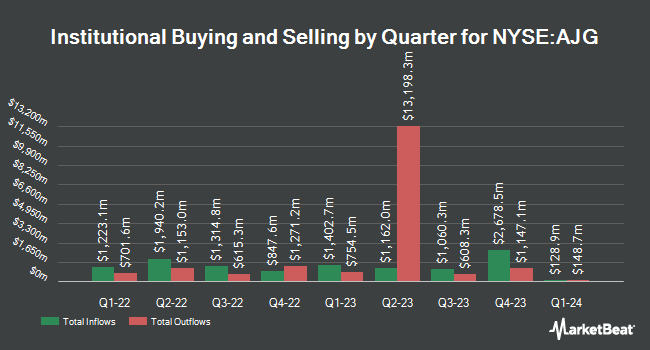

ARS Investment Partners LLC trimmed its stake in Arthur J. Gallagher & Co. (NYSE:AJG - Free Report) by 1.0% in the first quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 83,331 shares of the financial services provider's stock after selling 851 shares during the period. Arthur J. Gallagher & Co. comprises approximately 3.0% of ARS Investment Partners LLC's investment portfolio, making the stock its 11th biggest position. ARS Investment Partners LLC's holdings in Arthur J. Gallagher & Co. were worth $28,769,000 as of its most recent SEC filing.

A number of other institutional investors and hedge funds have also bought and sold shares of the stock. HWG Holdings LP bought a new stake in Arthur J. Gallagher & Co. during the first quarter valued at $25,000. Johnson Financial Group Inc. boosted its position in Arthur J. Gallagher & Co. by 205.4% during the fourth quarter. Johnson Financial Group Inc. now owns 113 shares of the financial services provider's stock valued at $34,000 after acquiring an additional 76 shares during the last quarter. Parvin Asset Management LLC bought a new stake in Arthur J. Gallagher & Co. during the fourth quarter valued at $35,000. Centennial Bank AR bought a new stake in Arthur J. Gallagher & Co. during the first quarter valued at $38,000. Finally, Golden State Wealth Management LLC boosted its position in Arthur J. Gallagher & Co. by 2,750.0% during the first quarter. Golden State Wealth Management LLC now owns 114 shares of the financial services provider's stock valued at $39,000 after acquiring an additional 110 shares during the last quarter. 85.53% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

A number of brokerages have commented on AJG. Erste Group Bank reaffirmed a "hold" rating on shares of Arthur J. Gallagher & Co. in a research report on Wednesday, July 23rd. UBS Group cut their price target on shares of Arthur J. Gallagher & Co. from $345.00 to $322.00 and set a "neutral" rating on the stock in a research report on Monday, August 4th. Barclays cut their price objective on shares of Arthur J. Gallagher & Co. from $346.00 to $327.00 and set an "equal weight" rating on the stock in a research report on Monday, July 7th. Citigroup began coverage on shares of Arthur J. Gallagher & Co. in a research report on Wednesday, August 13th. They set a "neutral" rating and a $317.00 price objective on the stock. Finally, Cantor Fitzgerald raised shares of Arthur J. Gallagher & Co. to a "strong-buy" rating in a research report on Wednesday, August 13th. One equities research analyst has rated the stock with a Strong Buy rating, five have assigned a Buy rating, nine have given a Hold rating and one has given a Sell rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Hold" and a consensus price target of $331.07.

Check Out Our Latest Analysis on Arthur J. Gallagher & Co.

Arthur J. Gallagher & Co. Stock Down 0.8%

NYSE AJG traded down $2.5550 during trading hours on Friday, hitting $302.8250. The company's stock had a trading volume of 1,165,433 shares, compared to its average volume of 1,790,757. Arthur J. Gallagher & Co. has a 52 week low of $274.25 and a 52 week high of $351.23. The company has a market capitalization of $77.64 billion, a PE ratio of 43.01 and a beta of 0.68. The company has a current ratio of 1.36, a quick ratio of 1.36 and a debt-to-equity ratio of 0.52. The company's 50-day simple moving average is $306.50 and its two-hundred day simple moving average is $322.31.

Arthur J. Gallagher & Co. (NYSE:AJG - Get Free Report) last announced its quarterly earnings results on Thursday, July 31st. The financial services provider reported $2.33 earnings per share for the quarter, missing the consensus estimate of $2.36 by ($0.03). Arthur J. Gallagher & Co. had a net margin of 14.54% and a return on equity of 13.17%. The business had revenue of $3.18 billion during the quarter, compared to the consensus estimate of $3.20 billion. During the same period in the previous year, the business posted $2.29 EPS. Arthur J. Gallagher & Co.'s revenue was up 16.0% compared to the same quarter last year. Research analysts anticipate that Arthur J. Gallagher & Co. will post 11.54 EPS for the current fiscal year.

Arthur J. Gallagher & Co. Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Friday, September 19th. Investors of record on Friday, September 5th will be given a $0.65 dividend. The ex-dividend date of this dividend is Friday, September 5th. This represents a $2.60 annualized dividend and a yield of 0.9%. Arthur J. Gallagher & Co.'s dividend payout ratio (DPR) is presently 36.93%.

About Arthur J. Gallagher & Co.

(

Free Report)

Arthur J. Gallagher & Co engages in the provision of insurance brokerage, reinsurance brokerage, consulting, and third-party claims settlement and administration services. It operates through the following segments: Brokerage, Risk Management, and Corporate. The Brokerage segment consists of retail and wholesale insurance brokerage operations.

Recommended Stories

Before you consider Arthur J. Gallagher & Co., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arthur J. Gallagher & Co. wasn't on the list.

While Arthur J. Gallagher & Co. currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.