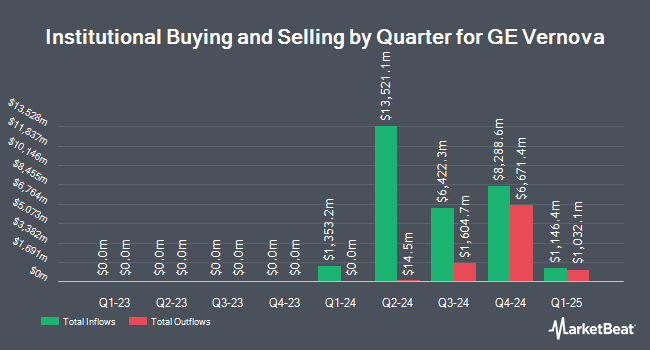

Banque Transatlantique SA lifted its position in GE Vernova Inc. (NYSE:GEV - Free Report) by 181.8% in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 3,334 shares of the company's stock after purchasing an additional 2,151 shares during the quarter. Banque Transatlantique SA's holdings in GE Vernova were worth $941,000 at the end of the most recent reporting period.

A number of other large investors have also modified their holdings of GEV. GAMMA Investing LLC raised its stake in shares of GE Vernova by 32,984.2% in the first quarter. GAMMA Investing LLC now owns 2,141,539 shares of the company's stock valued at $653,769,000 after purchasing an additional 2,135,066 shares in the last quarter. AQR Capital Management LLC raised its stake in shares of GE Vernova by 252.9% in the first quarter. AQR Capital Management LLC now owns 1,245,420 shares of the company's stock valued at $366,016,000 after purchasing an additional 892,549 shares in the last quarter. Amundi raised its stake in shares of GE Vernova by 109.0% in the first quarter. Amundi now owns 1,665,980 shares of the company's stock valued at $496,013,000 after purchasing an additional 868,927 shares in the last quarter. TD Asset Management Inc raised its stake in shares of GE Vernova by 627.2% in the first quarter. TD Asset Management Inc now owns 926,842 shares of the company's stock valued at $282,946,000 after purchasing an additional 799,388 shares in the last quarter. Finally, Nuveen LLC acquired a new position in shares of GE Vernova in the first quarter valued at $223,556,000.

GE Vernova Trading Down 2.8%

GE Vernova stock traded down $16.90 during mid-day trading on Friday, hitting $581.92. The stock had a trading volume of 3,473,078 shares, compared to its average volume of 2,574,632. The stock has a 50-day simple moving average of $597.95 and a two-hundred day simple moving average of $458.00. The stock has a market capitalization of $158.41 billion, a PE ratio of 140.22, a P/E/G ratio of 4.02 and a beta of 1.87. GE Vernova Inc. has a 12 month low of $193.38 and a 12 month high of $677.29.

GE Vernova (NYSE:GEV - Get Free Report) last posted its quarterly earnings results on Wednesday, July 23rd. The company reported $1.86 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.63 by $0.23. GE Vernova had a return on equity of 13.23% and a net margin of 3.16%.The business had revenue of $9.11 billion for the quarter, compared to analysts' expectations of $8.78 billion. During the same quarter last year, the business earned $4.65 earnings per share. The firm's quarterly revenue was up 11.1% compared to the same quarter last year. GE Vernova has set its FY 2025 guidance at EPS. Sell-side analysts expect that GE Vernova Inc. will post 6.59 earnings per share for the current fiscal year.

GE Vernova Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Monday, August 18th. Stockholders of record on Monday, July 21st were given a dividend of $0.25 per share. The ex-dividend date of this dividend was Monday, July 21st. This represents a $1.00 dividend on an annualized basis and a dividend yield of 0.2%. GE Vernova's dividend payout ratio (DPR) is currently 24.10%.

Wall Street Analysts Forecast Growth

Several research analysts have issued reports on GEV shares. Robert W. Baird increased their price objective on GE Vernova from $568.00 to $706.00 and gave the stock an "outperform" rating in a research note on Thursday, July 24th. Morgan Stanley increased their price objective on GE Vernova from $511.00 to $675.00 and gave the stock an "overweight" rating in a research note on Thursday, July 24th. Wells Fargo & Company increased their price objective on GE Vernova from $474.00 to $697.00 and gave the stock an "overweight" rating in a research note on Thursday, July 24th. The Goldman Sachs Group increased their price objective on GE Vernova from $500.00 to $570.00 and gave the stock a "buy" rating in a research note on Tuesday, June 10th. Finally, Wolfe Research lowered GE Vernova from an "outperform" rating to a "peer perform" rating in a research note on Friday, June 13th. Four investment analysts have rated the stock with a Strong Buy rating, eighteen have issued a Buy rating and nine have assigned a Hold rating to the stock. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average price target of $573.75.

Check Out Our Latest Stock Analysis on GE Vernova

Insider Activity at GE Vernova

In other news, CFO Kenneth Scott Parks sold 3,300 shares of the firm's stock in a transaction dated Tuesday, August 26th. The stock was sold at an average price of $620.00, for a total transaction of $2,046,000.00. Following the sale, the chief financial officer owned 7,590 shares of the company's stock, valued at $4,705,800. This trade represents a 30.30% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. 0.15% of the stock is currently owned by corporate insiders.

GE Vernova Profile

(

Free Report)

GE Vernova LLC, an energy business company, generates electricity. It operates under three segments: Power, Wind, and Electrification. The Power segments generates and sells electricity through hydro, gas, nuclear, and steam power. Wind segment engages in the manufacturing and sale of wind turbine blades; and Electrification segment provides grid solutions, power conversion, solar, and storage solutions.

Recommended Stories

Before you consider GE Vernova, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GE Vernova wasn't on the list.

While GE Vernova currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.