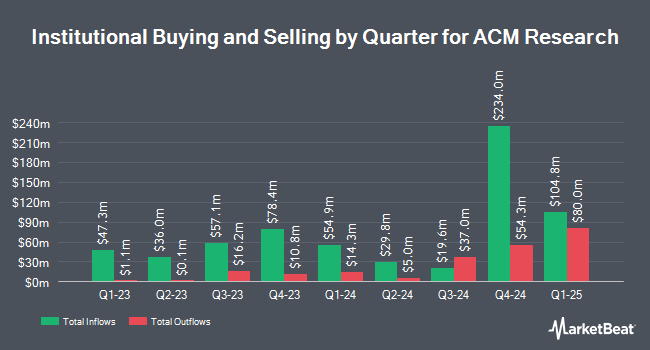

Amundi bought a new stake in shares of ACM Research, Inc. (NASDAQ:ACMR - Free Report) in the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor bought 337,606 shares of the specialty retailer's stock, valued at approximately $7,545,000. Amundi owned about 0.57% of ACM Research as of its most recent SEC filing.

Several other institutional investors also recently bought and sold shares of ACMR. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its position in shares of ACM Research by 1,418.5% during the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 1,174,720 shares of the specialty retailer's stock worth $17,738,000 after purchasing an additional 1,097,358 shares in the last quarter. Federated Hermes Inc. grew its stake in ACM Research by 12,871.6% during the 1st quarter. Federated Hermes Inc. now owns 1,072,752 shares of the specialty retailer's stock worth $25,038,000 after buying an additional 1,064,482 shares during the last quarter. Triata Capital Ltd acquired a new position in ACM Research during the 4th quarter valued at about $15,507,000. Broad Bay Capital Management LP purchased a new stake in ACM Research in the first quarter valued at about $21,134,000. Finally, Raiffeisen Bank International AG acquired a new stake in ACM Research in the fourth quarter worth about $10,549,000. 66.75% of the stock is currently owned by institutional investors and hedge funds.

Insider Buying and Selling

In other news, insider David H. Wang sold 60,000 shares of the company's stock in a transaction dated Thursday, September 4th. The stock was sold at an average price of $26.44, for a total value of $1,586,400.00. Following the sale, the insider owned 672,708 shares in the company, valued at $17,786,399.52. This represents a 8.19% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Also, insider Lisa Feng sold 15,000 shares of ACM Research stock in a transaction that occurred on Monday, July 7th. The shares were sold at an average price of $28.00, for a total value of $420,000.00. Following the transaction, the insider owned 50,001 shares of the company's stock, valued at approximately $1,400,028. This represents a 23.08% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 246,152 shares of company stock valued at $6,914,160 in the last 90 days. 25.00% of the stock is currently owned by insiders.

ACM Research Stock Up 3.7%

Shares of ACMR stock traded up $1.11 during trading hours on Tuesday, reaching $30.94. 1,499,845 shares of the company's stock were exchanged, compared to its average volume of 1,491,541. ACM Research, Inc. has a 1 year low of $13.87 and a 1 year high of $32.54. The company has a current ratio of 2.45, a quick ratio of 1.49 and a debt-to-equity ratio of 0.14. The stock has a market cap of $1.83 billion, a PE ratio of 18.75 and a beta of 1.43. The stock's fifty day moving average price is $28.32 and its two-hundred day moving average price is $25.36.

ACM Research (NASDAQ:ACMR - Get Free Report) last released its earnings results on Wednesday, August 6th. The specialty retailer reported $0.54 earnings per share for the quarter, topping the consensus estimate of $0.42 by $0.12. The company had revenue of $215.37 million for the quarter, compared to the consensus estimate of $223.42 million. ACM Research had a net margin of 13.76% and a return on equity of 9.57%. ACM Research's revenue was up 6.4% compared to the same quarter last year. During the same quarter in the previous year, the firm earned $0.55 EPS. Research analysts predict that ACM Research, Inc. will post 1.17 EPS for the current year.

About ACM Research

(

Free Report)

ACM Research, Inc, together with its subsidiaries, develops, manufactures, and sells single-wafer wet cleaning equipment for enhancing the manufacturing process and yield for integrated chips worldwide. It offers space alternated phase shift technology for flat and patterned wafer surfaces, which employs alternating phases of megasonic waves to deliver megasonic energy in a uniform manner on a microscopic level; timely energized bubble oscillation technology for patterned wafer surfaces at advanced process nodes, which provides cleaning for 2D and 3D patterned wafers; Tahoe technology for delivering cleaning performance using less sulfuric acid and hydrogen peroxide; and electro-chemical plating technology for advanced metal plating.

Read More

Before you consider ACM Research, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ACM Research wasn't on the list.

While ACM Research currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.