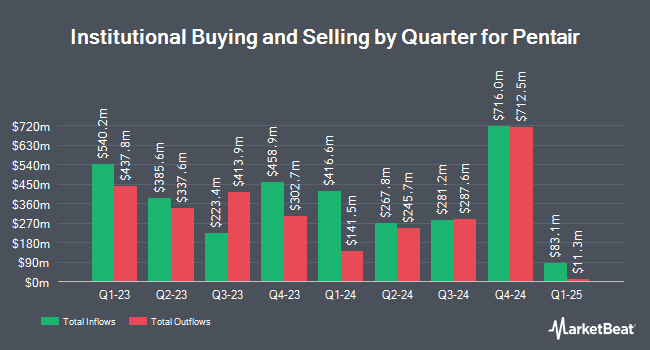

Ameriprise Financial Inc. raised its holdings in shares of Pentair plc (NYSE:PNR - Free Report) by 373.8% during the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 1,137,682 shares of the industrial products company's stock after acquiring an additional 897,585 shares during the quarter. Ameriprise Financial Inc. owned approximately 0.69% of Pentair worth $99,523,000 as of its most recent SEC filing.

A number of other institutional investors and hedge funds have also bought and sold shares of the business. Horizon Investments LLC raised its holdings in Pentair by 4.8% during the first quarter. Horizon Investments LLC now owns 2,372 shares of the industrial products company's stock valued at $207,000 after acquiring an additional 109 shares during the period. Brooklyn Investment Group raised its holdings in Pentair by 14.8% during the first quarter. Brooklyn Investment Group now owns 847 shares of the industrial products company's stock valued at $74,000 after acquiring an additional 109 shares during the period. Strategic Blueprint LLC raised its holdings in Pentair by 2.3% during the first quarter. Strategic Blueprint LLC now owns 5,521 shares of the industrial products company's stock valued at $483,000 after acquiring an additional 123 shares during the period. HB Wealth Management LLC raised its holdings in Pentair by 5.6% during the first quarter. HB Wealth Management LLC now owns 3,604 shares of the industrial products company's stock valued at $315,000 after acquiring an additional 192 shares during the period. Finally, Azzad Asset Management Inc. ADV raised its holdings in Pentair by 0.7% during the fourth quarter. Azzad Asset Management Inc. ADV now owns 29,930 shares of the industrial products company's stock valued at $3,012,000 after acquiring an additional 197 shares during the period. 92.37% of the stock is owned by institutional investors.

Wall Street Analysts Forecast Growth

Several equities research analysts have recently issued reports on PNR shares. Mizuho lifted their target price on Pentair from $118.00 to $122.00 and gave the stock an "outperform" rating in a report on Wednesday, July 23rd. Wall Street Zen raised Pentair from a "hold" rating to a "buy" rating in a report on Saturday, July 26th. JPMorgan Chase & Co. lifted their target price on Pentair from $113.00 to $116.00 and gave the stock an "overweight" rating in a report on Wednesday, July 23rd. Robert W. Baird lifted their target price on Pentair from $107.00 to $121.00 and gave the stock an "outperform" rating in a report on Wednesday, July 23rd. Finally, Barclays lifted their target price on Pentair from $116.00 to $117.00 and gave the stock an "overweight" rating in a report on Wednesday, July 23rd. Two equities research analysts have rated the stock with a Strong Buy rating, ten have issued a Buy rating, three have assigned a Hold rating and one has assigned a Sell rating to the company's stock. According to data from MarketBeat.com, Pentair has a consensus rating of "Moderate Buy" and a consensus target price of $114.36.

Get Our Latest Report on Pentair

Pentair Trading Down 1.5%

PNR traded down $1.68 on Friday, hitting $107.50. The company had a trading volume of 1,048,959 shares, compared to its average volume of 1,295,746. The company has a market cap of $17.62 billion, a PE ratio of 29.37, a PEG ratio of 2.06 and a beta of 1.08. Pentair plc has a 12-month low of $74.25 and a 12-month high of $110.71. The company has a quick ratio of 0.84, a current ratio of 1.45 and a debt-to-equity ratio of 0.38. The business's fifty day simple moving average is $104.90 and its 200 day simple moving average is $96.14.

Pentair (NYSE:PNR - Get Free Report) last released its quarterly earnings results on Tuesday, July 22nd. The industrial products company reported $1.39 EPS for the quarter, topping the consensus estimate of $1.33 by $0.06. The company had revenue of $1.12 billion during the quarter, compared to analyst estimates of $1.12 billion. Pentair had a return on equity of 21.62% and a net margin of 14.86%.The firm's revenue was up 2.2% on a year-over-year basis. During the same quarter last year, the business posted $1.22 earnings per share. Pentair has set its Q3 2025 guidance at 1.160-1.20 EPS. FY 2025 guidance at 4.750-4.85 EPS. Equities research analysts expect that Pentair plc will post 4.77 EPS for the current year.

Pentair Profile

(

Free Report)

Pentair plc provides various water solutions in the United States, Western Europe, China, Eastern Europe, Latin America, the Middle East, Southeast Asia, Australia, Canada, and Japan. The company operates through three segments: Flow, Water Solutions, and Pool. The Flow segment designs, manufactures, and sells fluid treatment and pump products and systems, including pressure vessels, gas recovery solutions, membrane bioreactors, wastewater reuse systems and advanced membrane filtration, separation systems, water disposal pumps, water supply pumps, fluid transfer pumps, turbine pumps, solid handling pumps, and agricultural spray nozzles for fluid delivery, ion exchange, desalination, food and beverage, separation technologies in the oil and gas industry, residential and municipal wells, water treatment, wastewater solids handling, pressure boosting, circulation and transfer, fire suppression, flood control, agricultural irrigation, and crop spray in residential, commercial, and industrial markets.

Featured Stories

Before you consider Pentair, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pentair wasn't on the list.

While Pentair currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.