Alyeska Investment Group L.P. trimmed its stake in FrontView REIT, Inc. (NYSE:FVR - Free Report) by 12.1% during the first quarter, according to its most recent 13F filing with the SEC. The firm owned 1,289,700 shares of the company's stock after selling 177,311 shares during the period. Alyeska Investment Group L.P. owned about 7.46% of FrontView REIT worth $16,495,000 as of its most recent filing with the SEC.

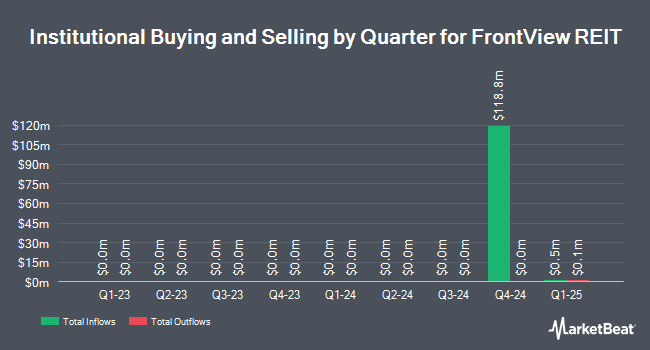

Several other large investors have also recently added to or reduced their stakes in the business. Wells Fargo & Company MN acquired a new position in FrontView REIT during the 4th quarter worth approximately $154,000. Barclays PLC acquired a new position in shares of FrontView REIT in the 4th quarter valued at $393,000. MetLife Investment Management LLC purchased a new stake in FrontView REIT in the 4th quarter valued at $167,000. Tower Research Capital LLC TRC purchased a new stake in FrontView REIT in the 4th quarter valued at $34,000. Finally, Northern Trust Corp purchased a new stake in FrontView REIT in the 4th quarter valued at $2,105,000.

Insider Activity

In other FrontView REIT news, Director Elizabeth F. Frank bought 2,808 shares of the stock in a transaction on Friday, August 15th. The stock was purchased at an average price of $12.44 per share, for a total transaction of $34,931.52. Following the completion of the purchase, the director directly owned 5,177 shares in the company, valued at approximately $64,401.88. This trade represents a 118.53% increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Company insiders own 4.30% of the company's stock.

Analyst Ratings Changes

A number of equities analysts have commented on FVR shares. Morgan Stanley downgraded shares of FrontView REIT from an "overweight" rating to an "equal weight" rating and set a $13.50 price objective for the company. in a research report on Friday, July 11th. Wall Street Zen cut shares of FrontView REIT from a "hold" rating to a "sell" rating in a research note on Sunday, August 31st. JPMorgan Chase & Co. cut shares of FrontView REIT from an "overweight" rating to a "neutral" rating and decreased their price target for the stock from $14.00 to $12.00 in a research note on Tuesday, June 17th. Finally, Bank of America reaffirmed an "underperform" rating and set a $11.00 price target (down from $15.00) on shares of FrontView REIT in a research note on Tuesday, June 17th. Two research analysts have rated the stock with a Buy rating, two have issued a Hold rating and one has issued a Sell rating to the company's stock. According to data from MarketBeat, the stock currently has an average rating of "Hold" and an average price target of $15.10.

View Our Latest Stock Analysis on FVR

FrontView REIT Trading Up 0.3%

Shares of FVR traded up $0.04 during mid-day trading on Wednesday, hitting $13.44. The company had a trading volume of 3,241 shares, compared to its average volume of 204,773. The business's 50-day simple moving average is $12.58 and its 200-day simple moving average is $12.66. The company has a quick ratio of 0.73, a current ratio of 0.73 and a debt-to-equity ratio of 0.63. FrontView REIT, Inc. has a 1-year low of $10.61 and a 1-year high of $19.76. The stock has a market cap of $274.87 million and a PE ratio of -12.48.

FrontView REIT Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Wednesday, October 15th. Investors of record on Tuesday, September 30th will be paid a $0.215 dividend. This represents a $0.86 dividend on an annualized basis and a dividend yield of 6.4%. The ex-dividend date is Tuesday, September 30th. FrontView REIT's payout ratio is -80.37%.

FrontView REIT Company Profile

(

Free Report)

FrontView REIT specializes in real estate investing.

Featured Articles

Before you consider FrontView REIT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FrontView REIT wasn't on the list.

While FrontView REIT currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.