Boston Common Asset Management LLC lessened its holdings in SK Telecom Co., Ltd. (NYSE:SKM - Free Report) by 7.1% during the second quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 204,667 shares of the Wireless communications provider's stock after selling 15,544 shares during the period. Boston Common Asset Management LLC owned about 0.05% of SK Telecom worth $4,779,000 at the end of the most recent quarter.

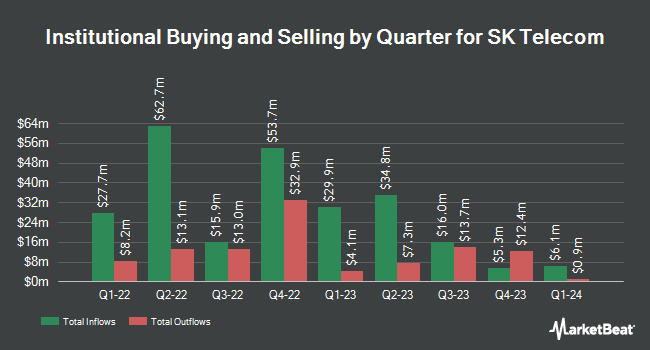

A number of other hedge funds have also recently made changes to their positions in SKM. Wealth Enhancement Advisory Services LLC boosted its stake in shares of SK Telecom by 46.2% during the fourth quarter. Wealth Enhancement Advisory Services LLC now owns 12,587 shares of the Wireless communications provider's stock valued at $265,000 after purchasing an additional 3,980 shares in the last quarter. GAMMA Investing LLC boosted its stake in shares of SK Telecom by 1,961.9% during the first quarter. GAMMA Investing LLC now owns 62,249 shares of the Wireless communications provider's stock valued at $1,323,000 after purchasing an additional 59,230 shares in the last quarter. Parallel Advisors LLC boosted its stake in shares of SK Telecom by 55.0% during the first quarter. Parallel Advisors LLC now owns 2,490 shares of the Wireless communications provider's stock valued at $53,000 after purchasing an additional 884 shares in the last quarter. Rhumbline Advisers boosted its stake in shares of SK Telecom by 8.6% during the first quarter. Rhumbline Advisers now owns 94,631 shares of the Wireless communications provider's stock valued at $2,012,000 after purchasing an additional 7,485 shares in the last quarter. Finally, CHICAGO TRUST Co NA boosted its stake in shares of SK Telecom by 24.4% during the first quarter. CHICAGO TRUST Co NA now owns 13,033 shares of the Wireless communications provider's stock valued at $277,000 after purchasing an additional 2,559 shares in the last quarter.

SK Telecom Price Performance

Shares of SKM opened at $21.68 on Friday. SK Telecom Co., Ltd. has a 52-week low of $19.84 and a 52-week high of $24.34. The company has a debt-to-equity ratio of 0.62, a quick ratio of 1.01 and a current ratio of 1.03. The business's 50 day moving average price is $21.99 and its two-hundred day moving average price is $21.82. The firm has a market cap of $8.54 billion, a PE ratio of 11.12, a price-to-earnings-growth ratio of 11.04 and a beta of 0.58.

SK Telecom (NYSE:SKM - Get Free Report) last issued its quarterly earnings results on Wednesday, August 6th. The Wireless communications provider reported $0.16 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.36 by ($0.20). SK Telecom had a net margin of 5.92% and a return on equity of 8.92%. The business had revenue of $3.12 billion during the quarter, compared to analyst estimates of $3.14 billion. On average, equities analysts anticipate that SK Telecom Co., Ltd. will post 2.27 EPS for the current year.

Analyst Upgrades and Downgrades

SKM has been the topic of a number of recent research reports. The Goldman Sachs Group lowered SK Telecom from a "neutral" rating to a "sell" rating in a research note on Monday, July 7th. Weiss Ratings reissued a "hold (c+)" rating on shares of SK Telecom in a research note on Saturday, September 27th. One research analyst has rated the stock with a Buy rating, four have issued a Hold rating and one has given a Sell rating to the company. Based on data from MarketBeat.com, SK Telecom currently has an average rating of "Hold".

Check Out Our Latest Stock Report on SK Telecom

About SK Telecom

(

Free Report)

SK Telecom Co, Ltd. provides wireless telecommunication services in South Korea. The company operates through three segments: Cellular Services, Fixed-Line Telecommunications Services, and Other Businesses. The Cellular Services segment offers wireless voice and data transmission, Internet of Things solutions, platform, cloud, smart factory solutions, subscription, advertising and curated shopping under T Deal brand name, and metaverse platform-based services, as well as sells wireless devices.

Featured Articles

Want to see what other hedge funds are holding SKM? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for SK Telecom Co., Ltd. (NYSE:SKM - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider SK Telecom, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SK Telecom wasn't on the list.

While SK Telecom currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.