Bryce Point Capital LLC acquired a new stake in shares of Pitney Bowes Inc. (NYSE:PBI - Free Report) in the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund acquired 98,631 shares of the technology company's stock, valued at approximately $893,000. Bryce Point Capital LLC owned approximately 0.05% of Pitney Bowes at the end of the most recent reporting period.

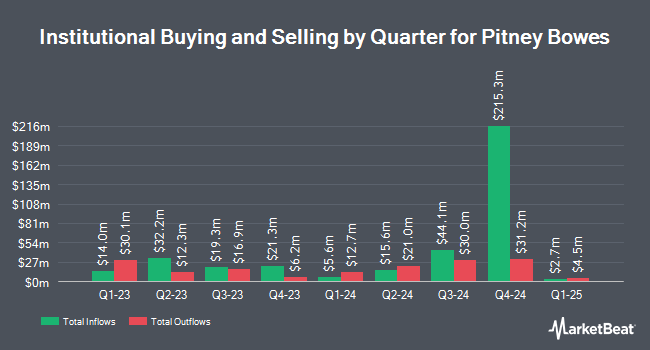

Other institutional investors have also added to or reduced their stakes in the company. Meeder Asset Management Inc. acquired a new position in Pitney Bowes during the fourth quarter valued at approximately $31,000. KBC Group NV acquired a new position in Pitney Bowes during the first quarter valued at approximately $65,000. Universal Beteiligungs und Servicegesellschaft mbH acquired a new position in Pitney Bowes during the first quarter valued at approximately $98,000. PFG Investments LLC raised its position in Pitney Bowes by 14.6% during the first quarter. PFG Investments LLC now owns 12,884 shares of the technology company's stock valued at $117,000 after purchasing an additional 1,644 shares in the last quarter. Finally, Wealth Enhancement Advisory Services LLC acquired a new position in Pitney Bowes during the first quarter valued at approximately $124,000. 67.88% of the stock is currently owned by institutional investors and hedge funds.

Pitney Bowes Stock Down 1.2%

Shares of NYSE PBI traded down $0.15 during midday trading on Monday, reaching $12.13. 3,650,032 shares of the company were exchanged, compared to its average volume of 2,845,750. The stock's 50-day moving average price is $10.87 and its 200-day moving average price is $9.65. The stock has a market cap of $2.22 billion, a P/E ratio of -13.33, a PEG ratio of 0.65 and a beta of 1.60. Pitney Bowes Inc. has a one year low of $5.58 and a one year high of $13.11.

Pitney Bowes (NYSE:PBI - Get Free Report) last posted its earnings results on Wednesday, May 7th. The technology company reported $0.33 earnings per share for the quarter, topping analysts' consensus estimates of $0.28 by $0.05. The firm had revenue of $493.42 million for the quarter, compared to analysts' expectations of $498.99 million. Pitney Bowes had a negative net margin of 7.18% and a negative return on equity of 31.61%. The company's revenue was down 5.3% on a year-over-year basis. During the same quarter in the previous year, the firm posted ($0.01) earnings per share. On average, equities research analysts anticipate that Pitney Bowes Inc. will post 1.21 EPS for the current year.

Pitney Bowes Increases Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Friday, June 6th. Investors of record on Monday, May 19th were paid a $0.07 dividend. This is a boost from Pitney Bowes's previous quarterly dividend of $0.06. The ex-dividend date was Monday, May 19th. This represents a $0.28 annualized dividend and a dividend yield of 2.31%. Pitney Bowes's payout ratio is currently -30.77%.

Insider Buying and Selling at Pitney Bowes

In related news, EVP Deborah Pfeiffer sold 35,000 shares of the business's stock in a transaction on Monday, July 14th. The shares were sold at an average price of $12.14, for a total value of $424,900.00. Following the sale, the executive vice president owned 115,405 shares of the company's stock, valued at $1,401,016.70. The trade was a 23.27% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. 9.00% of the stock is currently owned by corporate insiders.

Analyst Ratings Changes

A number of analysts have weighed in on the stock. Wall Street Zen cut shares of Pitney Bowes from a "strong-buy" rating to a "buy" rating in a research note on Thursday, May 15th. Sidoti raised shares of Pitney Bowes to a "hold" rating in a research note on Monday, May 5th.

Read Our Latest Research Report on PBI

Pitney Bowes Company Profile

(

Free Report)

Pitney Bowes Inc, a shipping and mailing company, provides technology, logistics, and financial services to small and medium-sized businesses, large enterprises, retailers, and government clients in the United States and internationally. It operates through Global Ecommerce, Presort Services, and SendTech Solutions segments.

Further Reading

Before you consider Pitney Bowes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pitney Bowes wasn't on the list.

While Pitney Bowes currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.