Covea Finance raised its holdings in BJ's Wholesale Club Holdings, Inc. (NYSE:BJ - Free Report) by 50.2% in the 2nd quarter, according to its most recent 13F filing with the SEC. The fund owned 33,800 shares of the company's stock after acquiring an additional 11,300 shares during the period. Covea Finance's holdings in BJ's Wholesale Club were worth $3,645,000 at the end of the most recent reporting period.

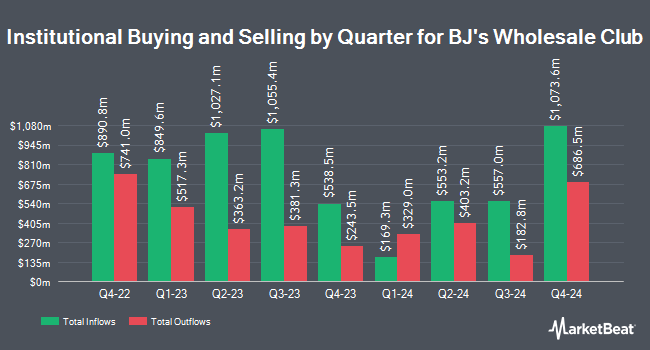

Other institutional investors also recently bought and sold shares of the company. Oliver Lagore Vanvalin Investment Group acquired a new position in BJ's Wholesale Club in the 2nd quarter valued at $26,000. Atlantic Edge Private Wealth Management LLC acquired a new position in BJ's Wholesale Club in the 1st quarter valued at $33,000. HM Payson & Co. acquired a new position in BJ's Wholesale Club in the 1st quarter valued at $41,000. Bartlett & CO. Wealth Management LLC acquired a new position in BJ's Wholesale Club in the 1st quarter valued at $43,000. Finally, Quarry LP acquired a new position in BJ's Wholesale Club in the 1st quarter valued at $48,000. 98.60% of the stock is currently owned by institutional investors and hedge funds.

BJ's Wholesale Club Stock Up 0.5%

Shares of NYSE BJ opened at $96.52 on Tuesday. BJ's Wholesale Club Holdings, Inc. has a 12-month low of $80.47 and a 12-month high of $121.10. The company has a market cap of $12.72 billion, a P/E ratio of 22.14, a P/E/G ratio of 2.56 and a beta of 0.40. The company has a current ratio of 0.79, a quick ratio of 0.17 and a debt-to-equity ratio of 0.19. The stock has a fifty day moving average price of $102.09 and a 200 day moving average price of $109.02.

BJ's Wholesale Club (NYSE:BJ - Get Free Report) last posted its quarterly earnings data on Friday, August 22nd. The company reported $1.14 earnings per share for the quarter, beating analysts' consensus estimates of $1.10 by $0.04. The company had revenue of $5.38 billion during the quarter, compared to analysts' expectations of $5.49 billion. BJ's Wholesale Club had a net margin of 2.77% and a return on equity of 30.40%. The firm's revenue for the quarter was up 3.2% on a year-over-year basis. During the same period in the prior year, the company posted $1.09 EPS. BJ's Wholesale Club has set its FY 2025 guidance at 4.200-4.35 EPS. Research analysts anticipate that BJ's Wholesale Club Holdings, Inc. will post 3.96 EPS for the current fiscal year.

Insider Buying and Selling at BJ's Wholesale Club

In other BJ's Wholesale Club news, EVP Graham Luce sold 6,300 shares of the company's stock in a transaction dated Wednesday, September 17th. The shares were sold at an average price of $99.86, for a total value of $629,118.00. Following the completion of the transaction, the executive vice president directly owned 11,617 shares of the company's stock, valued at $1,160,073.62. This represents a 35.16% decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. Also, CEO Robert W. Eddy sold 17,900 shares of the stock in a transaction dated Tuesday, July 1st. The stock was sold at an average price of $107.08, for a total transaction of $1,916,732.00. Following the transaction, the chief executive officer directly owned 368,333 shares in the company, valued at $39,441,097.64. The trade was a 4.63% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 126,461 shares of company stock valued at $13,652,421 in the last ninety days. Insiders own 1.40% of the company's stock.

Analyst Ratings Changes

Several research analysts have weighed in on BJ shares. JPMorgan Chase & Co. cut their price target on BJ's Wholesale Club from $113.00 to $110.00 and set a "neutral" rating for the company in a report on Monday, August 25th. UBS Group dropped their price objective on BJ's Wholesale Club from $135.00 to $125.00 and set a "buy" rating for the company in a report on Monday, August 25th. DA Davidson dropped their price objective on BJ's Wholesale Club from $140.00 to $123.00 and set a "buy" rating for the company in a report on Monday, August 25th. Roth Capital restated a "neutral" rating and set a $106.00 price objective (up from $101.00) on shares of BJ's Wholesale Club in a report on Wednesday, May 28th. Finally, Jefferies Financial Group restated a "buy" rating on shares of BJ's Wholesale Club in a report on Friday, August 22nd. Nine equities research analysts have rated the stock with a Buy rating and nine have issued a Hold rating to the stock. According to MarketBeat, BJ's Wholesale Club currently has an average rating of "Moderate Buy" and a consensus target price of $114.63.

Read Our Latest Analysis on BJ's Wholesale Club

About BJ's Wholesale Club

(

Free Report)

BJ's Wholesale Club Holdings, Inc engages in the operation of membership warehouse clubs. Its product categories include grocery, household and pet, television and electronics, furniture, computer and tablets, patio and outdoor living, lawn and garden, baby and kids, toys, home, health and beauty, appliances, and jewelry.

See Also

Want to see what other hedge funds are holding BJ? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for BJ's Wholesale Club Holdings, Inc. (NYSE:BJ - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider BJ's Wholesale Club, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BJ's Wholesale Club wasn't on the list.

While BJ's Wholesale Club currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.