Envestnet Asset Management Inc. lowered its position in Bilibili Inc. Sponsored ADR (NASDAQ:BILI - Free Report) by 28.4% in the first quarter, according to the company in its most recent disclosure with the SEC. The firm owned 35,474 shares of the company's stock after selling 14,092 shares during the period. Envestnet Asset Management Inc.'s holdings in Bilibili were worth $678,000 at the end of the most recent quarter.

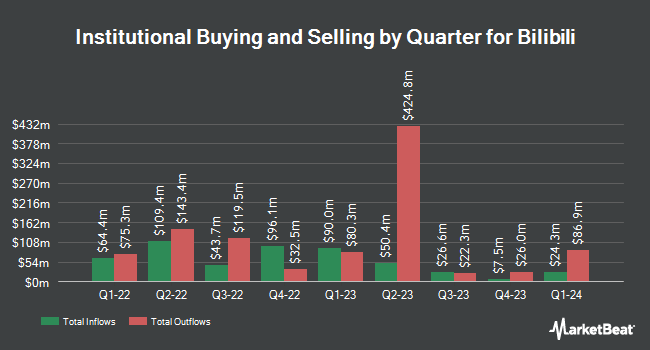

A number of other large investors have also modified their holdings of BILI. Federated Hermes Inc. purchased a new stake in Bilibili during the 4th quarter valued at about $55,000. FNY Investment Advisers LLC purchased a new stake in Bilibili during the 1st quarter valued at about $57,000. Mirae Asset Global Investments Co. Ltd. grew its stake in Bilibili by 8.5% during the 1st quarter. Mirae Asset Global Investments Co. Ltd. now owns 9,261 shares of the company's stock valued at $178,000 after acquiring an additional 722 shares in the last quarter. Dimensional Fund Advisors LP purchased a new stake in Bilibili during the 4th quarter valued at about $200,000. Finally, XTX Topco Ltd purchased a new stake in Bilibili during the 4th quarter valued at about $227,000. Institutional investors and hedge funds own 16.08% of the company's stock.

Bilibili Trading Down 1.1%

Shares of BILI stock traded down $0.26 during trading hours on Friday, hitting $22.74. The company had a trading volume of 596,512 shares, compared to its average volume of 5,013,052. The company's fifty day moving average is $21.56 and its 200 day moving average is $19.70. The company has a debt-to-equity ratio of 0.23, a current ratio of 1.36 and a quick ratio of 1.36. Bilibili Inc. Sponsored ADR has a fifty-two week low of $12.72 and a fifty-two week high of $31.77. The stock has a market capitalization of $9.50 billion, a PE ratio of -113.57 and a beta of 0.94.

Wall Street Analysts Forecast Growth

Several analysts recently issued reports on BILI shares. Wall Street Zen cut shares of Bilibili from a "buy" rating to a "hold" rating in a research note on Friday, July 18th. HSBC reaffirmed a "buy" rating on shares of Bilibili in a research note on Tuesday, July 15th. Bank of America boosted their target price on shares of Bilibili from $25.00 to $27.00 and gave the company a "buy" rating in a report on Thursday, July 17th. Hsbc Global Res upgraded shares of Bilibili to a "strong-buy" rating in a report on Wednesday, May 21st. Finally, Sanford C. Bernstein began coverage on shares of Bilibili in a report on Tuesday, July 8th. They issued an "outperform" rating and a $28.00 target price on the stock. Four research analysts have rated the stock with a hold rating, nine have assigned a buy rating and two have given a strong buy rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus price target of $23.81.

Check Out Our Latest Analysis on BILI

Bilibili Company Profile

(

Free Report)

Bilibili Inc provides online entertainment services for the young generations in the People's Republic of China. It offers a range of digital content, including professional user generated videos, mobile games, and value-added services, such as live broadcasting, occupationally generated videos, audio drama on Maoer, and comics on Bilibili Comic.

See Also

Before you consider Bilibili, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bilibili wasn't on the list.

While Bilibili currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.