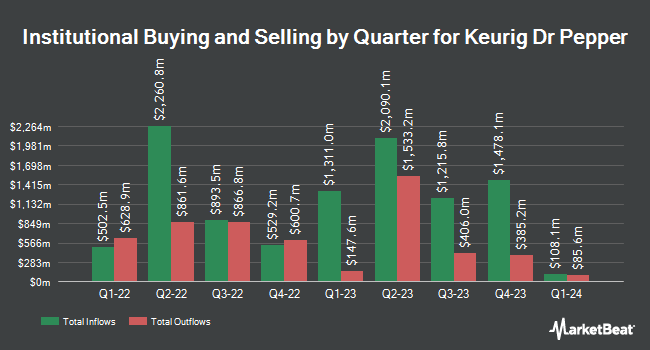

Bahl & Gaynor Inc. increased its position in Keurig Dr Pepper, Inc (NASDAQ:KDP - Free Report) by 2.7% in the first quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 4,252,806 shares of the company's stock after purchasing an additional 109,923 shares during the quarter. Bahl & Gaynor Inc. owned approximately 0.31% of Keurig Dr Pepper worth $145,531,000 as of its most recent SEC filing.

Other large investors also recently added to or reduced their stakes in the company. ST Germain D J Co. Inc. bought a new position in Keurig Dr Pepper during the 1st quarter worth about $27,000. Continuum Advisory LLC lifted its stake in Keurig Dr Pepper by 82.5% in the 1st quarter. Continuum Advisory LLC now owns 1,332 shares of the company's stock valued at $46,000 after acquiring an additional 602 shares in the last quarter. Global Trust Asset Management LLC acquired a new position in Keurig Dr Pepper during the 1st quarter worth approximately $48,000. LRI Investments LLC grew its stake in shares of Keurig Dr Pepper by 65.6% during the 4th quarter. LRI Investments LLC now owns 1,527 shares of the company's stock worth $49,000 after acquiring an additional 605 shares in the last quarter. Finally, Riverview Trust Co lifted its position in shares of Keurig Dr Pepper by 47.7% in the first quarter. Riverview Trust Co now owns 1,710 shares of the company's stock worth $59,000 after purchasing an additional 552 shares in the last quarter. 93.99% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

KDP has been the topic of several analyst reports. Deutsche Bank Aktiengesellschaft dropped their target price on Keurig Dr Pepper from $40.00 to $38.00 and set a "buy" rating on the stock in a report on Tuesday. Barclays raised their target price on shares of Keurig Dr Pepper from $37.00 to $39.00 and gave the company an "overweight" rating in a research note on Monday, July 28th. HSBC restated a "hold" rating and set a $30.00 target price (down from $42.00) on shares of Keurig Dr Pepper in a report on Tuesday. UBS Group dropped their target price on shares of Keurig Dr Pepper from $42.00 to $40.00 and set a "buy" rating on the stock in a report on Thursday, July 17th. Finally, Jefferies Financial Group set a $41.00 target price on shares of Keurig Dr Pepper in a research note on Monday. One equities research analyst has rated the stock with a Strong Buy rating, eleven have issued a Buy rating and three have given a Hold rating to the company. According to data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $38.77.

Read Our Latest Stock Analysis on Keurig Dr Pepper

Keurig Dr Pepper Price Performance

Keurig Dr Pepper stock traded down $2.15 during mid-day trading on Tuesday, reaching $28.95. The company had a trading volume of 63,300,215 shares, compared to its average volume of 9,902,298. The company has a current ratio of 0.64, a quick ratio of 0.40 and a debt-to-equity ratio of 0.56. The company has a market cap of $39.33 billion, a P/E ratio of 15.55, a P/E/G ratio of 2.22 and a beta of 0.45. Keurig Dr Pepper, Inc has a fifty-two week low of $28.93 and a fifty-two week high of $38.28. The business has a fifty day simple moving average of $33.67 and a 200 day simple moving average of $33.67.

Keurig Dr Pepper (NASDAQ:KDP - Get Free Report) last announced its quarterly earnings results on Thursday, July 24th. The company reported $0.49 earnings per share (EPS) for the quarter, meeting the consensus estimate of $0.49. The firm had revenue of $4.16 billion during the quarter, compared to analysts' expectations of $4.14 billion. Keurig Dr Pepper had a net margin of 9.75% and a return on equity of 11.05%. The company's revenue was up 6.1% on a year-over-year basis. During the same period in the prior year, the company posted $0.45 EPS. On average, equities research analysts predict that Keurig Dr Pepper, Inc will post 1.92 earnings per share for the current year.

Insiders Place Their Bets

In other Keurig Dr Pepper news, insider Mary Beth Denooyer sold 12,000 shares of Keurig Dr Pepper stock in a transaction that occurred on Thursday, July 17th. The stock was sold at an average price of $33.66, for a total value of $403,920.00. Following the completion of the sale, the insider directly owned 82,511 shares in the company, valued at approximately $2,777,320.26. The trade was a 12.70% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, Director De Ven Michael G. Van bought 15,000 shares of the firm's stock in a transaction that occurred on Wednesday, June 4th. The stock was purchased at an average cost of $33.20 per share, with a total value of $498,000.00. Following the completion of the transaction, the director directly owned 15,000 shares in the company, valued at $498,000. This represents a ∞ increase in their ownership of the stock. The disclosure for this purchase can be found here. In the last ninety days, insiders sold 679,601 shares of company stock worth $22,508,712. Company insiders own 1.00% of the company's stock.

Keurig Dr Pepper Profile

(

Free Report)

Keurig Dr Pepper Inc owns, manufactures, and distributors beverages and single serve brewing systems in the United States and internationally. It operates through three segments: U.S. Refreshment Beverages, U.S. Coffee, and International. The U.S. Refreshment Beverages segment manufactures and distributes branded concentrates, syrup, and finished beverages.

Featured Articles

Before you consider Keurig Dr Pepper, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Keurig Dr Pepper wasn't on the list.

While Keurig Dr Pepper currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.