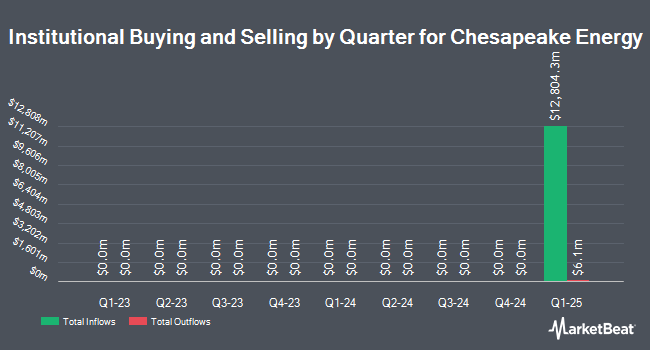

Applied Finance Capital Management LLC acquired a new position in shares of Expand Energy Corporation (NASDAQ:EXE - Free Report) in the first quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor acquired 4,342 shares of the company's stock, valued at approximately $483,000.

Other institutional investors have also added to or reduced their stakes in the company. First Horizon Advisors Inc. acquired a new stake in shares of Expand Energy during the first quarter worth $28,000. Princeton Global Asset Management LLC bought a new position in Expand Energy during the first quarter worth $31,000. BankPlus Trust Department bought a new position in shares of Expand Energy in the first quarter valued at $32,000. Peoples Bank KS bought a new position in shares of Expand Energy in the first quarter valued at $33,000. Finally, Key Financial Inc bought a new position in shares of Expand Energy in the first quarter valued at $41,000. 97.93% of the stock is currently owned by institutional investors and hedge funds.

Expand Energy Stock Performance

Shares of NASDAQ EXE traded up $4.84 during trading on Wednesday, reaching $104.21. 3,837,864 shares of the company traded hands, compared to its average volume of 3,778,999. The firm has a 50 day simple moving average of $112.12 and a 200-day simple moving average of $107.72. Expand Energy Corporation has a 52-week low of $69.12 and a 52-week high of $123.35. The company has a quick ratio of 0.59, a current ratio of 0.59 and a debt-to-equity ratio of 0.30. The stock has a market capitalization of $24.80 billion, a PE ratio of -19.49 and a beta of 0.48.

Expand Energy (NASDAQ:EXE - Get Free Report) last issued its quarterly earnings data on Tuesday, July 29th. The company reported $1.10 earnings per share for the quarter, missing the consensus estimate of $1.14 by ($0.04). Expand Energy had a positive return on equity of 4.64% and a negative net margin of 18.49%. The business had revenue of $3.69 billion during the quarter, compared to the consensus estimate of $2.09 billion. Equities research analysts anticipate that Expand Energy Corporation will post 1.33 earnings per share for the current year.

Analysts Set New Price Targets

A number of research firms have weighed in on EXE. Benchmark raised their price objective on shares of Expand Energy from $93.00 to $112.00 and gave the company a "buy" rating in a research note on Thursday, April 3rd. Sanford C. Bernstein upgraded shares of Expand Energy to a "strong-buy" rating and set a $150.00 price objective for the company in a report on Thursday, May 22nd. UBS Group lifted their target price on shares of Expand Energy from $144.00 to $145.00 and gave the stock a "buy" rating in a research note on Tuesday, July 1st. KeyCorp set a $135.00 price objective on shares of Expand Energy and gave the company an "overweight" rating in a research note on Friday, June 13th. Finally, Stephens reduced their price objective on shares of Expand Energy from $123.00 to $118.00 and set an "overweight" rating for the company in a research note on Tuesday, April 15th. One equities research analyst has rated the stock with a hold rating, seventeen have assigned a buy rating and three have issued a strong buy rating to the stock. According to MarketBeat, the company currently has an average rating of "Buy" and a consensus price target of $129.80.

Read Our Latest Stock Report on EXE

Expand Energy Profile

(

Free Report)

Expand Energy Corporation is an independent natural gas producer principally in the United States. Expand Energy Corporation, formerly known as Chesapeake Energy Corporation, is based in OKLAHOMA CITY.

Read More

Before you consider Expand Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Expand Energy wasn't on the list.

While Expand Energy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.