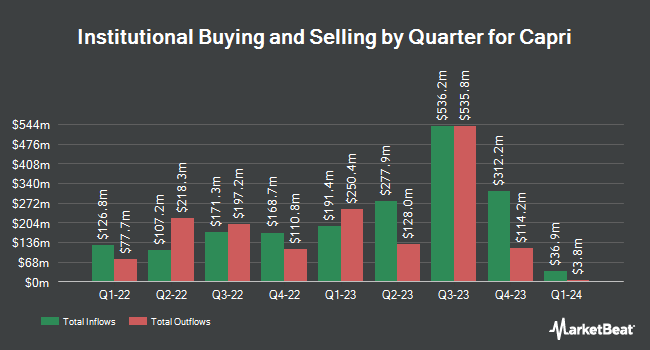

Bayforest Capital Ltd increased its position in Capri Holdings Limited (NYSE:CPRI - Free Report) by 569.1% during the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 35,330 shares of the company's stock after buying an additional 30,050 shares during the period. Bayforest Capital Ltd's holdings in Capri were worth $697,000 at the end of the most recent quarter.

A number of other hedge funds also recently made changes to their positions in the company. XTX Topco Ltd purchased a new stake in shares of Capri in the first quarter worth about $364,000. Capricorn Fund Managers Ltd bought a new stake in Capri during the first quarter worth approximately $3,259,000. Banque Cantonale Vaudoise bought a new stake in Capri during the first quarter worth approximately $29,000. Federated Hermes Inc. increased its stake in Capri by 20.6% during the first quarter. Federated Hermes Inc. now owns 21,965 shares of the company's stock worth $433,000 after acquiring an additional 3,756 shares during the last quarter. Finally, Royce & Associates LP bought a new stake in Capri during the first quarter worth approximately $5,437,000. 84.34% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several equities research analysts have weighed in on the company. Wall Street Zen cut Capri from a "hold" rating to a "sell" rating in a research note on Sunday, July 13th. Telsey Advisory Group reissued a "market perform" rating and set a $20.00 price objective on shares of Capri in a research note on Wednesday. Robert W. Baird reduced their price objective on Capri from $26.00 to $18.00 and set a "neutral" rating on the stock in a research note on Friday, April 11th. UBS Group boosted their price objective on Capri from $14.00 to $18.00 and gave the stock a "neutral" rating in a research note on Thursday, May 29th. Finally, JPMorgan Chase & Co. boosted their price objective on Capri from $18.00 to $21.00 and gave the stock a "neutral" rating in a research note on Monday. One research analyst has rated the stock with a sell rating, eight have issued a hold rating and four have given a buy rating to the company's stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus target price of $22.75.

Get Our Latest Research Report on Capri

Capri Trading Down 3.1%

NYSE:CPRI traded down $0.59 during midday trading on Wednesday, hitting $18.56. The stock had a trading volume of 2,009,212 shares, compared to its average volume of 2,261,306. Capri Holdings Limited has a one year low of $11.86 and a one year high of $43.34. The company has a market capitalization of $2.19 billion, a price-to-earnings ratio of -1.86, a PEG ratio of 0.41 and a beta of 1.67. The stock has a 50-day moving average of $18.07 and a 200 day moving average of $19.06. The company has a quick ratio of 0.49, a current ratio of 1.14 and a debt-to-equity ratio of 3.97.

Capri (NYSE:CPRI - Get Free Report) last announced its quarterly earnings data on Wednesday, May 28th. The company reported ($4.90) earnings per share (EPS) for the quarter, missing the consensus estimate of $0.22 by ($5.12). Capri had a negative return on equity of 39.55% and a negative net margin of 26.61%. The firm had revenue of $1.04 billion during the quarter, compared to the consensus estimate of $989.05 million. During the same period last year, the company earned $0.42 EPS. The firm's revenue for the quarter was down 15.4% compared to the same quarter last year. As a group, sell-side analysts forecast that Capri Holdings Limited will post 0.98 EPS for the current year.

About Capri

(

Free Report)

Capri Holdings Limited designs, markets, distributes, and retails branded women's and men's apparel, footwear, and accessories in the United States, Canada, Latin America, Europe, the Middle East, Africa, and Asia. It operates through three segments: Versace, Jimmy Choo, and Michael Kors. The company offers ready-to-wear, accessories, footwear, handbags, scarves and belts, small leather goods, eyewear, watches, jewelry, fragrances, and home furnishings through a distribution network, including boutiques, department, and specialty stores, as well as through e-commerce sites.

Featured Stories

Before you consider Capri, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Capri wasn't on the list.

While Capri currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.