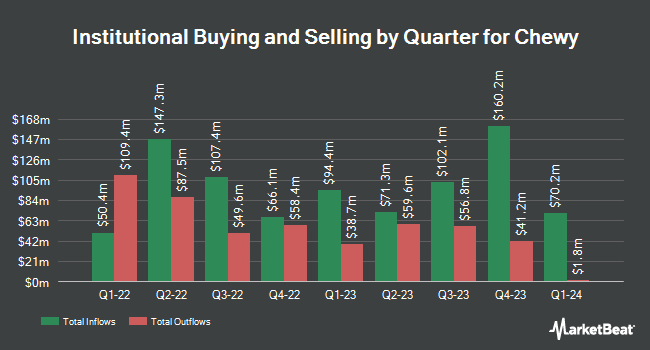

Ameriprise Financial Inc. increased its stake in Chewy (NYSE:CHWY - Free Report) by 426.1% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 1,189,957 shares of the company's stock after buying an additional 963,780 shares during the quarter. Ameriprise Financial Inc. owned approximately 0.29% of Chewy worth $38,686,000 as of its most recent SEC filing.

Other large investors also recently made changes to their positions in the company. Parallel Advisors LLC boosted its holdings in shares of Chewy by 150.2% in the 1st quarter. Parallel Advisors LLC now owns 788 shares of the company's stock valued at $26,000 after buying an additional 473 shares during the last quarter. Banque Transatlantique SA acquired a new stake in Chewy during the 4th quarter valued at $30,000. Golden State Wealth Management LLC lifted its holdings in Chewy by 104.6% during the 1st quarter. Golden State Wealth Management LLC now owns 941 shares of the company's stock valued at $31,000 after purchasing an additional 481 shares during the last quarter. N.E.W. Advisory Services LLC acquired a new stake in Chewy during the 1st quarter valued at $44,000. Finally, North Star Investment Management Corp. lifted its holdings in Chewy by 26.6% during the 1st quarter. North Star Investment Management Corp. now owns 1,678 shares of the company's stock valued at $55,000 after purchasing an additional 353 shares during the last quarter. Institutional investors and hedge funds own 93.09% of the company's stock.

Insider Buying and Selling

In related news, CAO William G. Billings sold 20,142 shares of Chewy stock in a transaction that occurred on Monday, August 4th. The stock was sold at an average price of $35.57, for a total value of $716,450.94. Following the transaction, the chief accounting officer directly owned 29,464 shares of the company's stock, valued at $1,048,034.48. The trade was a 40.60% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, CEO Sumit Singh sold 29,557 shares of the business's stock in a transaction that occurred on Monday, August 4th. The shares were sold at an average price of $35.57, for a total value of $1,051,342.49. Following the completion of the transaction, the chief executive officer directly owned 540,406 shares in the company, valued at approximately $19,222,241.42. This trade represents a 5.19% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 30,008,777 shares of company stock valued at $1,252,444,321 in the last ninety days. Insiders own 0.43% of the company's stock.

Chewy Stock Down 3.4%

Shares of CHWY stock traded down $1.38 during mid-day trading on Tuesday, reaching $39.58. 2,790,465 shares of the stock traded hands, compared to its average volume of 6,281,957. The stock's fifty day simple moving average is $39.01 and its two-hundred day simple moving average is $38.14. Chewy has a 1-year low of $25.19 and a 1-year high of $48.62. The company has a market cap of $16.43 billion, a price-to-earnings ratio of 44.47, a price-to-earnings-growth ratio of 8.55 and a beta of 1.65.

Chewy (NYSE:CHWY - Get Free Report) last announced its quarterly earnings results on Wednesday, June 11th. The company reported $0.35 EPS for the quarter, beating analysts' consensus estimates of $0.34 by $0.01. Chewy had a return on equity of 35.04% and a net margin of 3.21%.The firm had revenue of $3.12 billion for the quarter, compared to analyst estimates of $3.08 billion. During the same period last year, the firm posted $0.31 earnings per share. The business's revenue for the quarter was up 6.3% on a year-over-year basis. Chewy has set its FY 2025 guidance at EPS. On average, equities research analysts anticipate that Chewy will post 0.24 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

CHWY has been the subject of a number of research reports. JPMorgan Chase & Co. lifted their target price on Chewy from $36.00 to $47.00 and gave the stock an "overweight" rating in a report on Thursday, June 12th. Barclays lifted their target price on Chewy from $44.00 to $50.00 and gave the stock an "overweight" rating in a report on Wednesday, May 28th. Morgan Stanley reissued an "overweight" rating and set a $50.00 target price (up previously from $39.00) on shares of Chewy in a report on Thursday, June 12th. Citizens Jmp raised Chewy to a "strong-buy" rating in a report on Thursday, July 10th. Finally, Evercore ISI set a $52.00 target price on Chewy and gave the stock an "outperform" rating in a report on Thursday, June 12th. One equities research analyst has rated the stock with a Strong Buy rating, seventeen have issued a Buy rating and seven have given a Hold rating to the company's stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $43.78.

Read Our Latest Stock Analysis on CHWY

Chewy Profile

(

Free Report)

Chewy, Inc, together with its subsidiaries, engages in the pure play e-commerce business in the United States. It provides pet food and treats, pet supplies and pet medications, and other pet-health products, as well as pet services for dogs, cats, fish, birds, small pets, horses, and reptiles through its retail websites and mobile applications.

Recommended Stories

Before you consider Chewy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chewy wasn't on the list.

While Chewy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.