Avantax Advisory Services Inc. acquired a new stake in shares of Expand Energy Corporation (NASDAQ:EXE - Free Report) during the 1st quarter, according to its most recent 13F filing with the SEC. The firm acquired 8,235 shares of the company's stock, valued at approximately $917,000.

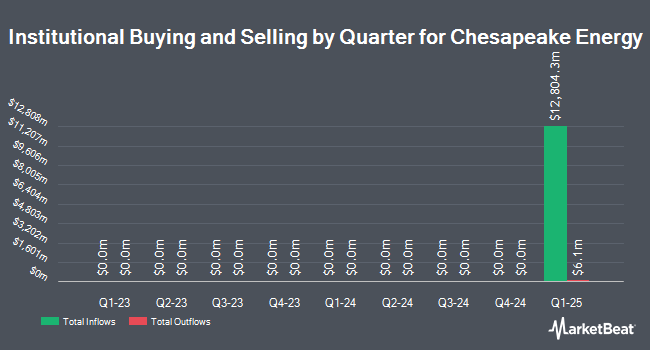

A number of other large investors also recently made changes to their positions in EXE. First Horizon Advisors Inc. bought a new position in Expand Energy during the first quarter worth about $28,000. Princeton Global Asset Management LLC bought a new position in shares of Expand Energy in the first quarter worth $31,000. BankPlus Trust Department bought a new stake in shares of Expand Energy during the 1st quarter valued at $32,000. Peoples Bank KS purchased a new stake in Expand Energy during the 1st quarter worth about $33,000. Finally, Key Financial Inc bought a new position in Expand Energy in the 1st quarter worth about $41,000. 97.93% of the stock is owned by institutional investors.

Analyst Ratings Changes

Several equities analysts recently commented on EXE shares. Siebert Williams Shank reduced their price objective on shares of Expand Energy from $142.00 to $128.00 in a research note on Wednesday, July 16th. Wells Fargo & Company dropped their price objective on Expand Energy from $121.00 to $120.00 and set an "equal weight" rating for the company in a research note on Tuesday, July 15th. The Goldman Sachs Group decreased their target price on Expand Energy from $127.00 to $125.00 in a research note on Thursday, July 17th. Morgan Stanley raised their target price on shares of Expand Energy from $134.00 to $139.00 and gave the company an "overweight" rating in a research note on Monday. Finally, Bernstein Bank decreased their price objective on Expand Energy from $150.00 to $146.00 in a report on Monday, July 7th. One investment analyst has rated the stock with a hold rating, seventeen have given a buy rating and three have issued a strong buy rating to the company. Based on data from MarketBeat, the company has a consensus rating of "Buy" and a consensus price target of $128.92.

Read Our Latest Stock Analysis on Expand Energy

Expand Energy Price Performance

EXE stock traded down $0.74 during mid-day trading on Monday, hitting $101.23. The company had a trading volume of 3,675,475 shares, compared to its average volume of 3,801,874. The company has a market capitalization of $24.11 billion, a price-to-earnings ratio of 259.57 and a beta of 0.47. The company has a 50-day moving average price of $111.44 and a 200 day moving average price of $107.72. The company has a quick ratio of 0.78, a current ratio of 0.78 and a debt-to-equity ratio of 0.29. Expand Energy Corporation has a 12-month low of $69.12 and a 12-month high of $123.35.

Expand Energy (NASDAQ:EXE - Get Free Report) last posted its quarterly earnings data on Tuesday, July 29th. The company reported $1.10 EPS for the quarter, missing the consensus estimate of $1.14 by ($0.04). The firm had revenue of $3.69 billion for the quarter, compared to analysts' expectations of $2.09 billion. Expand Energy had a return on equity of 5.76% and a net margin of 2.41%. On average, research analysts anticipate that Expand Energy Corporation will post 1.33 earnings per share for the current year.

Expand Energy Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Thursday, September 4th. Shareholders of record on Thursday, August 14th will be issued a $0.575 dividend. The ex-dividend date of this dividend is Thursday, August 14th. This represents a $2.30 dividend on an annualized basis and a dividend yield of 2.3%. Expand Energy's dividend payout ratio (DPR) is currently 589.74%.

Expand Energy Profile

(

Free Report)

Expand Energy Corporation is an independent natural gas producer principally in the United States. Expand Energy Corporation, formerly known as Chesapeake Energy Corporation, is based in OKLAHOMA CITY.

Read More

Before you consider Expand Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Expand Energy wasn't on the list.

While Expand Energy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.