Balefire LLC bought a new stake in shares of Linde PLC (NASDAQ:LIN - Free Report) in the second quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm bought 654 shares of the basic materials company's stock, valued at approximately $307,000.

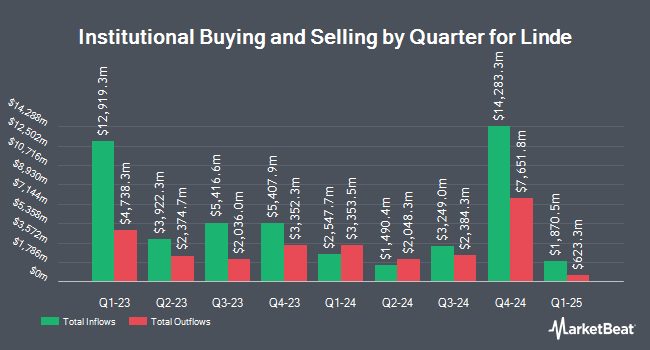

Several other hedge funds and other institutional investors have also made changes to their positions in LIN. Nuveen LLC purchased a new position in shares of Linde in the 1st quarter valued at about $2,097,793,000. GAMMA Investing LLC raised its position in shares of Linde by 58,312.0% during the 1st quarter. GAMMA Investing LLC now owns 3,415,935 shares of the basic materials company's stock worth $1,590,596,000 after acquiring an additional 3,410,087 shares in the last quarter. Deutsche Bank AG raised its position in shares of Linde by 172.4% during the 1st quarter. Deutsche Bank AG now owns 2,407,637 shares of the basic materials company's stock worth $1,121,092,000 after acquiring an additional 1,523,702 shares in the last quarter. Wellington Management Group LLP raised its position in shares of Linde by 18.6% during the 1st quarter. Wellington Management Group LLP now owns 7,542,991 shares of the basic materials company's stock worth $3,511,751,000 after acquiring an additional 1,182,157 shares in the last quarter. Finally, Universal Beteiligungs und Servicegesellschaft mbH acquired a new stake in shares of Linde during the 4th quarter worth about $386,957,000. Hedge funds and other institutional investors own 82.80% of the company's stock.

Analyst Upgrades and Downgrades

Several brokerages have recently weighed in on LIN. Citigroup raised Linde from a "neutral" rating to a "buy" rating and raised their target price for the stock from $500.00 to $535.00 in a research report on Monday, June 30th. Royal Bank Of Canada assumed coverage on Linde in a report on Friday, June 13th. They set an "outperform" rating and a $576.00 price objective on the stock. JPMorgan Chase & Co. upped their price objective on Linde from $470.00 to $475.00 and gave the stock an "overweight" rating in a report on Monday, August 4th. Finally, UBS Group upped their price objective on Linde from $485.00 to $504.00 and gave the stock a "neutral" rating in a report on Wednesday, July 9th. Two research analysts have rated the stock with a Strong Buy rating, seven have issued a Buy rating and two have given a Hold rating to the company's stock. According to MarketBeat.com, the company has an average rating of "Buy" and an average target price of $519.63.

Get Our Latest Analysis on Linde

Linde Stock Performance

NASDAQ:LIN traded up $3.01 during trading hours on Friday, reaching $479.01. 3,725,607 shares of the stock were exchanged, compared to its average volume of 1,663,088. The firm has a 50 day simple moving average of $473.32 and a 200-day simple moving average of $463.38. The company has a quick ratio of 0.78, a current ratio of 0.93 and a debt-to-equity ratio of 0.49. The stock has a market capitalization of $224.61 billion, a P/E ratio of 34.07, a P/E/G ratio of 3.14 and a beta of 0.95. Linde PLC has a 52 week low of $408.65 and a 52 week high of $487.49.

Linde (NASDAQ:LIN - Get Free Report) last issued its quarterly earnings results on Friday, August 1st. The basic materials company reported $4.09 earnings per share (EPS) for the quarter, beating the consensus estimate of $4.03 by $0.06. Linde had a return on equity of 19.09% and a net margin of 20.20%.The company had revenue of $8.50 billion for the quarter, compared to analysts' expectations of $8.35 billion. During the same period last year, the firm earned $3.85 EPS. The firm's revenue for the quarter was up 2.3% on a year-over-year basis. Linde has set its FY 2025 guidance at 16.300-16.500 EPS. Q3 2025 guidance at 4.100-4.20 EPS. As a group, sell-side analysts forecast that Linde PLC will post 16.54 earnings per share for the current fiscal year.

Linde Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Thursday, September 18th. Shareholders of record on Thursday, September 4th were issued a $1.50 dividend. The ex-dividend date of this dividend was Thursday, September 4th. This represents a $6.00 annualized dividend and a yield of 1.3%. Linde's dividend payout ratio is 42.67%.

Insider Buying and Selling at Linde

In related news, Director Stephen F. Angel sold 50,309 shares of the stock in a transaction that occurred on Thursday, August 7th. The stock was sold at an average price of $473.38, for a total transaction of $23,815,274.42. Following the sale, the director directly owned 480,543 shares in the company, valued at $227,479,445.34. This represents a 9.48% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Corporate insiders own 0.70% of the company's stock.

About Linde

(

Free Report)

Linde plc operates as an industrial gas company in the Americas, Europe, the Middle East, Africa, Asia, and South Pacific. It offers atmospheric gases, including oxygen, nitrogen, argon, and rare gases; and process gases, such as carbon dioxide, helium, hydrogen, electronic gases, specialty gases, and acetylene.

Featured Articles

Before you consider Linde, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Linde wasn't on the list.

While Linde currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report