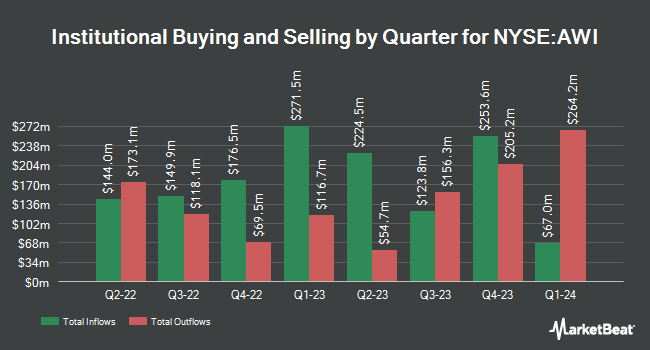

AlphaQuest LLC lifted its holdings in shares of Armstrong World Industries, Inc. (NYSE:AWI - Free Report) by 591.4% during the first quarter, according to its most recent disclosure with the SEC. The fund owned 13,822 shares of the construction company's stock after acquiring an additional 11,823 shares during the period. AlphaQuest LLC's holdings in Armstrong World Industries were worth $1,947,000 at the end of the most recent quarter.

Other large investors have also modified their holdings of the company. Quantbot Technologies LP purchased a new stake in shares of Armstrong World Industries during the first quarter worth about $2,508,000. Versor Investments LP purchased a new stake in Armstrong World Industries in the first quarter valued at approximately $596,000. Wealth Enhancement Advisory Services LLC boosted its position in Armstrong World Industries by 113.6% in the first quarter. Wealth Enhancement Advisory Services LLC now owns 4,773 shares of the construction company's stock valued at $672,000 after buying an additional 2,538 shares during the last quarter. Dynamic Advisor Solutions LLC boosted its position in Armstrong World Industries by 194.2% in the first quarter. Dynamic Advisor Solutions LLC now owns 4,848 shares of the construction company's stock valued at $683,000 after buying an additional 3,200 shares during the last quarter. Finally, Public Employees Retirement System of Ohio purchased a new stake in Armstrong World Industries in the fourth quarter valued at approximately $2,326,000. Hedge funds and other institutional investors own 98.93% of the company's stock.

Armstrong World Industries Price Performance

Shares of NYSE:AWI traded down $1.53 during midday trading on Thursday, reaching $196.14. 87,518 shares of the company's stock traded hands, compared to its average volume of 321,630. Armstrong World Industries, Inc. has a 1 year low of $118.14 and a 1 year high of $198.64. The company has a market cap of $8.48 billion, a P/E ratio of 29.01, a PEG ratio of 2.17 and a beta of 1.43. The company has a debt-to-equity ratio of 0.59, a quick ratio of 1.11 and a current ratio of 1.61. The company has a fifty day simple moving average of $176.64 and a two-hundred day simple moving average of $157.05.

Armstrong World Industries (NYSE:AWI - Get Free Report) last announced its earnings results on Tuesday, July 29th. The construction company reported $2.09 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.75 by $0.34. Armstrong World Industries had a return on equity of 39.80% and a net margin of 18.95%.The firm had revenue of $424.60 million for the quarter, compared to analyst estimates of $404.05 million. During the same quarter last year, the firm posted $1.62 EPS. The business's revenue was up 16.3% on a year-over-year basis. Armstrong World Industries has set its FY 2025 guidance at 7.150-7.300 EPS. Equities analysts predict that Armstrong World Industries, Inc. will post 6.18 EPS for the current fiscal year.

Armstrong World Industries Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Thursday, August 21st. Shareholders of record on Thursday, August 7th were issued a $0.308 dividend. The ex-dividend date was Thursday, August 7th. This represents a $1.23 dividend on an annualized basis and a yield of 0.6%. Armstrong World Industries's dividend payout ratio (DPR) is presently 18.20%.

Analyst Upgrades and Downgrades

A number of brokerages recently commented on AWI. UBS Group reiterated a "neutral" rating and issued a $178.00 target price (up previously from $158.00) on shares of Armstrong World Industries in a research report on Wednesday, July 30th. Truist Financial set a $195.00 target price on Armstrong World Industries and gave the company a "buy" rating in a research report on Wednesday, July 30th. Wall Street Zen lowered Armstrong World Industries from a "buy" rating to a "hold" rating in a research report on Friday, August 22nd. Bank of America upped their price objective on Armstrong World Industries from $162.00 to $170.00 and gave the stock a "buy" rating in a research report on Thursday, May 15th. Finally, Loop Capital set a $190.00 price objective on Armstrong World Industries and gave the stock a "hold" rating in a research report on Wednesday, July 30th. Four analysts have rated the stock with a Buy rating and four have issued a Hold rating to the company. According to data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $177.13.

Get Our Latest Research Report on AWI

About Armstrong World Industries

(

Free Report)

Armstrong World Industries, Inc, together with its subsidiaries, engages in the design, manufacture, and sale of ceiling and wall solutions in the Americas. It operates through Mineral Fiber and Architectural Specialties segments. The company offers mineral fiber, fiberglass wool, metal, wood, felt, wood fiber, and glass-reinforced-gypsum; ceiling component products, such as ceiling perimeters and trims, as well as grid products that support drywall ceiling systems; ceilings, walls, and facades for use in commercial settings; and manufactures ceiling suspension system (grid) products.

Read More

Before you consider Armstrong World Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Armstrong World Industries wasn't on the list.

While Armstrong World Industries currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.