ARK Investment Management LLC lessened its stake in shares of Stratasys, Ltd. (NASDAQ:SSYS - Free Report) by 15.9% in the first quarter, according to the company in its most recent filing with the SEC. The fund owned 591,678 shares of the technology company's stock after selling 111,847 shares during the quarter. ARK Investment Management LLC owned about 0.83% of Stratasys worth $5,793,000 as of its most recent SEC filing.

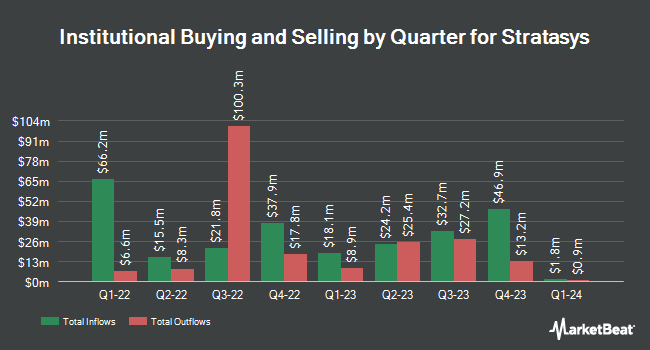

Several other hedge funds have also recently bought and sold shares of the company. Headlands Technologies LLC bought a new position in shares of Stratasys in the 4th quarter worth about $68,000. Teton Advisors Inc. purchased a new stake in Stratasys during the fourth quarter worth $89,000. Harbor Capital Advisors Inc. purchased a new position in Stratasys in the first quarter valued at about $105,000. Hsbc Holdings PLC boosted its stake in shares of Stratasys by 10.4% during the 4th quarter. Hsbc Holdings PLC now owns 16,664 shares of the technology company's stock worth $148,000 after acquiring an additional 1,564 shares in the last quarter. Finally, Graham Capital Management L.P. acquired a new stake in Stratasys during the fourth quarter valued at $166,000. 75.77% of the stock is owned by institutional investors.

Analyst Ratings Changes

Separately, Wall Street Zen upgraded shares of Stratasys from a "hold" rating to a "buy" rating in a research report on Thursday, May 15th. One analyst has rated the stock with a hold rating and five have given a buy rating to the stock. According to MarketBeat.com, Stratasys presently has a consensus rating of "Moderate Buy" and an average target price of $12.20.

Get Our Latest Stock Report on Stratasys

Stratasys Stock Up 0.2%

SSYS stock traded up $0.02 during trading on Wednesday, hitting $10.87. The company had a trading volume of 167,757 shares, compared to its average volume of 526,303. The firm has a market capitalization of $923.25 million, a P/E ratio of -7.28 and a beta of 1.53. The company has a 50 day simple moving average of $10.89 and a 200-day simple moving average of $10.40. Stratasys, Ltd. has a 52-week low of $6.05 and a 52-week high of $12.88.

Stratasys (NASDAQ:SSYS - Get Free Report) last announced its quarterly earnings data on Thursday, May 8th. The technology company reported $0.04 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.03 by $0.01. The firm had revenue of $136.05 million during the quarter, compared to analyst estimates of $134.11 million. Stratasys had a negative net margin of 19.02% and a negative return on equity of 1.86%. Stratasys's quarterly revenue was down 5.6% on a year-over-year basis. During the same quarter in the prior year, the firm posted ($0.02) earnings per share. Sell-side analysts forecast that Stratasys, Ltd. will post -0.4 earnings per share for the current year.

About Stratasys

(

Free Report)

Stratasys Ltd. provides connected polymer-based 3D printing solutions. It offers range of 3D printing systems, which includes polyjet printer, Fused Deposition Modeling (FDM) printers, stereolithography printing systems, origin P3 printers, and selective absorption fusion printer for additive manufacturing, and tooling and rapid prototyping for various vertical markets, such as automotive, aerospace, consumer products and healthcare.

Featured Stories

Before you consider Stratasys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stratasys wasn't on the list.

While Stratasys currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.