Avalon Trust Co grew its holdings in The Cooper Companies, Inc. (NASDAQ:COO - Free Report) by 203,860.0% during the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 203,960 shares of the medical device company's stock after purchasing an additional 203,860 shares during the period. Cooper Companies comprises approximately 1.4% of Avalon Trust Co's holdings, making the stock its 21st largest holding. Avalon Trust Co owned approximately 0.10% of Cooper Companies worth $17,204,000 as of its most recent SEC filing.

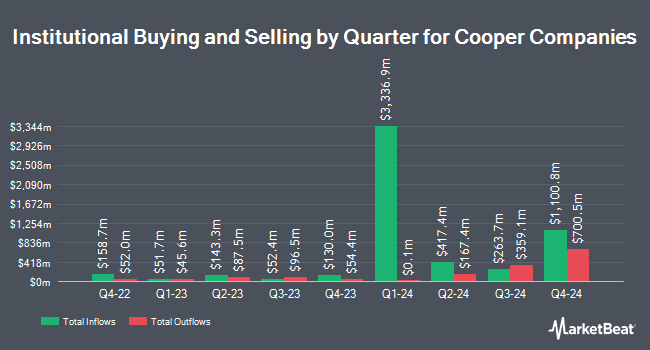

A number of other hedge funds and other institutional investors have also bought and sold shares of COO. City Holding Co. purchased a new stake in Cooper Companies in the first quarter worth $34,000. Covestor Ltd increased its stake in Cooper Companies by 35.5% in the fourth quarter. Covestor Ltd now owns 458 shares of the medical device company's stock worth $42,000 after purchasing an additional 120 shares during the period. Larson Financial Group LLC increased its stake in Cooper Companies by 1,071.0% in the first quarter. Larson Financial Group LLC now owns 726 shares of the medical device company's stock worth $61,000 after purchasing an additional 664 shares during the period. HM Payson & Co. increased its stake in Cooper Companies by 147.4% in the first quarter. HM Payson & Co. now owns 893 shares of the medical device company's stock worth $75,000 after purchasing an additional 532 shares during the period. Finally, UMB Bank n.a. increased its stake in Cooper Companies by 16.7% in the first quarter. UMB Bank n.a. now owns 902 shares of the medical device company's stock worth $76,000 after purchasing an additional 129 shares during the period. Hedge funds and other institutional investors own 24.39% of the company's stock.

Cooper Companies Price Performance

Shares of NASDAQ COO opened at $70.87 on Friday. The company has a debt-to-equity ratio of 0.30, a quick ratio of 1.23 and a current ratio of 2.10. The company has a market cap of $14.17 billion, a PE ratio of 34.40, a P/E/G ratio of 1.73 and a beta of 1.00. The business has a 50-day simple moving average of $72.33 and a two-hundred day simple moving average of $80.68. The Cooper Companies, Inc. has a fifty-two week low of $65.00 and a fifty-two week high of $112.38.

Cooper Companies (NASDAQ:COO - Get Free Report) last issued its quarterly earnings results on Thursday, May 29th. The medical device company reported $0.96 earnings per share for the quarter, topping the consensus estimate of $0.93 by $0.03. The business had revenue of $1 billion during the quarter, compared to the consensus estimate of $995.12 million. Cooper Companies had a return on equity of 9.60% and a net margin of 10.39%. The company's quarterly revenue was up 6.3% on a year-over-year basis. During the same quarter last year, the company earned $0.85 earnings per share. As a group, equities analysts expect that The Cooper Companies, Inc. will post 3.98 EPS for the current fiscal year.

Analysts Set New Price Targets

Several equities analysts have recently commented on the company. Piper Sandler restated an "overweight" rating and set a $105.00 price target (down previously from $115.00) on shares of Cooper Companies in a research note on Friday, May 30th. BNP Paribas Exane upgraded Cooper Companies from a "neutral" rating to an "outperform" rating and set a $92.00 price target on the stock in a research note on Tuesday, July 22nd. Wall Street Zen lowered Cooper Companies from a "buy" rating to a "hold" rating in a research note on Saturday, July 12th. Robert W. Baird cut their price target on Cooper Companies from $107.00 to $97.00 and set an "outperform" rating on the stock in a research note on Friday, May 30th. Finally, Wells Fargo & Company dropped their price objective on Cooper Companies from $118.00 to $93.00 and set an "overweight" rating on the stock in a research report on Friday, May 30th. Three investment analysts have rated the stock with a hold rating, nine have issued a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, the company has an average rating of "Moderate Buy" and an average target price of $96.73.

View Our Latest Stock Report on Cooper Companies

Cooper Companies Company Profile

(

Free Report)

The Cooper Companies, Inc, together with its subsidiaries, develops, manufactures, and markets contact lens wearers. The company operates in two segments, CooperVision and CooperSurgical. The CooperVision segment provides spherical lense, including lenses that correct near and farsightedness; and toric and multifocal lenses comprising lenses correcting vision challenges, such as astigmatism, presbyopia, and myopia in the Americas, Europe, Middle East, Africa, and Asia Pacific.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cooper Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cooper Companies wasn't on the list.

While Cooper Companies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.