Bank of New York Mellon Corp reduced its position in shares of FirstCash Holdings, Inc. (NASDAQ:FCFS - Free Report) by 1.5% in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 382,002 shares of the company's stock after selling 5,683 shares during the period. Bank of New York Mellon Corp owned approximately 0.85% of FirstCash worth $45,963,000 at the end of the most recent reporting period.

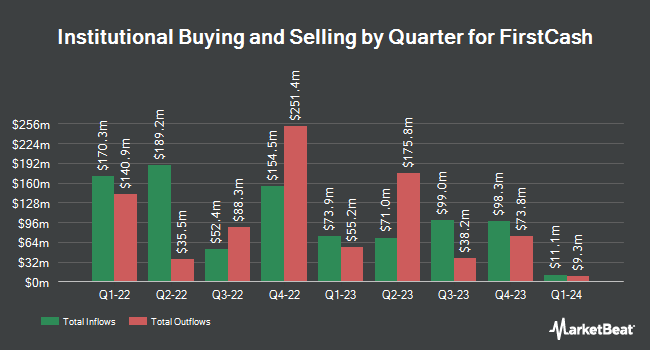

Several other institutional investors have also added to or reduced their stakes in the company. Huntleigh Advisors Inc. raised its position in FirstCash by 16.7% during the first quarter. Huntleigh Advisors Inc. now owns 3,528 shares of the company's stock valued at $424,000 after purchasing an additional 504 shares in the last quarter. Principal Financial Group Inc. raised its position in FirstCash by 1.2% during the first quarter. Principal Financial Group Inc. now owns 132,236 shares of the company's stock valued at $15,911,000 after purchasing an additional 1,629 shares in the last quarter. MBM Wealth Consultants LLC raised its position in FirstCash by 1.6% during the first quarter. MBM Wealth Consultants LLC now owns 5,757 shares of the company's stock valued at $693,000 after purchasing an additional 90 shares in the last quarter. Teacher Retirement System of Texas raised its position in FirstCash by 18.2% during the first quarter. Teacher Retirement System of Texas now owns 11,522 shares of the company's stock valued at $1,386,000 after purchasing an additional 1,771 shares in the last quarter. Finally, First Bank & Trust acquired a new position in FirstCash during the first quarter valued at approximately $206,000. 80.30% of the stock is currently owned by institutional investors and hedge funds.

FirstCash Price Performance

Shares of NASDAQ:FCFS traded up $1.80 during trading on Thursday, hitting $132.42. 251,462 shares of the company were exchanged, compared to its average volume of 275,965. The business's 50 day moving average is $130.46 and its 200-day moving average is $121.63. The company has a market capitalization of $5.88 billion, a P/E ratio of 21.19 and a beta of 0.62. The company has a quick ratio of 3.28, a current ratio of 4.39 and a debt-to-equity ratio of 0.83. FirstCash Holdings, Inc. has a 1-year low of $100.24 and a 1-year high of $138.42.

FirstCash (NASDAQ:FCFS - Get Free Report) last announced its quarterly earnings results on Thursday, April 24th. The company reported $2.07 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.75 by $0.32. The company had revenue of $836.42 million during the quarter, compared to the consensus estimate of $837.11 million. FirstCash had a net margin of 8.29% and a return on equity of 16.08%. The company's revenue for the quarter was up .0% compared to the same quarter last year. During the same period in the prior year, the business earned $1.55 earnings per share. Equities analysts forecast that FirstCash Holdings, Inc. will post 7.7 earnings per share for the current year.

FirstCash Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Friday, May 30th. Investors of record on Thursday, May 15th were paid a $0.38 dividend. The ex-dividend date of this dividend was Thursday, May 15th. This represents a $1.52 annualized dividend and a dividend yield of 1.15%. FirstCash's dividend payout ratio is 24.32%.

Insider Buying and Selling at FirstCash

In related news, insider Howard F. Hambleton sold 3,900 shares of the business's stock in a transaction on Tuesday, June 10th. The shares were sold at an average price of $130.93, for a total value of $510,627.00. Following the sale, the insider owned 32,481 shares of the company's stock, valued at $4,252,737.33. The trade was a 10.72% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. 2.93% of the stock is currently owned by corporate insiders.

Analyst Ratings Changes

Separately, Wall Street Zen downgraded shares of FirstCash from a "strong-buy" rating to a "buy" rating in a report on Saturday, July 12th.

Get Our Latest Stock Report on FCFS

FirstCash Company Profile

(

Free Report)

FirstCash Holdings, Inc, together with its subsidiaries, operates retail pawn stores in the United States, Mexico, and rest of Latin America. The company operates in three segments: U.S. Pawn, Latin America Pawn, and Retail POS Payment Solutions segments. Its pawn stores lend money on the collateral of pledged personal property, including jewelry, electronics, tools, appliances, sporting goods, and musical instruments; and retails merchandise acquired through collateral forfeitures on forfeited pawn loans and over-the-counter purchases of merchandise directly from customers.

Featured Stories

Before you consider FirstCash, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FirstCash wasn't on the list.

While FirstCash currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.