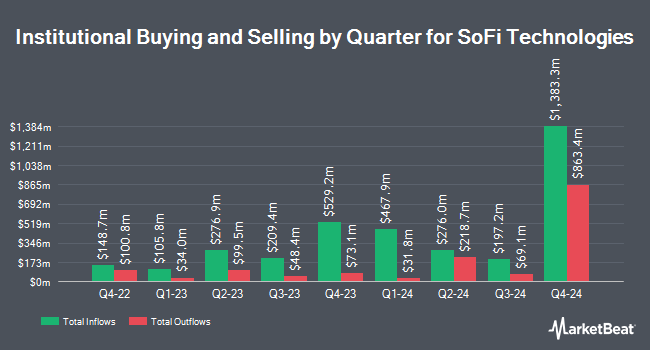

Burney Co. grew its stake in shares of SoFi Technologies, Inc. (NASDAQ:SOFI - Free Report) by 44.2% in the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 146,579 shares of the company's stock after purchasing an additional 44,900 shares during the quarter. Burney Co.'s holdings in SoFi Technologies were worth $1,705,000 as of its most recent SEC filing.

Other institutional investors also recently made changes to their positions in the company. Hazlett Burt & Watson Inc. boosted its position in shares of SoFi Technologies by 2,200.0% during the first quarter. Hazlett Burt & Watson Inc. now owns 2,300 shares of the company's stock worth $27,000 after buying an additional 2,200 shares during the period. Garde Capital Inc. acquired a new position in shares of SoFi Technologies during the first quarter worth approximately $31,000. Mpwm Advisory Solutions LLC acquired a new position in shares of SoFi Technologies during the fourth quarter worth approximately $32,000. Larson Financial Group LLC boosted its position in shares of SoFi Technologies by 127.1% during the first quarter. Larson Financial Group LLC now owns 2,714 shares of the company's stock worth $32,000 after buying an additional 1,519 shares during the period. Finally, MCF Advisors LLC boosted its position in shares of SoFi Technologies by 119.3% during the first quarter. MCF Advisors LLC now owns 3,072 shares of the company's stock worth $36,000 after buying an additional 1,671 shares during the period. 38.43% of the stock is owned by institutional investors.

Insiders Place Their Bets

In other SoFi Technologies news, EVP Kelli Keough sold 11,520 shares of the stock in a transaction that occurred on Tuesday, May 20th. The shares were sold at an average price of $13.38, for a total transaction of $154,137.60. Following the transaction, the executive vice president owned 203,509 shares in the company, valued at $2,722,950.42. This represents a 5.36% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, Director Magdalena Yesil sold 87,140 shares of the stock in a transaction that occurred on Tuesday, June 10th. The stock was sold at an average price of $14.39, for a total transaction of $1,253,944.60. Following the transaction, the director owned 289,258 shares in the company, valued at approximately $4,162,422.62. The trade was a 23.15% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 273,181 shares of company stock worth $4,043,240 in the last quarter. Corporate insiders own 2.60% of the company's stock.

Wall Street Analyst Weigh In

SOFI has been the subject of a number of research analyst reports. TD Cowen initiated coverage on SoFi Technologies in a research report on Friday, July 11th. They issued a "hold" rating and a $21.00 target price for the company. The Goldman Sachs Group began coverage on SoFi Technologies in a report on Monday, July 14th. They issued a "neutral" rating and a $19.00 price target on the stock. UBS Group upped their price target on SoFi Technologies from $14.00 to $15.50 and gave the company a "neutral" rating in a report on Wednesday, April 30th. Keefe, Bruyette & Woods upped their price target on SoFi Technologies from $9.00 to $13.00 and gave the company an "underperform" rating in a report on Thursday, July 10th. Finally, Needham & Company LLC reaffirmed a "buy" rating and issued a $20.00 price target on shares of SoFi Technologies in a report on Wednesday, April 30th. Three investment analysts have rated the stock with a sell rating, nine have assigned a hold rating, six have assigned a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus target price of $16.78.

Get Our Latest Report on SoFi Technologies

SoFi Technologies Stock Performance

SOFI traded down $0.31 on Friday, reaching $21.20. The company had a trading volume of 40,013,421 shares, compared to its average volume of 69,386,928. SoFi Technologies, Inc. has a fifty-two week low of $6.01 and a fifty-two week high of $22.74. The stock has a market cap of $23.43 billion, a P/E ratio of 51.71, a P/E/G ratio of 3.63 and a beta of 1.91. The company's fifty day moving average is $16.73 and its 200 day moving average is $14.61. The company has a debt-to-equity ratio of 0.46, a quick ratio of 0.14 and a current ratio of 0.80.

SoFi Technologies (NASDAQ:SOFI - Get Free Report) last announced its quarterly earnings results on Tuesday, April 29th. The company reported $0.06 EPS for the quarter, beating analysts' consensus estimates of $0.03 by $0.03. SoFi Technologies had a net margin of 17.21% and a return on equity of 3.34%. The business had revenue of $763.81 million for the quarter, compared to analyst estimates of $739.93 million. During the same quarter in the prior year, the business earned $0.02 EPS. SoFi Technologies's quarterly revenue was up 32.7% on a year-over-year basis. As a group, analysts predict that SoFi Technologies, Inc. will post 0.26 earnings per share for the current fiscal year.

About SoFi Technologies

(

Free Report)

SoFi Technologies, Inc provides various financial services in the United States, Latin America, and Canada. It operates through three segments: Lending, Technology Platform, and Financial Services. The company offers lending and financial services and products that allows its members to borrow, save, spend, invest, and protect money.

Recommended Stories

Before you consider SoFi Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SoFi Technologies wasn't on the list.

While SoFi Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.