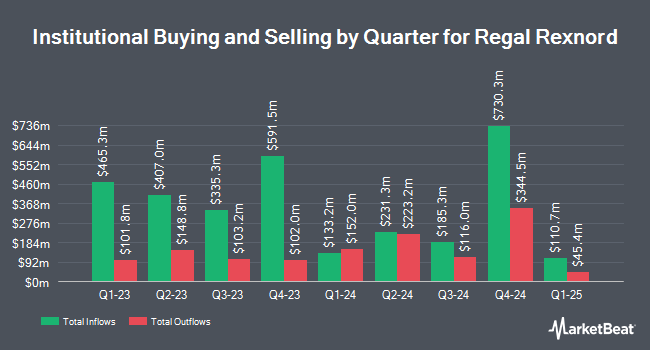

Blue Trust Inc. lowered its position in Regal Rexnord Corporation (NYSE:RRX - Free Report) by 57.8% in the second quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 1,534 shares of the company's stock after selling 2,103 shares during the quarter. Blue Trust Inc.'s holdings in Regal Rexnord were worth $222,000 as of its most recent SEC filing.

A number of other institutional investors also recently added to or reduced their stakes in the company. Tandem Capital Management Corp ADV lifted its stake in Regal Rexnord by 5.6% in the second quarter. Tandem Capital Management Corp ADV now owns 13,914 shares of the company's stock worth $2,017,000 after acquiring an additional 740 shares during the last quarter. Tectonic Advisors LLC lifted its stake in Regal Rexnord by 16.5% in the second quarter. Tectonic Advisors LLC now owns 3,266 shares of the company's stock worth $474,000 after acquiring an additional 463 shares during the last quarter. Vontobel Holding Ltd. lifted its stake in Regal Rexnord by 4.7% in the second quarter. Vontobel Holding Ltd. now owns 267,225 shares of the company's stock worth $38,737,000 after acquiring an additional 11,992 shares during the last quarter. Louisiana State Employees Retirement System lifted its stake in Regal Rexnord by 0.5% in the second quarter. Louisiana State Employees Retirement System now owns 18,700 shares of the company's stock worth $2,711,000 after acquiring an additional 100 shares during the last quarter. Finally, KLP Kapitalforvaltning AS lifted its stake in Regal Rexnord by 2.2% in the second quarter. KLP Kapitalforvaltning AS now owns 13,803 shares of the company's stock worth $2,005,000 after acquiring an additional 300 shares during the last quarter. Hedge funds and other institutional investors own 99.72% of the company's stock.

Analyst Upgrades and Downgrades

RRX has been the subject of a number of recent research reports. KeyCorp decreased their price target on shares of Regal Rexnord from $180.00 to $170.00 and set an "overweight" rating for the company in a research note on Tuesday. Wall Street Zen cut shares of Regal Rexnord from a "strong-buy" rating to a "buy" rating in a report on Sunday, September 21st. Barclays reduced their price target on shares of Regal Rexnord from $163.00 to $161.00 and set an "overweight" rating for the company in a research report on Tuesday, September 16th. Citigroup reissued a "buy" rating and issued a $165.00 price target (up from $145.00) on shares of Regal Rexnord in a research report on Tuesday, June 24th. Finally, Weiss Ratings reissued a "hold (c)" rating on shares of Regal Rexnord in a research report on Wednesday, October 8th. Eight research analysts have rated the stock with a Buy rating and one has issued a Hold rating to the stock. Based on data from MarketBeat, the company presently has an average rating of "Moderate Buy" and an average target price of $180.38.

View Our Latest Report on RRX

Regal Rexnord Price Performance

Shares of NYSE:RRX opened at $143.10 on Wednesday. The company has a 50-day simple moving average of $144.98 and a 200-day simple moving average of $136.40. Regal Rexnord Corporation has a one year low of $90.56 and a one year high of $185.28. The company has a debt-to-equity ratio of 0.72, a quick ratio of 0.93 and a current ratio of 2.00. The stock has a market capitalization of $9.50 billion, a price-to-earnings ratio of 38.06, a PEG ratio of 1.40 and a beta of 1.16.

Regal Rexnord (NYSE:RRX - Get Free Report) last announced its earnings results on Friday, September 8th. The company reported $2.76 EPS for the quarter. Regal Rexnord had a net margin of 4.28% and a return on equity of 9.73%. The business had revenue of $1.85 billion during the quarter. On average, analysts predict that Regal Rexnord Corporation will post 9.95 EPS for the current year.

Regal Rexnord Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Tuesday, October 14th. Shareholders of record on Tuesday, September 30th were given a dividend of $0.35 per share. The ex-dividend date was Tuesday, September 30th. This represents a $1.40 dividend on an annualized basis and a yield of 1.0%. Regal Rexnord's dividend payout ratio is presently 37.23%.

Regal Rexnord Profile

(

Free Report)

Regal Rexnord Corporation manufactures and sells industrial powertrain solutions, power transmission components, electric motors and electronic controls, air moving products, and specialty electrical components and systems worldwide. The Industrial Powertrain Solutions segment provides mounted and unmounted bearings, couplings, mechanical power transmission drives and components, gearboxes, gear motors, clutches, brakes, special, and industrial powertrain components and solutions for food and beverage, bulk material handling, eCommerce/warehouse distribution, energy, mining, marine, agricultural machinery, turf and garden, and general industrial markets.

Featured Articles

Want to see what other hedge funds are holding RRX? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Regal Rexnord Corporation (NYSE:RRX - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Regal Rexnord, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Regal Rexnord wasn't on the list.

While Regal Rexnord currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.