Invesco Ltd. raised its stake in Baidu, Inc. (NASDAQ:BIDU - Free Report) by 2.7% during the 1st quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 211,711 shares of the information services provider's stock after buying an additional 5,530 shares during the quarter. Invesco Ltd. owned 0.06% of Baidu worth $19,484,000 at the end of the most recent reporting period.

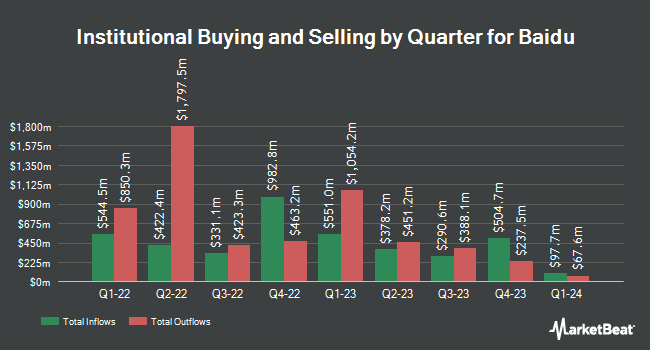

Other large investors have also recently added to or reduced their stakes in the company. Creekmur Asset Management LLC acquired a new position in Baidu in the 1st quarter valued at approximately $29,000. Assetmark Inc. increased its stake in Baidu by 143.3% in the 1st quarter. Assetmark Inc. now owns 326 shares of the information services provider's stock valued at $30,000 after buying an additional 192 shares during the period. UMB Bank n.a. increased its stake in Baidu by 80.3% in the 1st quarter. UMB Bank n.a. now owns 402 shares of the information services provider's stock valued at $37,000 after buying an additional 179 shares during the period. CX Institutional acquired a new position in Baidu in the 1st quarter valued at approximately $49,000. Finally, GeoWealth Management LLC increased its stake in shares of Baidu by 88.5% during the 4th quarter. GeoWealth Management LLC now owns 656 shares of the information services provider's stock worth $55,000 after purchasing an additional 308 shares during the last quarter.

Baidu Stock Performance

NASDAQ:BIDU traded down $2.62 during midday trading on Wednesday, reaching $89.86. The stock had a trading volume of 4,292,343 shares, compared to its average volume of 3,995,075. Baidu, Inc. has a 1-year low of $74.71 and a 1-year high of $116.25. The firm's fifty day simple moving average is $88.06 and its 200-day simple moving average is $88.47. The company has a debt-to-equity ratio of 0.19, a current ratio of 1.85 and a quick ratio of 1.85. The stock has a market capitalization of $31.04 billion, a P/E ratio of 8.28 and a beta of 0.34.

Analysts Set New Price Targets

Several brokerages have recently commented on BIDU. Benchmark dropped their price target on shares of Baidu from $120.00 to $115.00 and set a "buy" rating on the stock in a research note on Thursday, August 21st. Citigroup increased their price target on shares of Baidu from $138.00 to $140.00 and gave the stock a "buy" rating in a research note on Thursday, July 17th. Jefferies Financial Group dropped their price target on shares of Baidu from $120.00 to $110.00 and set a "buy" rating on the stock in a research note on Wednesday, July 16th. Macquarie restated a "neutral" rating on shares of Baidu in a research note on Wednesday, May 21st. Finally, Wall Street Zen lowered shares of Baidu from a "hold" rating to a "sell" rating in a research note on Friday, August 22nd. Five investment analysts have rated the stock with a Buy rating and eleven have assigned a Hold rating to the stock. According to data from MarketBeat, the stock currently has an average rating of "Hold" and an average target price of $102.75.

Get Our Latest Research Report on Baidu

Baidu Profile

(

Free Report)

Baidu, Inc engages in the provision of internet search services in China. It operates through two segments: Baidu Core and iQIYI. The company offers Baidu App to access search, feed, and other services using mobile devices; Baidu Search to access its search and other services; Baidu Feed that provides users with personalized timeline based on their demographics and interests; Baidu Health that helps users to find the doctor and hospital for healthcare needs; and Haokan, a short video app.

See Also

Before you consider Baidu, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Baidu wasn't on the list.

While Baidu currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.