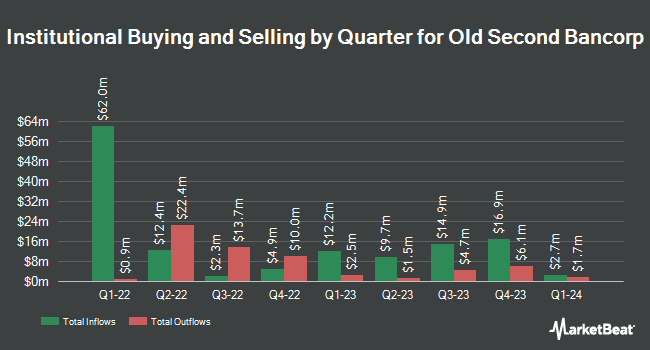

AQR Capital Management LLC lifted its stake in shares of Old Second Bancorp, Inc. (NASDAQ:OSBC - Free Report) by 33.6% in the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 540,946 shares of the financial services provider's stock after purchasing an additional 135,971 shares during the period. AQR Capital Management LLC owned 1.20% of Old Second Bancorp worth $9,001,000 at the end of the most recent quarter.

Several other institutional investors have also bought and sold shares of the company. GAMMA Investing LLC grew its holdings in Old Second Bancorp by 4,125.0% during the first quarter. GAMMA Investing LLC now owns 5,408 shares of the financial services provider's stock valued at $90,000 after purchasing an additional 5,280 shares during the period. Quarry LP lifted its position in shares of Old Second Bancorp by 145.5% during the 1st quarter. Quarry LP now owns 5,802 shares of the financial services provider's stock valued at $97,000 after buying an additional 3,439 shares during the last quarter. PharVision Advisers LLC bought a new position in shares of Old Second Bancorp during the 4th quarter worth $178,000. Quantbot Technologies LP increased its holdings in Old Second Bancorp by 50.4% in the 1st quarter. Quantbot Technologies LP now owns 11,322 shares of the financial services provider's stock worth $188,000 after acquiring an additional 3,794 shares during the last quarter. Finally, Avantax Advisory Services Inc. bought a new stake in Old Second Bancorp in the 1st quarter valued at about $193,000. Hedge funds and other institutional investors own 67.76% of the company's stock.

Analysts Set New Price Targets

A number of equities analysts have weighed in on OSBC shares. Piper Sandler reiterated an "overweight" rating and set a $24.50 target price (up previously from $22.00) on shares of Old Second Bancorp in a research report on Wednesday, July 2nd. Wall Street Zen raised shares of Old Second Bancorp from a "sell" rating to a "hold" rating in a report on Friday, July 18th. Finally, DA Davidson lifted their price objective on shares of Old Second Bancorp from $17.00 to $19.00 and gave the company a "neutral" rating in a research note on Friday, July 25th. One investment analyst has rated the stock with a Strong Buy rating, three have given a Buy rating and one has issued a Hold rating to the company. According to MarketBeat.com, the company has a consensus rating of "Buy" and a consensus target price of $20.70.

Read Our Latest Research Report on Old Second Bancorp

Old Second Bancorp Price Performance

Old Second Bancorp stock traded down $0.22 during midday trading on Tuesday, reaching $17.82. 185,010 shares of the stock were exchanged, compared to its average volume of 194,263. Old Second Bancorp, Inc. has a 52 week low of $14.14 and a 52 week high of $19.46. The company has a debt-to-equity ratio of 0.12, a quick ratio of 0.85 and a current ratio of 0.85. The firm has a market cap of $938.22 million, a PE ratio of 9.74 and a beta of 0.85. The company's fifty day moving average is $17.99 and its 200-day moving average is $17.06.

Old Second Bancorp (NASDAQ:OSBC - Get Free Report) last released its quarterly earnings results on Wednesday, July 23rd. The financial services provider reported $0.48 EPS for the quarter, missing analysts' consensus estimates of $0.49 by ($0.01). The firm had revenue of $75.13 million for the quarter, compared to analysts' expectations of $63.58 million. Old Second Bancorp had a net margin of 24.38% and a return on equity of 12.53%. On average, sell-side analysts forecast that Old Second Bancorp, Inc. will post 1.86 EPS for the current year.

Old Second Bancorp Dividend Announcement

The firm also recently announced a special dividend, which was paid on Monday, August 4th. Shareholders of record on Friday, July 25th were paid a $0.06 dividend. This represents a yield of 130.0%. The ex-dividend date was Friday, July 25th. Old Second Bancorp's dividend payout ratio is currently 13.11%.

Old Second Bancorp Company Profile

(

Free Report)

Old Second Bancorp, Inc operates as the bank holding company for Old Second National Bank that provides community banking services. It offers demand, NOW, money market, savings, time deposit, individual retirement, and checking accounts, as well as certificates of deposit accounts. The company also provides commercial loans; lease financing receivables; commercial real estate loans; construction loans; residential real estate loans, such as residential first mortgage and second mortgage loans; home equity line of credit; consumer loans, including motor vehicle, home improvement, and signature loans; installment and agricultural loans; residential mortgages; and overdraft checking.

Featured Stories

Before you consider Old Second Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Old Second Bancorp wasn't on the list.

While Old Second Bancorp currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.