Assetmark Inc. lowered its holdings in Expeditors International of Washington, Inc. (NASDAQ:EXPD - Free Report) by 2.9% in the first quarter, according to the company in its most recent disclosure with the SEC. The firm owned 369,666 shares of the transportation company's stock after selling 10,954 shares during the quarter. Assetmark Inc. owned 0.27% of Expeditors International of Washington worth $44,452,000 as of its most recent filing with the SEC.

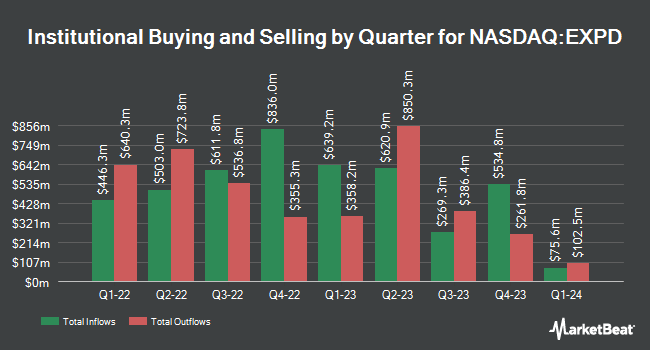

A number of other hedge funds and other institutional investors also recently bought and sold shares of EXPD. Cetera Investment Advisers grew its holdings in Expeditors International of Washington by 19.9% in the first quarter. Cetera Investment Advisers now owns 13,540 shares of the transportation company's stock valued at $1,628,000 after purchasing an additional 2,246 shares during the last quarter. Avantax Advisory Services Inc. grew its holdings in Expeditors International of Washington by 6.5% in the first quarter. Avantax Advisory Services Inc. now owns 2,426 shares of the transportation company's stock valued at $292,000 after purchasing an additional 149 shares during the last quarter. AE Wealth Management LLC grew its holdings in Expeditors International of Washington by 6.4% in the first quarter. AE Wealth Management LLC now owns 6,810 shares of the transportation company's stock valued at $819,000 after purchasing an additional 410 shares during the last quarter. Wakefield Asset Management LLLP acquired a new stake in Expeditors International of Washington in the first quarter valued at $3,614,000. Finally, Convergence Investment Partners LLC acquired a new stake in Expeditors International of Washington in the first quarter valued at $406,000. Institutional investors and hedge funds own 94.02% of the company's stock.

Expeditors International of Washington Trading Down 1.3%

NASDAQ EXPD traded down $1.46 during mid-day trading on Wednesday, reaching $113.00. 225,293 shares of the company's stock traded hands, compared to its average volume of 1,361,996. Expeditors International of Washington, Inc. has a 1-year low of $100.47 and a 1-year high of $131.59. The company has a fifty day simple moving average of $114.39 and a 200-day simple moving average of $113.77. The company has a market cap of $15.48 billion, a price-to-earnings ratio of 19.73, a P/E/G ratio of 5.00 and a beta of 1.07.

Expeditors International of Washington Increases Dividend

The firm also recently disclosed a semi-annual dividend, which was paid on Monday, June 16th. Shareholders of record on Monday, June 2nd were paid a dividend of $0.77 per share. This represents a yield of 1.4%. The ex-dividend date was Monday, June 2nd. This is a positive change from Expeditors International of Washington's previous semi-annual dividend of $0.73. Expeditors International of Washington's dividend payout ratio (DPR) is 25.58%.

Analyst Ratings Changes

Several research firms recently weighed in on EXPD. Bank of America downgraded Expeditors International of Washington from a "neutral" rating to an "underperform" rating and increased their target price for the stock from $117.00 to $118.00 in a research report on Friday, July 11th. Robert W. Baird assumed coverage on Expeditors International of Washington in a research report on Tuesday, July 1st. They set a "neutral" rating and a $124.00 target price on the stock. TD Cowen cut their price objective on Expeditors International of Washington from $112.00 to $107.00 and set a "sell" rating on the stock in a report on Wednesday, May 7th. UBS Group cut their price objective on Expeditors International of Washington from $128.00 to $117.00 and set a "neutral" rating on the stock in a report on Wednesday, May 7th. Finally, Barclays cut their price objective on Expeditors International of Washington from $110.00 to $105.00 and set an "underweight" rating on the stock in a report on Wednesday, May 7th. Five research analysts have rated the stock with a sell rating and eight have given a hold rating to the company's stock. According to data from MarketBeat.com, the company presently has an average rating of "Hold" and a consensus price target of $113.89.

View Our Latest Stock Analysis on Expeditors International of Washington

Expeditors International of Washington Company Profile

(

Free Report)

Expeditors International of Washington, Inc, together with its subsidiaries, provides logistics services worldwide. The company offers airfreight services, such as air freight consolidation and forwarding; ocean freight and ocean services, including ocean freight consolidation, direct ocean forwarding, and order management; customs brokerage, import, intra-continental ground transportation and delivery, and warehousing and distribution services; and customs clearance, purchase order management, vendor consolidation, time-definite transportation services, temperature-controlled transit, cargo insurance, specialized cargo monitoring and tracking, and other supply chain solutions.

Read More

Before you consider Expeditors International of Washington, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Expeditors International of Washington wasn't on the list.

While Expeditors International of Washington currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.