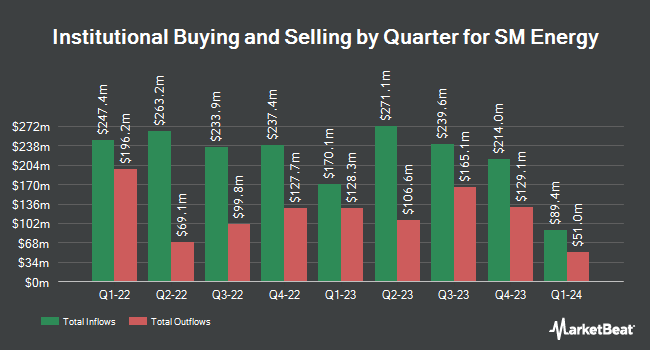

Assenagon Asset Management S.A. purchased a new stake in SM Energy Company (NYSE:SM - Free Report) in the 2nd quarter, according to its most recent Form 13F filing with the SEC. The firm purchased 218,419 shares of the energy company's stock, valued at approximately $5,397,000. Assenagon Asset Management S.A. owned 0.19% of SM Energy at the end of the most recent reporting period.

Several other hedge funds have also modified their holdings of the business. Exchange Traded Concepts LLC lifted its holdings in shares of SM Energy by 6.1% in the 2nd quarter. Exchange Traded Concepts LLC now owns 39,357 shares of the energy company's stock valued at $973,000 after buying an additional 2,262 shares during the period. Wealth Enhancement Advisory Services LLC acquired a new stake in shares of SM Energy in the 2nd quarter valued at approximately $216,000. MassMutual Private Wealth & Trust FSB lifted its holdings in shares of SM Energy by 332.8% in the 2nd quarter. MassMutual Private Wealth & Trust FSB now owns 1,887 shares of the energy company's stock valued at $47,000 after buying an additional 1,451 shares during the period. Insight Wealth Strategies LLC lifted its holdings in shares of SM Energy by 30.8% in the 2nd quarter. Insight Wealth Strategies LLC now owns 107,381 shares of the energy company's stock valued at $2,796,000 after buying an additional 25,273 shares during the period. Finally, Voya Investment Management LLC lifted its holdings in shares of SM Energy by 31.4% in the 1st quarter. Voya Investment Management LLC now owns 97,851 shares of the energy company's stock valued at $2,931,000 after buying an additional 23,386 shares during the period. 94.56% of the stock is owned by institutional investors and hedge funds.

SM Energy Trading Up 3.1%

NYSE:SM opened at $27.33 on Thursday. The company has a debt-to-equity ratio of 0.59, a quick ratio of 0.69 and a current ratio of 0.69. The stock has a market cap of $3.14 billion, a price-to-earnings ratio of 3.86 and a beta of 2.46. SM Energy Company has a one year low of $19.67 and a one year high of $46.42. The business's 50-day simple moving average is $27.06 and its 200 day simple moving average is $26.03.

SM Energy (NYSE:SM - Get Free Report) last announced its quarterly earnings data on Thursday, July 31st. The energy company reported $1.50 earnings per share for the quarter, beating the consensus estimate of $1.23 by $0.27. The firm had revenue of $792.94 million during the quarter, compared to analyst estimates of $792.58 million. SM Energy had a return on equity of 18.06% and a net margin of 25.94%.SM Energy's quarterly revenue was up 25.0% on a year-over-year basis. During the same period in the previous year, the company earned $1.85 earnings per share. As a group, sell-side analysts predict that SM Energy Company will post 8.1 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

Several equities analysts recently issued reports on the company. Wells Fargo & Company reduced their price objective on SM Energy from $33.00 to $29.00 and set an "equal weight" rating for the company in a report on Monday, June 16th. Susquehanna lifted their price objective on SM Energy from $24.00 to $27.00 and gave the stock a "neutral" rating in a report on Wednesday, July 23rd. Raymond James Financial cut SM Energy from an "outperform" rating to an "underperform" rating in a report on Tuesday, June 24th. TD Cowen raised SM Energy to a "strong-buy" rating in a report on Monday, July 7th. Finally, Mizuho reduced their price objective on SM Energy from $44.00 to $39.00 and set an "outperform" rating for the company in a report on Monday, September 15th. One equities research analyst has rated the stock with a Strong Buy rating, three have assigned a Buy rating, six have assigned a Hold rating and one has assigned a Sell rating to the company's stock. Based on data from MarketBeat.com, SM Energy has a consensus rating of "Hold" and a consensus target price of $42.08.

Get Our Latest Stock Report on SM

SM Energy Company Profile

(

Free Report)

SM Energy Company, an independent energy company, engages in the acquisition, exploration, development, and production of oil, gas, and natural gas liquids in the state of Texas. It has working interests in oil and gas producing wells in the Midland Basin and South Texas. The company was formerly known as St.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider SM Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SM Energy wasn't on the list.

While SM Energy currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.