ASR Vermogensbeheer N.V. acquired a new position in shares of Lowe's Companies, Inc. (NYSE:LOW - Free Report) in the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm acquired 74,690 shares of the home improvement retailer's stock, valued at approximately $17,419,000.

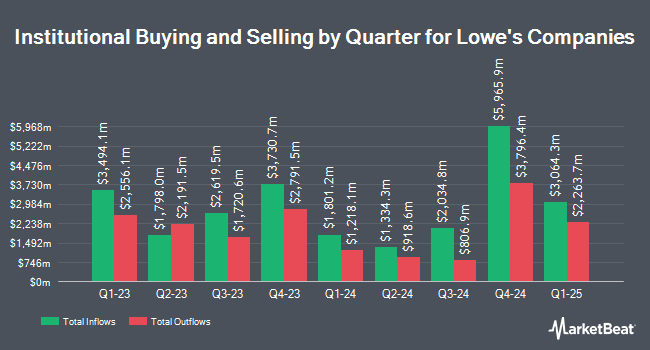

Several other hedge funds also recently modified their holdings of the company. Vanguard Group Inc. increased its holdings in shares of Lowe's Companies by 0.4% during the first quarter. Vanguard Group Inc. now owns 54,609,378 shares of the home improvement retailer's stock worth $12,736,545,000 after buying an additional 230,359 shares in the last quarter. Northern Trust Corp increased its holdings in shares of Lowe's Companies by 16.3% in the fourth quarter. Northern Trust Corp now owns 7,074,391 shares of the home improvement retailer's stock valued at $1,745,960,000 after purchasing an additional 993,833 shares in the last quarter. Goldman Sachs Group Inc. increased its holdings in shares of Lowe's Companies by 6.9% in the first quarter. Goldman Sachs Group Inc. now owns 5,111,747 shares of the home improvement retailer's stock valued at $1,192,213,000 after purchasing an additional 330,701 shares in the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its holdings in shares of Lowe's Companies by 6.9% in the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 5,035,630 shares of the home improvement retailer's stock valued at $1,242,793,000 after purchasing an additional 323,371 shares in the last quarter. Finally, Kovitz Investment Group Partners LLC increased its holdings in shares of Lowe's Companies by 350.2% in the fourth quarter. Kovitz Investment Group Partners LLC now owns 2,373,460 shares of the home improvement retailer's stock valued at $585,770,000 after purchasing an additional 1,846,315 shares in the last quarter. Institutional investors and hedge funds own 74.06% of the company's stock.

Analyst Ratings Changes

A number of analysts recently weighed in on LOW shares. Morgan Stanley lowered their price target on shares of Lowe's Companies from $300.00 to $255.00 and set an "overweight" rating for the company in a report on Monday, May 5th. Sanford C. Bernstein set a $266.00 price target on shares of Lowe's Companies and gave the company an "outperform" rating in a report on Thursday, May 22nd. Royal Bank Of Canada lowered their price target on shares of Lowe's Companies from $244.00 to $242.00 and set a "sector perform" rating for the company in a report on Thursday, May 22nd. Guggenheim reissued a "buy" rating and issued a $300.00 price target on shares of Lowe's Companies in a report on Tuesday, July 22nd. Finally, Stifel Nicolaus lowered their price target on shares of Lowe's Companies from $250.00 to $240.00 and set a "hold" rating for the company in a report on Tuesday, May 27th. One equities research analyst has rated the stock with a sell rating, nine have given a hold rating and seventeen have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average price target of $270.68.

Check Out Our Latest Research Report on LOW

Insider Buying and Selling

In related news, EVP Juliette Williams Pryor sold 1,130 shares of the business's stock in a transaction on Tuesday, June 3rd. The shares were sold at an average price of $227.50, for a total value of $257,075.00. Following the sale, the executive vice president directly owned 31,898 shares of the company's stock, valued at approximately $7,256,795. The trade was a 3.42% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Corporate insiders own 0.27% of the company's stock.

Lowe's Companies Price Performance

Shares of NYSE LOW traded up $2.81 during midday trading on Friday, reaching $241.37. 2,746,101 shares of the stock were exchanged, compared to its average volume of 2,652,532. The business has a 50-day simple moving average of $224.08 and a two-hundred day simple moving average of $231.12. The company has a market capitalization of $135.27 billion, a price-to-earnings ratio of 20.00, a P/E/G ratio of 2.25 and a beta of 0.89. Lowe's Companies, Inc. has a 12 month low of $206.38 and a 12 month high of $287.01.

Lowe's Companies (NYSE:LOW - Get Free Report) last announced its quarterly earnings results on Wednesday, May 21st. The home improvement retailer reported $2.92 earnings per share for the quarter, topping analysts' consensus estimates of $2.88 by $0.04. The company had revenue of $20.93 billion for the quarter, compared to analysts' expectations of $21.09 billion. Lowe's Companies had a net margin of 8.22% and a negative return on equity of 49.12%. The business's quarterly revenue was down 2.0% compared to the same quarter last year. During the same period last year, the firm posted $3.06 earnings per share. Equities research analysts expect that Lowe's Companies, Inc. will post 11.9 earnings per share for the current fiscal year.

Lowe's Companies Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Wednesday, August 6th. Investors of record on Wednesday, July 23rd were given a $1.20 dividend. The ex-dividend date of this dividend was Wednesday, July 23rd. This represents a $4.80 annualized dividend and a yield of 2.0%. This is an increase from Lowe's Companies's previous quarterly dividend of $1.15. Lowe's Companies's payout ratio is presently 39.77%.

Lowe's Companies Company Profile

(

Free Report)

Lowe's Companies, Inc, together with its subsidiaries, operates as a home improvement retailer in the United States. The company offers a line of products for construction, maintenance, repair, remodeling, and decorating. It also provides home improvement products, such as appliances, seasonal and outdoor living, lawn and garden, lumber, kitchens and bath, tools, paint, millwork, hardware, flooring, rough plumbing, building materials, décor, and electrical.

Featured Stories

Before you consider Lowe's Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lowe's Companies wasn't on the list.

While Lowe's Companies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report