Amiral Gestion purchased a new position in shares of NVR, Inc. (NYSE:NVR - Free Report) in the fourth quarter, according to its most recent filing with the SEC. The firm purchased 721 shares of the construction company's stock, valued at approximately $5,897,000. NVR accounts for 3.7% of Amiral Gestion's portfolio, making the stock its 11th largest holding.

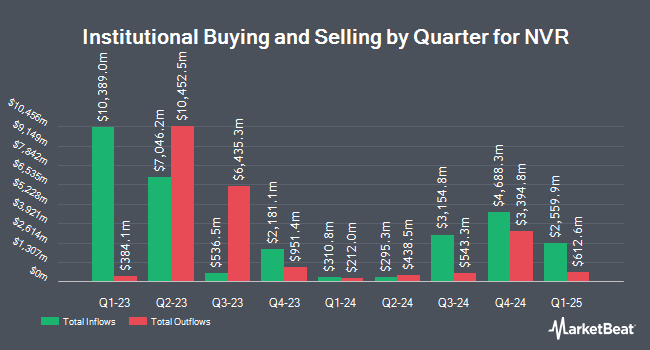

A number of other large investors have also recently bought and sold shares of the business. Proficio Capital Partners LLC acquired a new stake in shares of NVR in the 4th quarter valued at about $3,277,825,000. Siemens Fonds Invest GmbH grew its stake in shares of NVR by 116,808.2% in the 4th quarter. Siemens Fonds Invest GmbH now owns 57,285 shares of the construction company's stock valued at $468,528,000 after buying an additional 57,236 shares during the period. Norges Bank acquired a new stake in shares of NVR in the 4th quarter valued at about $295,643,000. JPMorgan Chase & Co. grew its stake in shares of NVR by 165.8% in the 4th quarter. JPMorgan Chase & Co. now owns 36,999 shares of the construction company's stock valued at $302,611,000 after buying an additional 23,079 shares during the period. Finally, Citadel Advisors LLC acquired a new stake in shares of NVR in the 4th quarter valued at about $118,087,000. 83.67% of the stock is currently owned by institutional investors and hedge funds.

NVR Stock Up 1.0%

NYSE NVR traded up $70.50 during trading hours on Thursday, hitting $7,070.62. The company's stock had a trading volume of 5,831 shares, compared to its average volume of 22,079. NVR, Inc. has a 52 week low of $6,562.85 and a 52 week high of $9,964.77. The company has a market capitalization of $20.67 billion, a PE ratio of 13.93, a price-to-earnings-growth ratio of 2.39 and a beta of 1.02. The company has a current ratio of 6.18, a quick ratio of 3.69 and a debt-to-equity ratio of 0.22. The company's 50-day simple moving average is $7,154.90 and its two-hundred day simple moving average is $7,774.45.

NVR (NYSE:NVR - Get Free Report) last announced its quarterly earnings results on Tuesday, April 22nd. The construction company reported $94.83 earnings per share for the quarter, missing the consensus estimate of $107.87 by ($13.04). NVR had a net margin of 16.34% and a return on equity of 39.67%. The business had revenue of $2.40 billion during the quarter, compared to the consensus estimate of $2.35 billion. Research analysts anticipate that NVR, Inc. will post 505.2 EPS for the current fiscal year.

NVR declared that its board has approved a stock buyback program on Tuesday, May 6th that permits the company to buyback $750.00 million in outstanding shares. This buyback authorization permits the construction company to reacquire up to 3.6% of its shares through open market purchases. Shares buyback programs are often an indication that the company's leadership believes its shares are undervalued.

Analyst Upgrades and Downgrades

Several brokerages have recently commented on NVR. Wall Street Zen upgraded NVR from a "sell" rating to a "hold" rating in a research note on Saturday, May 24th. UBS Group reduced their target price on NVR from $8,900.00 to $7,900.00 and set a "neutral" rating for the company in a research note on Wednesday, April 23rd. Finally, JPMorgan Chase & Co. reduced their target price on NVR from $9,245.00 to $8,570.00 and set a "neutral" rating for the company in a research note on Wednesday, January 29th. Four analysts have rated the stock with a hold rating and one has given a buy rating to the company's stock. Based on data from MarketBeat.com, NVR has a consensus rating of "Hold" and an average target price of $9,023.33.

Check Out Our Latest Analysis on NVR

NVR Company Profile

(

Free Report)

NVR, Inc operates as a homebuilder in the United States. The company operates through, Homebuilding and Mortgage Banking segments. It engages in the construction and sale of single-family detached homes, townhomes, and condominium buildings under the Ryan Homes, NVHomes, and Heartland Homes names. The company markets its Ryan Homes products to first-time and first-time move-up buyers; and NVHomes and Heartland Homes products to move-up and luxury buyers.

Further Reading

Before you consider NVR, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NVR wasn't on the list.

While NVR currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.