BI Asset Management Fondsmaeglerselskab A S decreased its stake in shares of Toast, Inc. (NYSE:TOST - Free Report) by 85.1% during the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 15,471 shares of the company's stock after selling 88,361 shares during the period. BI Asset Management Fondsmaeglerselskab A S's holdings in Toast were worth $513,000 as of its most recent SEC filing.

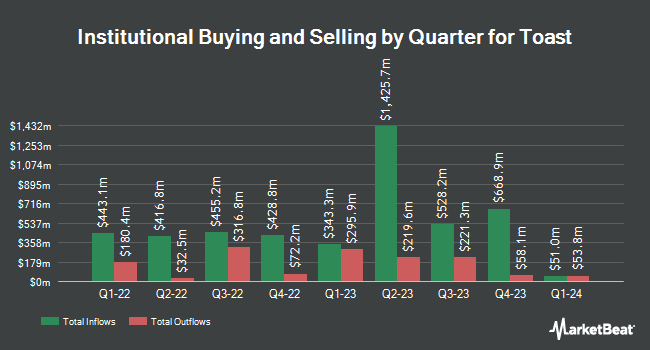

A number of other hedge funds and other institutional investors also recently made changes to their positions in TOST. Hsbc Holdings PLC boosted its holdings in shares of Toast by 16.3% in the first quarter. Hsbc Holdings PLC now owns 177,797 shares of the company's stock valued at $5,900,000 after acquiring an additional 24,875 shares in the last quarter. Colonial Trust Advisors raised its stake in Toast by 57.8% during the 1st quarter. Colonial Trust Advisors now owns 7,100 shares of the company's stock valued at $236,000 after purchasing an additional 2,600 shares during the period. Wellington Management Group LLP raised its position in Toast by 102.6% during the first quarter. Wellington Management Group LLP now owns 37,469 shares of the company's stock valued at $1,243,000 after buying an additional 18,971 shares during the period. Northern Trust Corp lifted its position in shares of Toast by 3.2% in the first quarter. Northern Trust Corp now owns 2,881,962 shares of the company's stock worth $95,595,000 after purchasing an additional 90,221 shares in the last quarter. Finally, Versor Investments LP acquired a new position in Toast in the 1st quarter valued at approximately $305,000. 82.91% of the stock is currently owned by institutional investors.

Insider Buying and Selling

In related news, General Counsel Brian R. Elworthy sold 300,000 shares of the business's stock in a transaction on Monday, June 2nd. The shares were sold at an average price of $42.60, for a total transaction of $12,780,000.00. Following the transaction, the general counsel owned 216,156 shares of the company's stock, valued at approximately $9,208,245.60. The trade was a 58.12% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, Director Paul D. Bell sold 12,500 shares of the business's stock in a transaction on Thursday, August 21st. The stock was sold at an average price of $42.38, for a total transaction of $529,750.00. Following the transaction, the director directly owned 226,892 shares in the company, valued at $9,615,682.96. This trade represents a 5.22% decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 405,554 shares of company stock valued at $17,333,686. 12.14% of the stock is owned by corporate insiders.

Wall Street Analysts Forecast Growth

TOST has been the topic of several research reports. Citigroup reiterated a "buy" rating on shares of Toast in a research note on Wednesday, July 16th. Truist Financial upped their price objective on shares of Toast from $48.00 to $50.00 and gave the company a "buy" rating in a research note on Thursday, July 17th. Jefferies Financial Group raised their price objective on shares of Toast from $50.00 to $54.00 and gave the company a "buy" rating in a research report on Friday, July 18th. Piper Sandler raised their price objective on shares of Toast from $35.00 to $37.00 and gave the company a "neutral" rating in a research report on Friday, May 9th. Finally, Canaccord Genuity Group raised their price objective on shares of Toast from $48.00 to $54.00 and gave the company a "buy" rating in a research report on Wednesday, August 6th. Fifteen research analysts have rated the stock with a Buy rating and eleven have given a Hold rating to the company's stock. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $45.54.

Check Out Our Latest Stock Report on TOST

Toast Stock Up 0.1%

Shares of NYSE:TOST traded up $0.03 during trading on Wednesday, reaching $43.91. The stock had a trading volume of 6,916,479 shares, compared to its average volume of 7,321,820. Toast, Inc. has a 52 week low of $22.91 and a 52 week high of $49.66. The firm has a market capitalization of $22.39 billion, a price-to-earnings ratio of 129.13 and a beta of 2.01. The stock has a fifty day simple moving average of $44.81 and a two-hundred day simple moving average of $40.23.

Toast (NYSE:TOST - Get Free Report) last released its quarterly earnings results on Tuesday, August 5th. The company reported $0.13 EPS for the quarter, missing analysts' consensus estimates of $0.23 by ($0.10). Toast had a net margin of 4.07% and a return on equity of 14.19%. The firm had revenue of $1.55 billion during the quarter, compared to the consensus estimate of $1.52 billion. During the same period in the prior year, the business earned $0.02 EPS. The company's revenue for the quarter was up 24.8% compared to the same quarter last year. On average, analysts forecast that Toast, Inc. will post 0.39 EPS for the current year.

Toast Company Profile

(

Free Report)

Toast, Inc operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, and India. The company offers software products for restaurant operations and point of sale, such as Toast POS, Toast now, multi-location management, kitchen display system, Toast mobile order and pay, Toast catering and events, Toast invoicing, Toast tables, and restaurant retail; and hardware products, including Toast flex, Toast flex for guest, Toast go 2, Toast tap, kiosks, and Delphi by Toast.

Read More

Before you consider Toast, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Toast wasn't on the list.

While Toast currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report