Bryce Point Capital LLC lessened its holdings in shares of Allegro MicroSystems, Inc. (NASDAQ:ALGM - Free Report) by 54.7% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 29,971 shares of the company's stock after selling 36,183 shares during the period. Bryce Point Capital LLC's holdings in Allegro MicroSystems were worth $754,000 as of its most recent SEC filing.

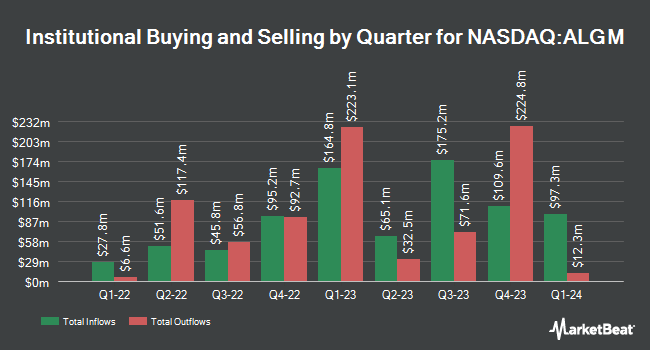

A number of other institutional investors and hedge funds have also recently bought and sold shares of the business. Capital Research Global Investors boosted its position in Allegro MicroSystems by 6.5% during the fourth quarter. Capital Research Global Investors now owns 5,768,208 shares of the company's stock worth $126,093,000 after purchasing an additional 353,776 shares in the last quarter. Wellington Management Group LLP boosted its position in Allegro MicroSystems by 30.5% during the fourth quarter. Wellington Management Group LLP now owns 3,993,682 shares of the company's stock worth $87,302,000 after purchasing an additional 934,048 shares in the last quarter. Adage Capital Partners GP L.L.C. boosted its position in Allegro MicroSystems by 50.1% during the fourth quarter. Adage Capital Partners GP L.L.C. now owns 2,733,560 shares of the company's stock worth $59,756,000 after purchasing an additional 911,993 shares in the last quarter. Principal Financial Group Inc. boosted its position in Allegro MicroSystems by 6.4% during the first quarter. Principal Financial Group Inc. now owns 2,416,102 shares of the company's stock worth $60,717,000 after purchasing an additional 144,824 shares in the last quarter. Finally, Paloma Partners Management Co boosted its position in Allegro MicroSystems by 312.8% during the fourth quarter. Paloma Partners Management Co now owns 2,103,800 shares of the company's stock worth $45,989,000 after purchasing an additional 1,594,170 shares in the last quarter. Institutional investors and hedge funds own 56.45% of the company's stock.

Wall Street Analyst Weigh In

A number of analysts have commented on the company. Morgan Stanley boosted their target price on Allegro MicroSystems from $23.00 to $25.00 and gave the stock an "equal weight" rating in a research report on Monday, June 9th. Barclays lifted their price objective on Allegro MicroSystems from $22.00 to $23.00 and gave the stock an "overweight" rating in a research report on Friday, May 9th. UBS Group lifted their price objective on Allegro MicroSystems from $35.00 to $42.00 and gave the stock a "buy" rating in a research report on Monday, July 7th. Wells Fargo & Company reiterated an "overweight" rating and set a $42.00 price objective (up previously from $33.00) on shares of Allegro MicroSystems in a research report on Wednesday, July 16th. Finally, Mizuho lifted their price objective on Allegro MicroSystems from $31.00 to $37.00 and gave the stock an "outperform" rating in a research report on Tuesday, July 8th. One analyst has rated the stock with a hold rating, six have given a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, Allegro MicroSystems presently has a consensus rating of "Buy" and a consensus price target of $33.63.

Check Out Our Latest Analysis on Allegro MicroSystems

Allegro MicroSystems Trading Down 7.6%

NASDAQ ALGM traded down $2.58 during trading hours on Thursday, hitting $31.29. 2,342,571 shares of the company's stock were exchanged, compared to its average volume of 2,930,618. The business's 50 day moving average is $32.04 and its 200-day moving average is $26.54. Allegro MicroSystems, Inc. has a 12-month low of $16.38 and a 12-month high of $38.45. The firm has a market capitalization of $5.79 billion, a P/E ratio of -80.61 and a beta of 1.75. The company has a debt-to-equity ratio of 0.37, a quick ratio of 2.66 and a current ratio of 4.30.

Allegro MicroSystems (NASDAQ:ALGM - Get Free Report) last announced its quarterly earnings results on Thursday, May 8th. The company reported $0.06 EPS for the quarter, topping the consensus estimate of $0.05 by $0.01. The company had revenue of $192.82 million during the quarter, compared to analyst estimates of $185.35 million. Allegro MicroSystems had a positive return on equity of 1.04% and a negative net margin of 10.07%. The firm's revenue was down 19.9% on a year-over-year basis. During the same period in the prior year, the firm posted $0.25 earnings per share. As a group, analysts anticipate that Allegro MicroSystems, Inc. will post 0.01 EPS for the current fiscal year.

About Allegro MicroSystems

(

Free Report)

Allegro MicroSystems, Inc, together with its subsidiaries, designs, develops, manufactures, and markets sensor integrated circuits (ICs) and application-specific analog power ICs for motion control and energy-efficient systems. Its products include magnetic sensor ICs, such as position, speed, and current sensor ICs; and power ICs comprising motor driver ICs, regulator and LED driver ICs, and isolated gate drivers.

Recommended Stories

Before you consider Allegro MicroSystems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Allegro MicroSystems wasn't on the list.

While Allegro MicroSystems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.