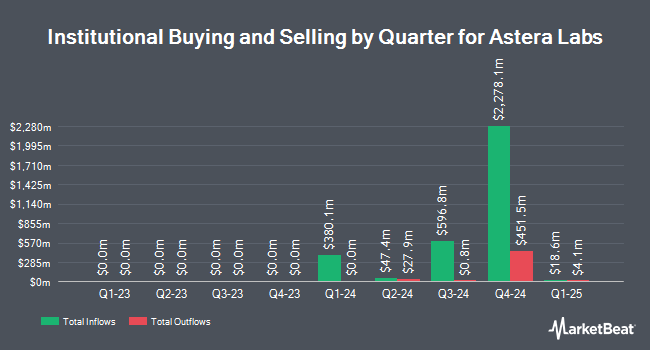

Blueshift Asset Management LLC acquired a new stake in Astera Labs, Inc. (NASDAQ:ALAB - Free Report) during the 1st quarter, according to its most recent filing with the SEC. The institutional investor acquired 12,133 shares of the company's stock, valued at approximately $724,000.

Several other large investors also recently modified their holdings of the stock. NewEdge Advisors LLC bought a new stake in Astera Labs during the 4th quarter worth approximately $63,000. National Bank of Canada FI grew its position in Astera Labs by 121.7% during the 4th quarter. National Bank of Canada FI now owns 541 shares of the company's stock worth $72,000 after acquiring an additional 297 shares during the last quarter. Banque Transatlantique SA bought a new stake in Astera Labs during the 4th quarter worth approximately $86,000. Emerald Mutual Fund Advisers Trust grew its position in Astera Labs by 429.3% during the 4th quarter. Emerald Mutual Fund Advisers Trust now owns 704 shares of the company's stock worth $93,000 after acquiring an additional 571 shares during the last quarter. Finally, Gen Wealth Partners Inc bought a new stake in Astera Labs during the 4th quarter worth approximately $105,000. 60.47% of the stock is currently owned by institutional investors.

Astera Labs Price Performance

Shares of ALAB stock traded down $5.63 during trading hours on Friday, reaching $131.10. The company had a trading volume of 6,935,750 shares, compared to its average volume of 5,314,275. The firm has a market cap of $21.62 billion, a price-to-earnings ratio of 595.94, a P/E/G ratio of 6.15 and a beta of 1.38. Astera Labs, Inc. has a 1-year low of $36.22 and a 1-year high of $147.39. The company has a 50 day moving average of $99.49 and a 200 day moving average of $86.04.

Astera Labs (NASDAQ:ALAB - Get Free Report) last issued its quarterly earnings data on Tuesday, May 6th. The company reported $0.33 EPS for the quarter, topping the consensus estimate of $0.28 by $0.05. The business had revenue of $159.44 million for the quarter, compared to the consensus estimate of $151.55 million. Astera Labs had a return on equity of 2.57% and a net margin of 8.44%. The firm's revenue was up 144.1% compared to the same quarter last year. During the same quarter last year, the business posted $0.10 EPS. As a group, sell-side analysts forecast that Astera Labs, Inc. will post 0.34 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

ALAB has been the topic of several research reports. Northland Capmk downgraded Astera Labs from a "strong-buy" rating to a "hold" rating in a report on Tuesday, July 22nd. Stifel Nicolaus upped their price objective on Astera Labs from $100.00 to $110.00 and gave the stock a "buy" rating in a report on Friday, July 18th. Jefferies Financial Group upped their price objective on Astera Labs from $95.00 to $130.00 and gave the stock a "buy" rating in a report on Tuesday, July 22nd. Needham & Company LLC reduced their price objective on Astera Labs from $140.00 to $100.00 and set a "buy" rating on the stock in a report on Wednesday, May 7th. Finally, Evercore ISI upped their price objective on Astera Labs from $87.00 to $104.00 and gave the stock an "outperform" rating in a report on Wednesday, May 21st. Four investment analysts have rated the stock with a hold rating and fourteen have assigned a buy rating to the company's stock. According to data from MarketBeat, Astera Labs currently has an average rating of "Moderate Buy" and an average price target of $104.40.

Get Our Latest Analysis on ALAB

Insiders Place Their Bets

In related news, Director Bethany Mayer sold 686 shares of the firm's stock in a transaction on Tuesday, June 24th. The stock was sold at an average price of $87.47, for a total transaction of $60,004.42. Following the sale, the director owned 6,238 shares of the company's stock, valued at approximately $545,637.86. This trade represents a 9.91% decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through this link. Also, CEO Jitendra Mohan sold 76,258 shares of the firm's stock in a transaction on Monday, July 21st. The stock was sold at an average price of $112.72, for a total value of $8,595,801.76. Following the sale, the chief executive officer directly owned 475,421 shares in the company, valued at $53,589,455.12. The trade was a 13.82% decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders sold 2,181,759 shares of company stock worth $200,883,431.

Astera Labs Company Profile

(

Free Report)

Astera Labs, Inc designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure. Its Intelligent Connectivity Platform is comprised of a portfolio of data, network, and memory connectivity products, which are built on a unifying software-defined architecture that enables customers to deploy and operate high performance cloud and AI infrastructure at scale.

See Also

Before you consider Astera Labs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Astera Labs wasn't on the list.

While Astera Labs currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.