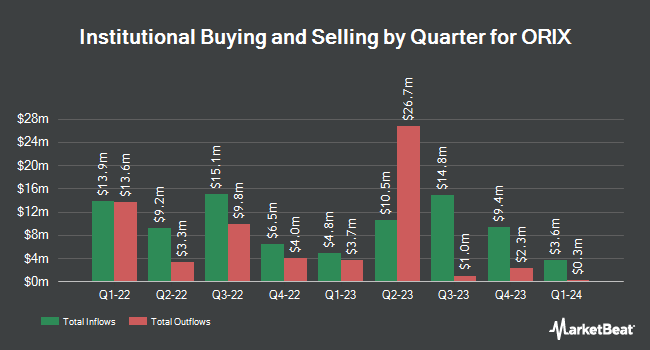

Ascent Group LLC purchased a new position in shares of Orix Corp Ads (NYSE:IX - Free Report) in the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund purchased 12,605 shares of the real estate investment trust's stock, valued at approximately $263,000.

A number of other large investors also recently modified their holdings of the business. Bessemer Group Inc. boosted its stake in Orix Corp Ads by 3,582.3% during the 1st quarter. Bessemer Group Inc. now owns 2,283 shares of the real estate investment trust's stock valued at $48,000 after purchasing an additional 2,221 shares in the last quarter. Yousif Capital Management LLC lifted its holdings in shares of Orix Corp Ads by 202.9% in the first quarter. Yousif Capital Management LLC now owns 11,300 shares of the real estate investment trust's stock valued at $236,000 after buying an additional 7,570 shares during the period. GAMMA Investing LLC lifted its holdings in shares of Orix Corp Ads by 343.2% in the first quarter. GAMMA Investing LLC now owns 5,708 shares of the real estate investment trust's stock valued at $119,000 after buying an additional 4,420 shares during the period. Two Sigma Investments LP bought a new position in Orix Corp Ads during the fourth quarter valued at about $273,000. Finally, Sequoia Financial Advisors LLC grew its holdings in Orix Corp Ads by 352.1% during the first quarter. Sequoia Financial Advisors LLC now owns 20,505 shares of the real estate investment trust's stock worth $428,000 after acquiring an additional 15,969 shares during the period. 1.73% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Separately, Wall Street Zen downgraded shares of Orix Corp Ads from a "strong-buy" rating to a "buy" rating in a report on Friday, August 22nd.

View Our Latest Analysis on IX

Orix Corp Ads Trading Down 0.4%

Shares of IX stock traded down $0.12 during trading hours on Wednesday, reaching $26.95. 11,582 shares of the stock traded hands, compared to its average volume of 208,700. The company has a quick ratio of 1.72, a current ratio of 1.76 and a debt-to-equity ratio of 1.36. The firm has a market capitalization of $30.71 billion, a PE ratio of 12.34, a PEG ratio of 1.01 and a beta of 0.89. Orix Corp Ads has a 1-year low of $17.75 and a 1-year high of $27.16. The business has a fifty day moving average price of $24.66 and a 200 day moving average price of $22.13.

Orix Corp Ads (NYSE:IX - Get Free Report) last posted its quarterly earnings data on Thursday, August 7th. The real estate investment trust reported $0.65 earnings per share for the quarter, topping the consensus estimate of $0.54 by $0.11. Orix Corp Ads had a net margin of 12.70% and a return on equity of 9.01%. The firm had revenue of $5.21 billion for the quarter, compared to analysts' expectations of $4.96 billion. On average, equities research analysts forecast that Orix Corp Ads will post 11.31 EPS for the current year.

Orix Corp Ads Company Profile

(

Free Report)

ORIX Corporation provides diversified financial services in Japan, the United States, Asia, Europe, Australasia, and the Middle East. The company's Corporate Financial Services and Maintenance Leasing segment is involved in the finance and fee; leasing and rental of automobiles, electronic measuring instruments, and ICT-related equipment businesses; and provision of life insurance and environment and energy-related products and services.

Read More

Before you consider Orix Corp Ads, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Orix Corp Ads wasn't on the list.

While Orix Corp Ads currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.