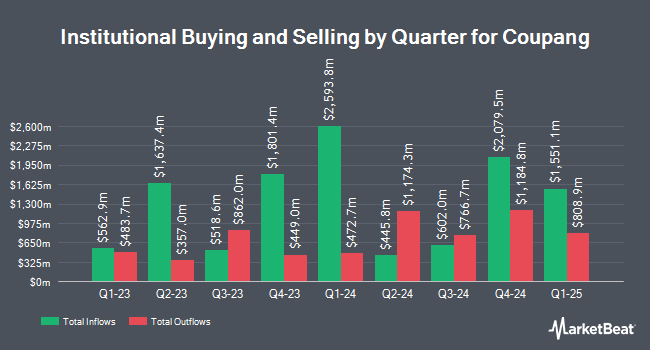

Apollon Wealth Management LLC bought a new position in Coupang, Inc. (NYSE:CPNG - Free Report) during the second quarter, according to its most recent 13F filing with the SEC. The institutional investor bought 9,079 shares of the company's stock, valued at approximately $272,000.

A number of other institutional investors have also modified their holdings of CPNG. Davidson Kahn Capital Management LLC boosted its holdings in shares of Coupang by 31.6% in the first quarter. Davidson Kahn Capital Management LLC now owns 103,567 shares of the company's stock valued at $2,271,000 after purchasing an additional 24,877 shares during the period. Altimeter Capital Management LP raised its position in Coupang by 24.3% during the 1st quarter. Altimeter Capital Management LP now owns 7,441,445 shares of the company's stock valued at $163,191,000 after purchasing an additional 1,455,555 shares in the last quarter. Allspring Global Investments Holdings LLC raised its position in Coupang by 40.1% during the 1st quarter. Allspring Global Investments Holdings LLC now owns 305,512 shares of the company's stock valued at $6,776,000 after purchasing an additional 87,412 shares in the last quarter. Vontobel Holding Ltd. purchased a new stake in shares of Coupang in the 1st quarter worth $241,000. Finally, Bain Capital Public Equity Management II LLC grew its position in shares of Coupang by 39.4% during the 1st quarter. Bain Capital Public Equity Management II LLC now owns 1,467,232 shares of the company's stock worth $32,176,000 after buying an additional 414,901 shares in the last quarter. 83.72% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several analysts recently weighed in on CPNG shares. Deutsche Bank Aktiengesellschaft downgraded Coupang from a "buy" rating to a "hold" rating and set a $27.00 price objective for the company. in a report on Wednesday, August 6th. Arete Research initiated coverage on shares of Coupang in a research report on Thursday, September 18th. They set a "buy" rating and a $40.00 target price on the stock. Zacks Research lowered shares of Coupang from a "hold" rating to a "strong sell" rating in a report on Monday, October 6th. Weiss Ratings reiterated a "hold (c)" rating on shares of Coupang in a research note on Wednesday, October 8th. Finally, Nomura Securities raised shares of Coupang to a "strong-buy" rating in a report on Wednesday, August 6th. One analyst has rated the stock with a Strong Buy rating, six have assigned a Buy rating, three have given a Hold rating and one has issued a Sell rating to the stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $33.50.

Get Our Latest Report on CPNG

Coupang Stock Down 0.8%

Shares of Coupang stock opened at $31.25 on Friday. The company has a quick ratio of 0.84, a current ratio of 1.09 and a debt-to-equity ratio of 0.18. The company has a market cap of $56.97 billion, a P/E ratio of 156.24 and a beta of 1.18. The firm's 50 day moving average price is $30.78 and its 200-day moving average price is $28.28. Coupang, Inc. has a 52-week low of $19.02 and a 52-week high of $34.08.

Coupang (NYSE:CPNG - Get Free Report) last posted its earnings results on Tuesday, August 5th. The company reported $0.02 EPS for the quarter, missing analysts' consensus estimates of $0.07 by ($0.05). Coupang had a net margin of 1.13% and a return on equity of 7.47%. The firm had revenue of $8.52 billion for the quarter, compared to analysts' expectations of $8.34 billion. During the same period in the previous year, the company earned $0.07 EPS. The company's revenue was up 16.4% on a year-over-year basis. On average, sell-side analysts predict that Coupang, Inc. will post 0.17 EPS for the current fiscal year.

Insider Transactions at Coupang

In other Coupang news, insider Harold Rogers sold 64,755 shares of the stock in a transaction dated Thursday, September 11th. The stock was sold at an average price of $32.06, for a total value of $2,076,045.30. Following the completion of the sale, the insider directly owned 449,569 shares in the company, valued at approximately $14,413,182.14. This trade represents a 12.59% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, Director Pedro Franceschi sold 21,428 shares of the firm's stock in a transaction dated Thursday, September 11th. The stock was sold at an average price of $32.05, for a total value of $686,767.40. The disclosure for this sale can be found here. Over the last three months, insiders have sold 988,983 shares of company stock worth $31,203,966. 12.78% of the stock is currently owned by corporate insiders.

Coupang Profile

(

Free Report)

Coupang, Inc, together with its subsidiaries owns and operates retail business through its mobile applications and Internet websites primarily in South Korea. The company operates through Product Commerce and Developing Offerings segments. It sells various products and services in the categories of home goods and décor products, apparel, beauty products, fresh food and groceries, sporting goods, electronics, and everyday consumables, as well as travel, and restaurant order and delivery services.

Read More

Want to see what other hedge funds are holding CPNG? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Coupang, Inc. (NYSE:CPNG - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Coupang, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coupang wasn't on the list.

While Coupang currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.