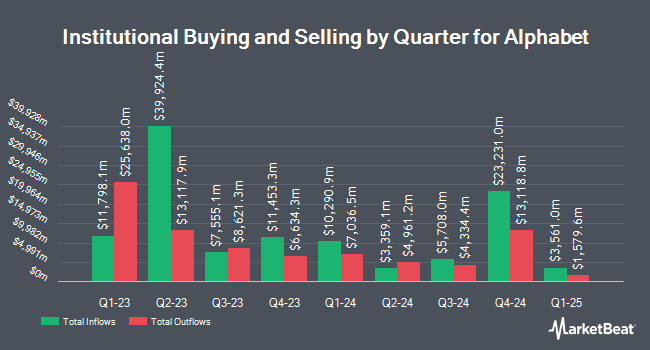

A number of other institutional investors have also recently bought and sold shares of GOOG. GAMMA Investing LLC increased its position in Alphabet by 18,562.3% in the 1st quarter. GAMMA Investing LLC now owns 14,323,323 shares of the information services provider's stock worth $2,237,733,000 after purchasing an additional 14,246,573 shares during the last quarter. Vanguard Group Inc. increased its position in Alphabet by 2.4% in the 1st quarter. Vanguard Group Inc. now owns 411,570,922 shares of the information services provider's stock worth $64,299,725,000 after purchasing an additional 9,687,855 shares during the last quarter. JPMorgan Chase & Co. increased its position in Alphabet by 9.9% in the 1st quarter. JPMorgan Chase & Co. now owns 102,232,997 shares of the information services provider's stock worth $15,971,861,000 after purchasing an additional 9,243,959 shares during the last quarter. Northern Trust Corp increased its position in Alphabet by 16.1% in the 4th quarter. Northern Trust Corp now owns 57,098,042 shares of the information services provider's stock worth $10,873,751,000 after purchasing an additional 7,917,625 shares during the last quarter. Finally, Capital International Investors increased its holdings in shares of Alphabet by 6.7% during the 4th quarter. Capital International Investors now owns 91,236,069 shares of the information services provider's stock valued at $17,376,706,000 after acquiring an additional 5,758,244 shares during the last quarter. 27.26% of the stock is currently owned by institutional investors and hedge funds.

Alphabet Stock Performance

Shares of GOOG stock traded down $0.46 during mid-day trading on Monday, reaching $201.63. The stock had a trading volume of 16,675,980 shares, compared to its average volume of 24,116,525. The firm's 50 day simple moving average is $181.90 and its 200 day simple moving average is $174.35. The company has a quick ratio of 1.90, a current ratio of 1.90 and a debt-to-equity ratio of 0.07. Alphabet Inc. has a one year low of $142.66 and a one year high of $208.70. The firm has a market cap of $2.44 trillion, a PE ratio of 21.47, a P/E/G ratio of 1.34 and a beta of 1.02.

Alphabet (NASDAQ:GOOG - Get Free Report) last announced its quarterly earnings data on Wednesday, July 23rd. The information services provider reported $2.31 EPS for the quarter, topping analysts' consensus estimates of $2.12 by $0.19. Alphabet had a return on equity of 34.31% and a net margin of 31.12%. The company had revenue of $96.43 billion during the quarter, compared to the consensus estimate of $93.67 billion. During the same quarter last year, the company earned $1.89 EPS. The company's quarterly revenue was up 13.8% on a year-over-year basis. On average, analysts forecast that Alphabet Inc. will post 8.89 EPS for the current year.

Alphabet Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Monday, September 15th. Stockholders of record on Monday, September 8th will be issued a $0.21 dividend. The ex-dividend date of this dividend is Monday, September 8th. This represents a $0.84 dividend on an annualized basis and a dividend yield of 0.4%. Alphabet's dividend payout ratio is presently 8.95%.

Insider Transactions at Alphabet

In other news, insider John Kent Walker sold 23,820 shares of the stock in a transaction that occurred on Monday, August 4th. The stock was sold at an average price of $194.70, for a total value of $4,637,754.00. Following the completion of the transaction, the insider directly owned 42,999 shares of the company's stock, valued at approximately $8,371,905.30. This represents a 35.65% decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, CEO Sundar Pichai sold 32,500 shares of the stock in a transaction that occurred on Wednesday, July 2nd. The stock was sold at an average price of $178.52, for a total value of $5,801,900.00. Following the completion of the transaction, the chief executive officer directly owned 2,559,892 shares of the company's stock, valued at approximately $456,991,919.84. The trade was a 1.25% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 274,219 shares of company stock valued at $49,674,273. Corporate insiders own 12.99% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research analysts have recently commented on the company. Tigress Financial reissued a "strong-buy" rating on shares of Alphabet in a report on Friday, May 2nd. Needham & Company LLC lowered Alphabet from a "buy" rating to a "cautious" rating in a report on Friday, May 2nd. Rosenblatt Securities raised Alphabet from a "hold" rating to a "strong-buy" rating in a report on Friday, April 25th. Citigroup reissued a "sell" rating on shares of Alphabet in a report on Wednesday, April 23rd. Finally, Piper Sandler restated a "neutral" rating on shares of Alphabet in a research note on Wednesday, July 9th. Three research analysts have rated the stock with a sell rating, six have given a hold rating, seventeen have assigned a buy rating and five have assigned a strong buy rating to the stock. According to data from MarketBeat, the company has an average rating of "Moderate Buy" and a consensus target price of $215.19.

Read Our Latest Stock Analysis on GOOG

Alphabet Company Profile

(

Free Report)

Alphabet Inc offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. It operates through Google Services, Google Cloud, and Other Bets segments. The Google Services segment provides products and services, including ads, Android, Chrome, devices, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube.

Featured Stories

Before you consider Alphabet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alphabet wasn't on the list.

While Alphabet currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report