Aragon Global Management LP raised its position in shares of On Holding AG (NYSE:ONON - Free Report) by 4.9% in the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 306,121 shares of the company's stock after buying an additional 14,200 shares during the period. ON comprises about 5.2% of Aragon Global Management LP's holdings, making the stock its 8th largest holding. Aragon Global Management LP's holdings in ON were worth $13,445,000 at the end of the most recent reporting period.

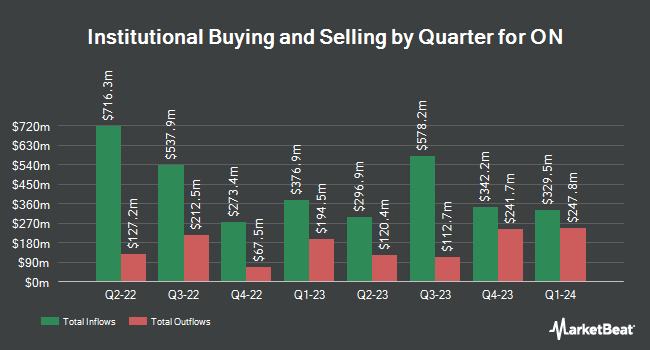

Other hedge funds and other institutional investors have also modified their holdings of the company. Park Square Financial Group LLC purchased a new position in shares of ON during the fourth quarter worth $32,000. TCTC Holdings LLC boosted its position in shares of ON by 118.4% during the first quarter. TCTC Holdings LLC now owns 581 shares of the company's stock worth $26,000 after buying an additional 315 shares during the period. Montag A & Associates Inc. purchased a new position in shares of ON during the first quarter worth $26,000. MassMutual Private Wealth & Trust FSB purchased a new position in shares of ON during the first quarter worth $32,000. Finally, Bernard Wealth Management Corp. purchased a new position in shares of ON during the fourth quarter worth $44,000. 36.39% of the stock is currently owned by hedge funds and other institutional investors.

ON Stock Down 0.7%

ON stock traded down $0.31 during midday trading on Wednesday, reaching $44.48. The company's stock had a trading volume of 2,076,846 shares, compared to its average volume of 5,424,567. On Holding AG has a fifty-two week low of $34.59 and a fifty-two week high of $64.05. The company has a quick ratio of 2.00, a current ratio of 2.53 and a debt-to-equity ratio of 0.31. The company has a market cap of $28.00 billion, a P/E ratio of 99.07, a P/E/G ratio of 4.97 and a beta of 2.23. The business has a 50-day simple moving average of $49.37 and a 200-day simple moving average of $49.58.

Analyst Upgrades and Downgrades

Several research firms have recently commented on ONON. KeyCorp raised their price target on ON from $60.00 to $68.00 and gave the stock an "overweight" rating in a research report on Wednesday, May 14th. Stifel Nicolaus increased their price objective on ON from $57.00 to $66.00 and gave the company a "buy" rating in a research note on Wednesday, May 14th. Evercore ISI increased their price objective on ON from $60.00 to $70.00 and gave the company an "outperform" rating in a research note on Wednesday, May 14th. Needham & Company LLC reiterated a "buy" rating and issued a $62.00 price objective on shares of ON in a research note on Tuesday, August 12th. Finally, Raymond James Financial cut ON from a "strong-buy" rating to an "outperform" rating and set a $66.00 price objective on the stock. in a research note on Tuesday, July 22nd. One investment analyst has rated the stock with a Strong Buy rating, nineteen have assigned a Buy rating, one has assigned a Hold rating and one has assigned a Sell rating to the company's stock. Based on data from MarketBeat.com, ON currently has an average rating of "Moderate Buy" and a consensus price target of $64.20.

Read Our Latest Research Report on ON

About ON

(

Free Report)

On Holding AG engages in the development and distribution of sports products such as footwear, apparel, and accessories for high-performance running, outdoor, all-day activities, and tennis. It sells its products worldwide through independent retailers and global distributors, its own online presence, and its own stores.

See Also

Before you consider ON, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ON wasn't on the list.

While ON currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.