Anson Funds Management LP bought a new position in shares of Shopify Inc. (NYSE:SHOP - Free Report) TSE: SHOP during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm bought 10,000 shares of the software maker's stock, valued at approximately $955,000.

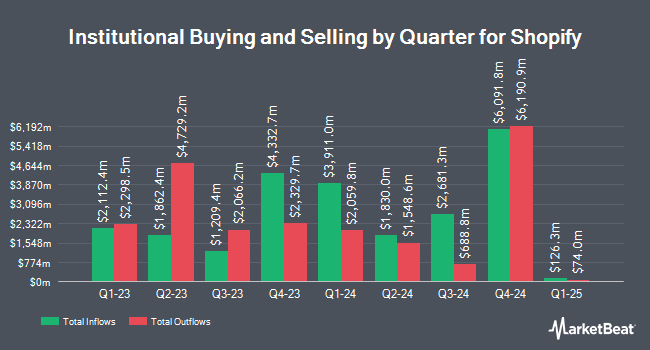

Several other institutional investors also recently modified their holdings of SHOP. LRI Investments LLC increased its holdings in Shopify by 9.8% during the fourth quarter. LRI Investments LLC now owns 889 shares of the software maker's stock worth $94,000 after buying an additional 79 shares during the last quarter. Fullcircle Wealth LLC increased its holdings in Shopify by 2.7% in the 1st quarter. Fullcircle Wealth LLC now owns 4,240 shares of the software maker's stock worth $418,000 after acquiring an additional 110 shares during the last quarter. Avidian Wealth Enterprises LLC raised its stake in Shopify by 3.4% in the 1st quarter. Avidian Wealth Enterprises LLC now owns 3,533 shares of the software maker's stock valued at $337,000 after acquiring an additional 116 shares during the period. SVB Wealth LLC raised its stake in Shopify by 2.2% in the 1st quarter. SVB Wealth LLC now owns 5,415 shares of the software maker's stock valued at $517,000 after acquiring an additional 119 shares during the period. Finally, Pinnacle Financial Partners Inc lifted its holdings in Shopify by 4.0% during the first quarter. Pinnacle Financial Partners Inc now owns 3,233 shares of the software maker's stock valued at $320,000 after purchasing an additional 125 shares during the last quarter. 69.27% of the stock is owned by institutional investors.

Shopify Trading Up 4.0%

SHOP opened at $142.11 on Friday. The stock has a fifty day simple moving average of $124.55 and a two-hundred day simple moving average of $109.83. The company has a market cap of $184.69 billion, a price-to-earnings ratio of 91.68, a price-to-earnings-growth ratio of 4.82 and a beta of 2.63. Shopify Inc. has a 12-month low of $65.86 and a 12-month high of $156.85.

Shopify (NYSE:SHOP - Get Free Report) TSE: SHOP last issued its quarterly earnings results on Wednesday, August 6th. The software maker reported $0.35 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.29 by $0.06. Shopify had a net margin of 22.74% and a return on equity of 12.00%. The company had revenue of $2.68 billion during the quarter, compared to analysts' expectations of $2.55 billion. During the same period last year, the company posted $0.26 EPS. Shopify's revenue was up 31.1% on a year-over-year basis. On average, analysts predict that Shopify Inc. will post 1.12 EPS for the current year.

Wall Street Analyst Weigh In

Several analysts have recently issued reports on SHOP shares. Robert W. Baird boosted their price target on shares of Shopify from $110.00 to $120.00 and gave the company an "outperform" rating in a research report on Monday, July 14th. CIBC raised their target price on Shopify from $145.00 to $185.00 and gave the stock an "outperform" rating in a research note on Thursday, August 7th. Wedbush boosted their price target on shares of Shopify from $115.00 to $160.00 and gave the company an "outperform" rating in a research report on Thursday, August 7th. Jefferies Financial Group decreased their price objective on shares of Shopify from $130.00 to $110.00 and set a "hold" rating on the stock in a research report on Monday, May 5th. Finally, Mizuho raised their price target on Shopify from $85.00 to $150.00 and gave the company a "neutral" rating in a research report on Thursday, August 7th. Twenty-four analysts have rated the stock with a Buy rating, twenty have issued a Hold rating and one has issued a Sell rating to the company's stock. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus price target of $148.51.

Check Out Our Latest Stock Report on Shopify

Shopify Company Profile

(

Free Report)

Shopify Inc, a commerce company, provides a commerce platform and services in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, Australia, China, and Latin America. The company's platform enables merchants to displays, manages, markets, and sells its products through various sales channels, including web and mobile storefronts, physical retail locations, pop-up shops, social media storefronts, native mobile apps, buy buttons, and marketplaces; and enables to manage products and inventory, process orders and payments, fulfill and ship orders, new buyers and build customer relationships, source products, leverage analytics and reporting, manage cash, payments and transactions, and access financing.

Further Reading

Want to see what other hedge funds are holding SHOP? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Shopify Inc. (NYSE:SHOP - Free Report) TSE: SHOP.

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Shopify, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Shopify wasn't on the list.

While Shopify currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.