Duncker Streett & Co. Inc. trimmed its position in shares of Apple Inc. (NASDAQ:AAPL - Free Report) by 2.1% during the first quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 79,310 shares of the iPhone maker's stock after selling 1,700 shares during the quarter. Apple accounts for approximately 3.5% of Duncker Streett & Co. Inc.'s portfolio, making the stock its 3rd largest holding. Duncker Streett & Co. Inc.'s holdings in Apple were worth $17,617,000 at the end of the most recent quarter.

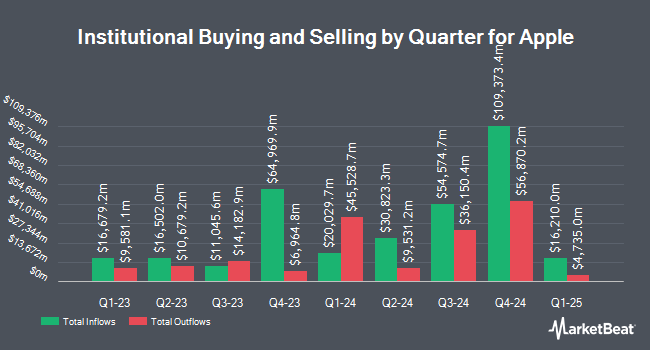

Other institutional investors and hedge funds have also made changes to their positions in the company. Tallon Kerry Patrick acquired a new position in Apple during the fourth quarter worth about $1,877,000. First National Bank of Hutchinson grew its position in Apple by 24.6% during the fourth quarter. First National Bank of Hutchinson now owns 35,319 shares of the iPhone maker's stock worth $8,845,000 after buying an additional 6,982 shares during the period. Capital & Planning LLC grew its position in Apple by 10.7% during the fourth quarter. Capital & Planning LLC now owns 27,298 shares of the iPhone maker's stock worth $6,836,000 after buying an additional 2,647 shares during the period. Eagle Capital Management LLC lifted its holdings in shares of Apple by 0.5% in the fourth quarter. Eagle Capital Management LLC now owns 54,085 shares of the iPhone maker's stock valued at $13,544,000 after purchasing an additional 272 shares in the last quarter. Finally, Brighton Jones LLC lifted its holdings in shares of Apple by 14.8% in the fourth quarter. Brighton Jones LLC now owns 537,314 shares of the iPhone maker's stock valued at $134,554,000 after purchasing an additional 69,207 shares in the last quarter. 67.73% of the stock is currently owned by institutional investors and hedge funds.

Apple Stock Down 2.5%

Shares of AAPL stock traded down $5.19 during trading hours on Friday, hitting $202.38. 97,423,066 shares of the company were exchanged, compared to its average volume of 44,912,472. The stock has a market capitalization of $3.02 trillion, a price-to-earnings ratio of 30.71, a P/E/G ratio of 2.22 and a beta of 1.17. Apple Inc. has a one year low of $169.21 and a one year high of $260.10. The business's 50-day simple moving average is $205.37 and its two-hundred day simple moving average is $213.60. The company has a debt-to-equity ratio of 1.18, a quick ratio of 0.78 and a current ratio of 0.82.

Apple (NASDAQ:AAPL - Get Free Report) last issued its earnings results on Thursday, July 31st. The iPhone maker reported $1.57 EPS for the quarter, topping the consensus estimate of $1.43 by $0.14. Apple had a return on equity of 172.48% and a net margin of 24.30%. The company had revenue of $94.04 billion during the quarter, compared to analyst estimates of $88.64 billion. During the same quarter last year, the firm earned $1.40 EPS. The business's revenue was up 9.6% on a year-over-year basis. Sell-side analysts predict that Apple Inc. will post 7.28 EPS for the current fiscal year.

Apple declared that its Board of Directors has initiated a share buyback program on Thursday, May 1st that allows the company to repurchase $100.00 billion in outstanding shares. This repurchase authorization allows the iPhone maker to buy up to 3.1% of its shares through open market purchases. Shares repurchase programs are usually a sign that the company's leadership believes its stock is undervalued.

Apple Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Thursday, August 14th. Shareholders of record on Monday, August 11th will be issued a dividend of $0.26 per share. This represents a $1.04 dividend on an annualized basis and a dividend yield of 0.5%. The ex-dividend date of this dividend is Monday, August 11th. Apple's dividend payout ratio is 15.78%.

Insider Buying and Selling at Apple

In other news, insider Chris Kondo sold 4,486 shares of Apple stock in a transaction dated Monday, May 12th. The shares were sold at an average price of $208.19, for a total value of $933,940.34. Following the completion of the transaction, the insider directly owned 15,533 shares of the company's stock, valued at approximately $3,233,815.27. The trade was a 22.41% decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. Company insiders own 0.06% of the company's stock.

Analysts Set New Price Targets

AAPL has been the topic of several recent analyst reports. Morgan Stanley upped their price objective on shares of Apple from $235.00 to $240.00 and gave the company an "overweight" rating in a research note on Friday. Evercore ISI upped their price objective on shares of Apple to $250.00 and gave the company a "buy" rating in a research note on Friday, June 6th. China Renaissance initiated coverage on shares of Apple in a research note on Tuesday, April 22nd. They set a "buy" rating and a $241.00 price objective on the stock. Rosenblatt Securities reissued a "neutral" rating and set a $217.00 price objective on shares of Apple in a research note on Tuesday, July 29th. Finally, Loop Capital cut their price target on shares of Apple from $230.00 to $215.00 and set a "hold" rating on the stock in a research note on Wednesday, April 30th. Two investment analysts have rated the stock with a sell rating, twelve have issued a hold rating, fifteen have assigned a buy rating and two have assigned a strong buy rating to the company's stock. According to MarketBeat.com, Apple currently has a consensus rating of "Moderate Buy" and a consensus price target of $237.25.

Check Out Our Latest Analysis on AAPL

About Apple

(

Free Report)

Apple Inc designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. The company offers iPhone, a line of smartphones; Mac, a line of personal computers; iPad, a line of multi-purpose tablets; and wearables, home, and accessories comprising AirPods, Apple TV, Apple Watch, Beats products, and HomePod.

Featured Articles

Before you consider Apple, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apple wasn't on the list.

While Apple currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report