Assetmark Inc. boosted its position in shares of Salesforce Inc. (NYSE:CRM - Free Report) by 7.9% in the 1st quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 187,934 shares of the CRM provider's stock after buying an additional 13,694 shares during the quarter. Assetmark Inc.'s holdings in Salesforce were worth $50,434,000 as of its most recent filing with the Securities & Exchange Commission.

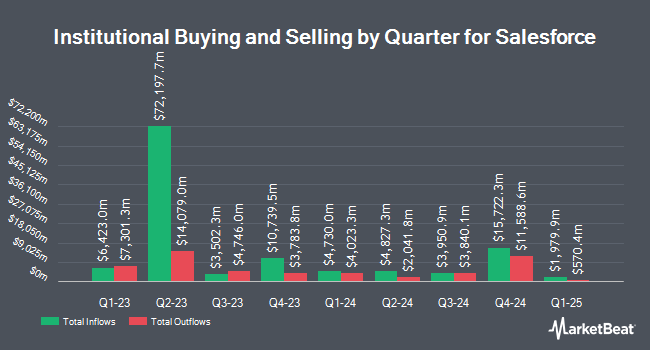

Other institutional investors and hedge funds also recently bought and sold shares of the company. Bernard Wealth Management Corp. purchased a new position in Salesforce during the fourth quarter worth $25,000. Accredited Wealth Management LLC purchased a new position in Salesforce during the fourth quarter worth $27,000. Capital A Wealth Management LLC boosted its stake in shares of Salesforce by 450.0% during the first quarter. Capital A Wealth Management LLC now owns 110 shares of the CRM provider's stock valued at $30,000 after purchasing an additional 90 shares during the period. CBIZ Investment Advisory Services LLC boosted its stake in shares of Salesforce by 314.8% during the first quarter. CBIZ Investment Advisory Services LLC now owns 112 shares of the CRM provider's stock valued at $30,000 after purchasing an additional 85 shares during the period. Finally, Abound Financial LLC purchased a new stake in shares of Salesforce during the first quarter valued at $31,000. 80.43% of the stock is owned by hedge funds and other institutional investors.

Salesforce Price Performance

Shares of NYSE CRM opened at $269.11 on Friday. The business's 50 day moving average price is $268.07 and its 200 day moving average price is $284.27. The firm has a market cap of $257.27 billion, a P/E ratio of 42.11, a P/E/G ratio of 2.43 and a beta of 1.36. Salesforce Inc. has a 52 week low of $230.00 and a 52 week high of $369.00. The company has a quick ratio of 1.07, a current ratio of 1.07 and a debt-to-equity ratio of 0.14.

Salesforce (NYSE:CRM - Get Free Report) last issued its earnings results on Wednesday, May 28th. The CRM provider reported $2.58 EPS for the quarter, beating analysts' consensus estimates of $2.55 by $0.03. The firm had revenue of $9.83 billion for the quarter, compared to analyst estimates of $9.74 billion. Salesforce had a return on equity of 12.94% and a net margin of 16.08%. Salesforce's revenue for the quarter was up 7.6% on a year-over-year basis. During the same quarter in the prior year, the firm earned $2.44 earnings per share. On average, sell-side analysts expect that Salesforce Inc. will post 7.46 earnings per share for the current year.

Salesforce Cuts Dividend

The business also recently disclosed a quarterly dividend, which was paid on Thursday, July 10th. Shareholders of record on Wednesday, June 18th were given a $0.416 dividend. The ex-dividend date of this dividend was Wednesday, June 18th. This represents a $1.66 annualized dividend and a yield of 0.62%. Salesforce's dividend payout ratio is presently 25.98%.

Insider Buying and Selling

In other Salesforce news, CEO Marc Benioff sold 2,250 shares of the company's stock in a transaction that occurred on Wednesday, July 23rd. The stock was sold at an average price of $266.56, for a total value of $599,760.00. Following the sale, the chief executive officer owned 11,911,571 shares in the company, valued at approximately $3,175,148,365.76. This represents a 0.02% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this link. In the last 90 days, insiders sold 33,479 shares of company stock valued at $9,091,796. Corporate insiders own 3.20% of the company's stock.

Analyst Ratings Changes

A number of analysts have recently issued reports on CRM shares. Needham & Company LLC reissued a "buy" rating and set a $400.00 target price on shares of Salesforce in a research note on Wednesday, May 28th. Northland Securities lowered their target price on shares of Salesforce from $423.00 to $396.00 and set an "outperform" rating for the company in a research note on Thursday, May 29th. Barclays lowered their target price on shares of Salesforce from $425.00 to $347.00 and set an "overweight" rating for the company in a research note on Thursday, May 29th. Canaccord Genuity Group lowered their target price on shares of Salesforce from $400.00 to $350.00 and set a "buy" rating for the company in a research note on Wednesday, May 28th. Finally, Piper Sandler boosted their target price on shares of Salesforce from $315.00 to $335.00 and gave the company an "overweight" rating in a research note on Wednesday, May 28th. Three investment analysts have rated the stock with a sell rating, eight have assigned a hold rating, twenty-seven have given a buy rating and four have assigned a strong buy rating to the stock. Based on data from MarketBeat, Salesforce presently has a consensus rating of "Moderate Buy" and an average target price of $348.16.

View Our Latest Analysis on Salesforce

Salesforce Profile

(

Free Report)

Salesforce, Inc provides Customer Relationship Management (CRM) technology that brings companies and customers together worldwide. The company's service includes sales to store data, monitor leads and progress, forecast opportunities, gain insights through analytics and artificial intelligence, and deliver quotes, contracts, and invoices; and service that enables companies to deliver trusted and highly personalized customer support at scale.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Salesforce, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Salesforce wasn't on the list.

While Salesforce currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.