Channing Capital Management LLC trimmed its position in Boyd Gaming Corporation (NYSE:BYD - Free Report) by 2.6% in the first quarter, according to its most recent filing with the SEC. The institutional investor owned 1,023,696 shares of the company's stock after selling 27,141 shares during the period. Boyd Gaming comprises 2.0% of Channing Capital Management LLC's investment portfolio, making the stock its 24th biggest position. Channing Capital Management LLC owned approximately 1.26% of Boyd Gaming worth $67,390,000 at the end of the most recent reporting period.

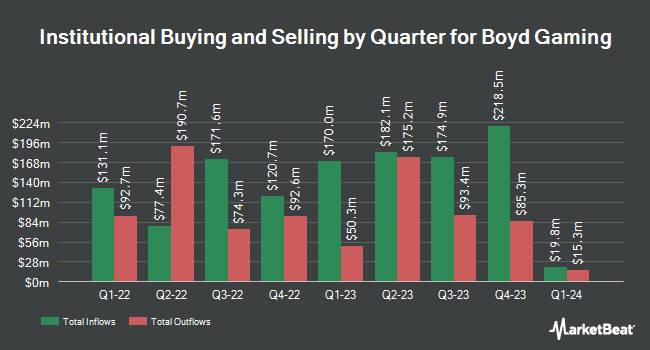

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Seven Six Capital Management LLC bought a new position in Boyd Gaming in the 4th quarter valued at $9,162,000. Victory Capital Management Inc. boosted its holdings in shares of Boyd Gaming by 13.3% in the 1st quarter. Victory Capital Management Inc. now owns 1,048,706 shares of the company's stock worth $69,036,000 after buying an additional 122,822 shares during the last quarter. J. Goldman & Co LP bought a new position in Boyd Gaming during the fourth quarter valued at about $8,359,000. Northern Trust Corp boosted its stake in Boyd Gaming by 14.2% in the first quarter. Northern Trust Corp now owns 682,518 shares of the company's stock valued at $44,930,000 after acquiring an additional 85,087 shares during the last quarter. Finally, Westfield Capital Management Co. LP bought a new position in shares of Boyd Gaming during the 1st quarter valued at approximately $5,329,000. Hedge funds and other institutional investors own 76.81% of the company's stock.

Boyd Gaming Price Performance

NYSE:BYD traded up $2.2750 during mid-day trading on Friday, hitting $85.5750. 704,901 shares of the stock traded hands, compared to its average volume of 1,181,805. The business's 50-day moving average price is $81.73 and its 200 day moving average price is $74.80. The company has a quick ratio of 0.82, a current ratio of 0.86 and a debt-to-equity ratio of 2.53. The company has a market cap of $6.86 billion, a PE ratio of 13.17, a price-to-earnings-growth ratio of 2.42 and a beta of 1.24. Boyd Gaming Corporation has a 12-month low of $57.67 and a 12-month high of $87.76.

Boyd Gaming (NYSE:BYD - Get Free Report) last issued its quarterly earnings data on Thursday, July 24th. The company reported $1.87 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.67 by $0.20. Boyd Gaming had a return on equity of 40.65% and a net margin of 14.02%.The company had revenue of $1.03 billion for the quarter, compared to the consensus estimate of $976.81 million. During the same quarter last year, the business posted $1.58 earnings per share. The firm's revenue was up 6.9% compared to the same quarter last year. On average, analysts expect that Boyd Gaming Corporation will post 6.52 EPS for the current fiscal year.

Boyd Gaming Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Wednesday, October 15th. Investors of record on Monday, September 15th will be given a $0.18 dividend. The ex-dividend date is Monday, September 15th. This represents a $0.72 dividend on an annualized basis and a yield of 0.8%. Boyd Gaming's payout ratio is presently 11.08%.

Insiders Place Their Bets

In other news, COO Ted Bogich sold 16,497 shares of the business's stock in a transaction that occurred on Friday, August 1st. The shares were sold at an average price of $83.18, for a total value of $1,372,220.46. Following the completion of the sale, the chief operating officer directly owned 45,116 shares in the company, valued at approximately $3,752,748.88. The trade was a 26.78% decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, insider Stephen S. Thompson sold 15,906 shares of the business's stock in a transaction on Friday, August 1st. The stock was sold at an average price of $83.25, for a total transaction of $1,324,174.50. Following the completion of the sale, the insider directly owned 38,609 shares of the company's stock, valued at $3,214,199.25. This represents a 29.18% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 245,403 shares of company stock valued at $20,556,696 over the last 90 days. Company insiders own 27.94% of the company's stock.

Wall Street Analyst Weigh In

A number of research firms recently commented on BYD. Morgan Stanley reaffirmed a "sell" rating on shares of Boyd Gaming in a report on Friday, July 11th. Raymond James Financial upped their price target on Boyd Gaming from $81.00 to $85.00 and gave the company an "outperform" rating in a research report on Monday, June 30th. Macquarie increased their price target on Boyd Gaming from $74.00 to $88.00 and gave the stock a "neutral" rating in a research note on Monday, July 28th. Barclays boosted their price objective on Boyd Gaming from $73.00 to $87.00 and gave the company an "equal weight" rating in a research note on Friday, July 18th. Finally, Stifel Nicolaus upped their price objective on shares of Boyd Gaming from $87.00 to $90.00 and gave the company a "hold" rating in a report on Friday, July 25th. Seven research analysts have rated the stock with a Buy rating, six have assigned a Hold rating and one has given a Sell rating to the company. Based on data from MarketBeat.com, the company currently has a consensus rating of "Hold" and an average price target of $86.62.

Check Out Our Latest Stock Analysis on Boyd Gaming

Boyd Gaming Company Profile

(

Free Report)

Boyd Gaming Corporation, together with its subsidiaries, operates as a multi-jurisdictional gaming company in Nevada, Illinois, Indiana, Iowa, Kansas, Louisiana, Mississippi, Missouri, Ohio, and Pennsylvania. The company operates through Las Vegas Locals, Downtown Las Vegas, Midwest & South, and Online segments.

Recommended Stories

Before you consider Boyd Gaming, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boyd Gaming wasn't on the list.

While Boyd Gaming currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report