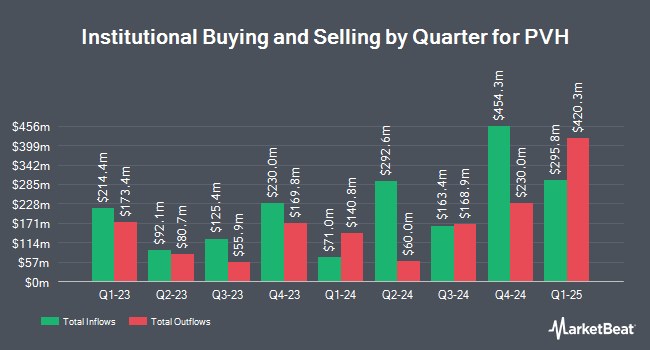

Bastion Asset Management Inc. bought a new stake in PVH Corp. (NYSE:PVH - Free Report) during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor bought 4,450 shares of the textile maker's stock, valued at approximately $303,000.

Several other hedge funds have also recently added to or reduced their stakes in the stock. Pzena Investment Management LLC grew its stake in PVH by 15.1% in the first quarter. Pzena Investment Management LLC now owns 6,161,567 shares of the textile maker's stock valued at $398,284,000 after purchasing an additional 807,301 shares in the last quarter. Balyasny Asset Management L.P. bought a new stake in shares of PVH during the 4th quarter worth $53,373,000. Schroder Investment Management Group bought a new stake in shares of PVH during the 4th quarter worth $38,035,000. AQR Capital Management LLC raised its position in PVH by 128.6% in the fourth quarter. AQR Capital Management LLC now owns 566,513 shares of the textile maker's stock valued at $59,909,000 after purchasing an additional 318,731 shares during the last quarter. Finally, Voya Investment Management LLC grew its stake in PVH by 29.4% during the fourth quarter. Voya Investment Management LLC now owns 679,762 shares of the textile maker's stock worth $71,885,000 after purchasing an additional 154,295 shares during the period. Institutional investors and hedge funds own 97.25% of the company's stock.

Wall Street Analyst Weigh In

Several analysts have issued reports on the company. Morgan Stanley lowered their target price on PVH from $86.00 to $64.00 and set an "equal weight" rating on the stock in a research note on Friday, June 6th. Cowen restated a "buy" rating on shares of PVH in a research report on Friday, June 6th. Jefferies Financial Group raised PVH from a "hold" rating to a "buy" rating and increased their target price for the company from $70.00 to $105.00 in a research report on Wednesday, May 14th. UBS Group dropped their price target on PVH from $150.00 to $146.00 and set a "buy" rating for the company in a research report on Friday, June 6th. Finally, Citigroup reissued a "neutral" rating and set a $68.00 price target (down previously from $83.00) on shares of PVH in a report on Monday, April 7th. Seven equities research analysts have rated the stock with a hold rating and ten have assigned a buy rating to the company. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $93.40.

View Our Latest Analysis on PVH

Insider Buying and Selling

In related news, Director Jesper Andersen purchased 600 shares of the company's stock in a transaction dated Wednesday, June 11th. The shares were acquired at an average cost of $66.10 per share, with a total value of $39,660.00. Following the completion of the purchase, the director owned 736 shares of the company's stock, valued at $48,649.60. The trade was a 441.18% increase in their position. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CEO Stefan Larsson purchased 15,645 shares of the firm's stock in a transaction on Thursday, June 26th. The shares were purchased at an average price of $63.92 per share, with a total value of $1,000,028.40. Following the completion of the acquisition, the chief executive officer directly owned 269,438 shares of the company's stock, valued at approximately $17,222,476.96. This trade represents a 6.16% increase in their ownership of the stock. The disclosure for this purchase can be found here. Corporate insiders own 1.20% of the company's stock.

PVH Stock Up 0.4%

NYSE PVH traded up $0.30 during trading hours on Wednesday, hitting $75.58. 292,586 shares of the company were exchanged, compared to its average volume of 1,455,864. PVH Corp. has a 52-week low of $59.28 and a 52-week high of $113.47. The firm has a market cap of $3.63 billion, a price-to-earnings ratio of 10.66, a PEG ratio of 1.58 and a beta of 1.81. The company has a quick ratio of 0.53, a current ratio of 1.11 and a debt-to-equity ratio of 0.37. The company has a 50 day moving average of $72.70 and a two-hundred day moving average of $74.90.

PVH (NYSE:PVH - Get Free Report) last released its quarterly earnings data on Wednesday, June 4th. The textile maker reported $2.30 earnings per share for the quarter, beating the consensus estimate of $2.24 by $0.06. PVH had a return on equity of 12.66% and a net margin of 4.63%. The firm had revenue of $1.98 billion during the quarter, compared to the consensus estimate of $1.93 billion. During the same period last year, the business posted $2.45 EPS. PVH's quarterly revenue was up 1.6% on a year-over-year basis. Equities research analysts anticipate that PVH Corp. will post 11.67 earnings per share for the current year.

PVH Company Profile

(

Free Report)

PVH Corp. operates as an apparel company in the United States and internationally. The company operates through Tommy Hilfiger North America, Tommy Hilfiger International, Calvin Klein North America, Calvin Klein International, and Heritage Brands Wholesale segments. It designs and markets men's, women's, and children's branded apparel, footwear and accessories, underwear, sleepwear, outerwear, home furnishings, luggage, dresses, suits and swimwear, activewear, sportswear, socks and accessories, outerwear, golf products, footwear, watches and jewelry, eyeglasses and non-ophthalmic sunglasses, jeans wear, performance apparel, intimate apparel, dress shirts, handbags, fragrance, small leather goods, and other related products; and men's and boy's tailored clothing products, duvets, pillows, mattress pads and toppers, and feather beds.

See Also

Before you consider PVH, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PVH wasn't on the list.

While PVH currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report